Unleash the Mouse

6-min read

The biggest unlock of shareholder value from 2005 to 2015 was digital technologies that increased choice — the iPhone bringing the world to your pocket and Amazon’s endless aisle. The greatest accretion of shareholder value from 2015 to 2025 has been / will be recurring revenue bundles that decrease choice — Apple One and Amazon Prime. The biggest mistake marketers make is believing choice is a good thing. It isn’t. Consumers don’t want more choice, but to be more confident in the choices presented.

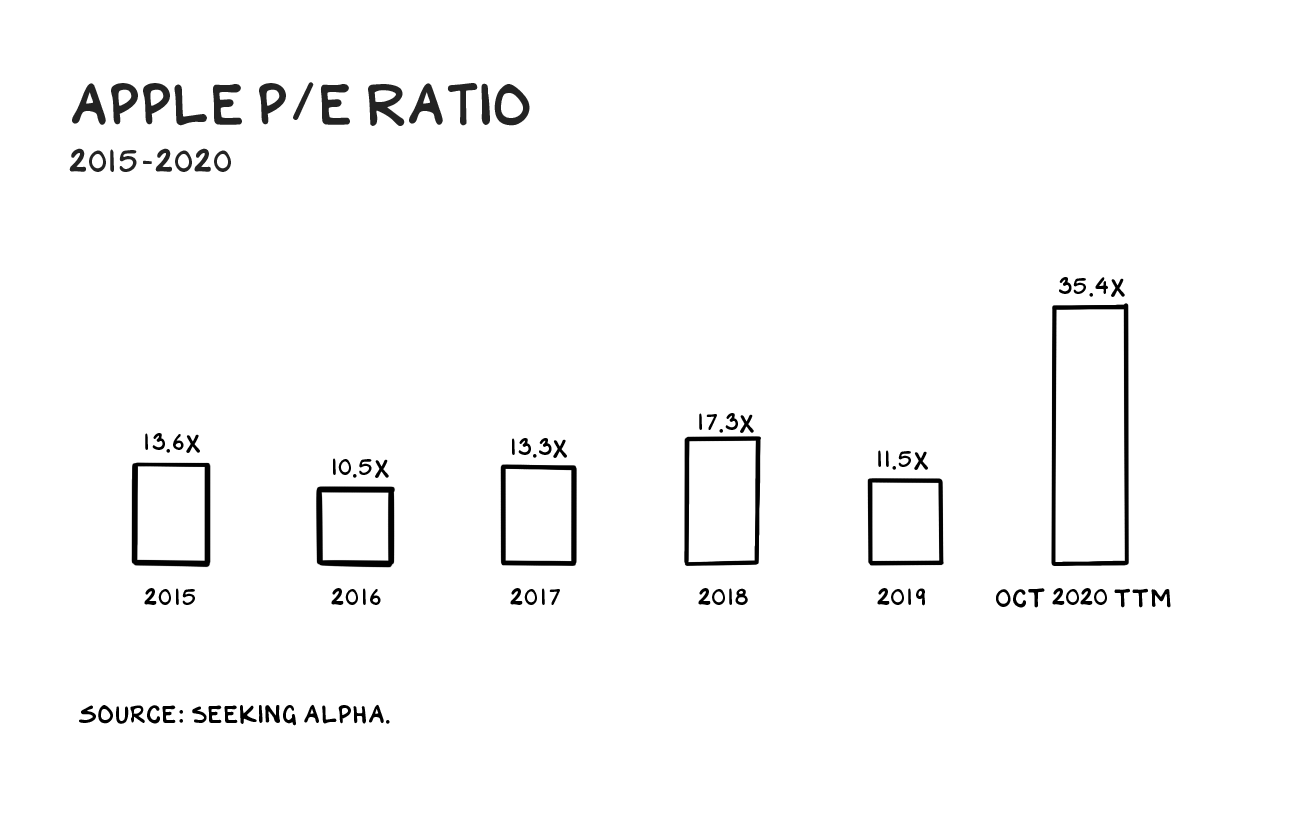

It took Apple 42 years to get to $1 trillion in value, and then 5 months to get to $2 trillion despite no increase in earnings and anemic growth. It now trades at 35x earnings vs. an average of 16x over the last 10 years. Much of the recasting of Apple is due to a move to recurring revenue, which now accounts for 22% of top-line. Since launching Amazon Prime, and establishing a monogamous relationship with 82% of US households, Amazon has likely added the value of all other retail in the US and Europe ($1.5 trillion).

“Train yourself to let go of everything you fear to lose.”

— Yoda

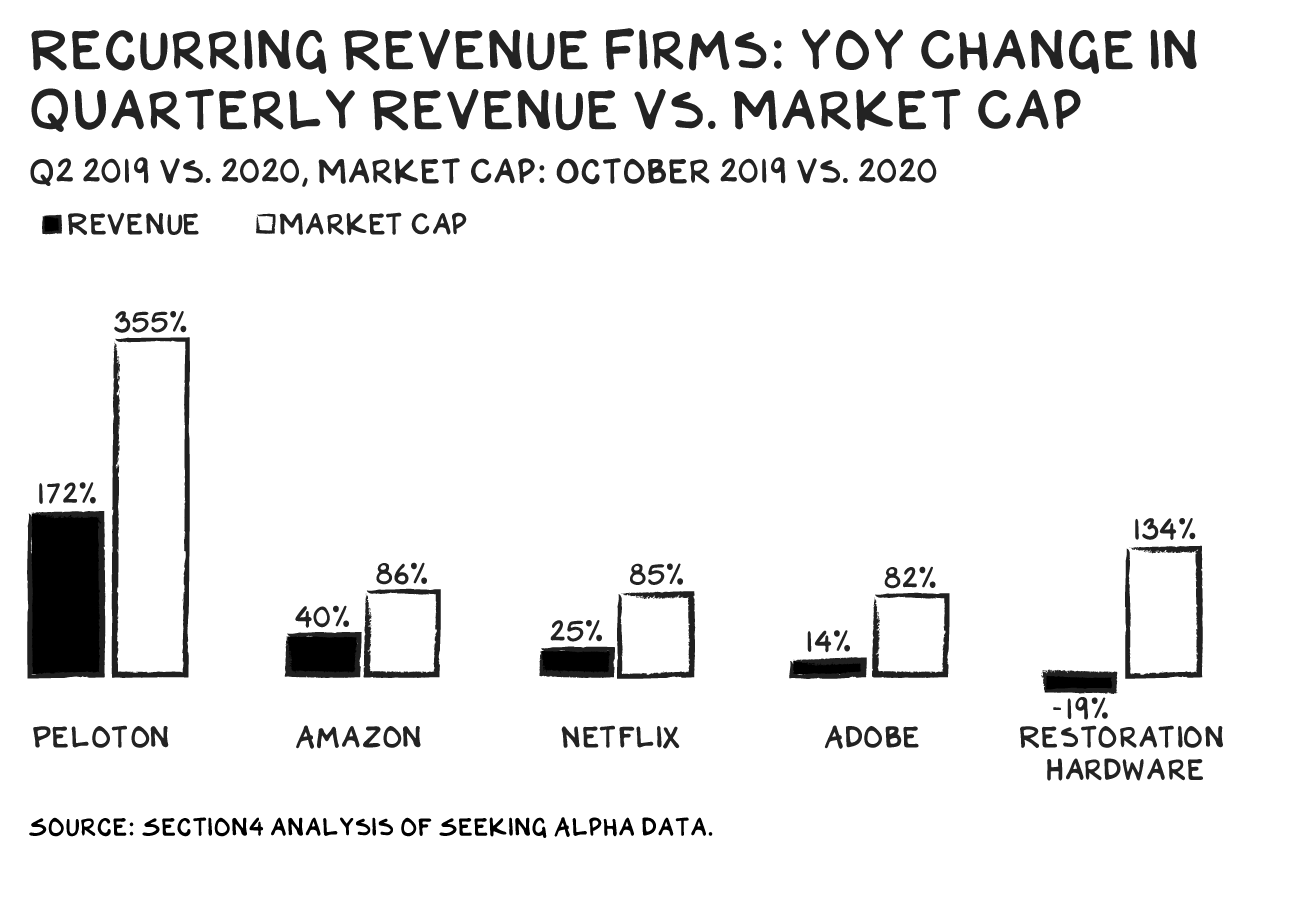

In a low-growth economy, the gangster way to register a sustainable increase in shareholder value is a move to a rundle (my term for “a recurring revenue bundle”).

Apple boasts the greatest asset in the consumer world, the iPhone. However, the greatest collection of consumer assets assembled under one corporate roof, is also the firm that stands to recognize the greatest accretion in stakeholder value with an aggressive move to a rundle. Simply put, it’s time to unleash the Mouse. Disney+ needs to bust a move to Disney2.

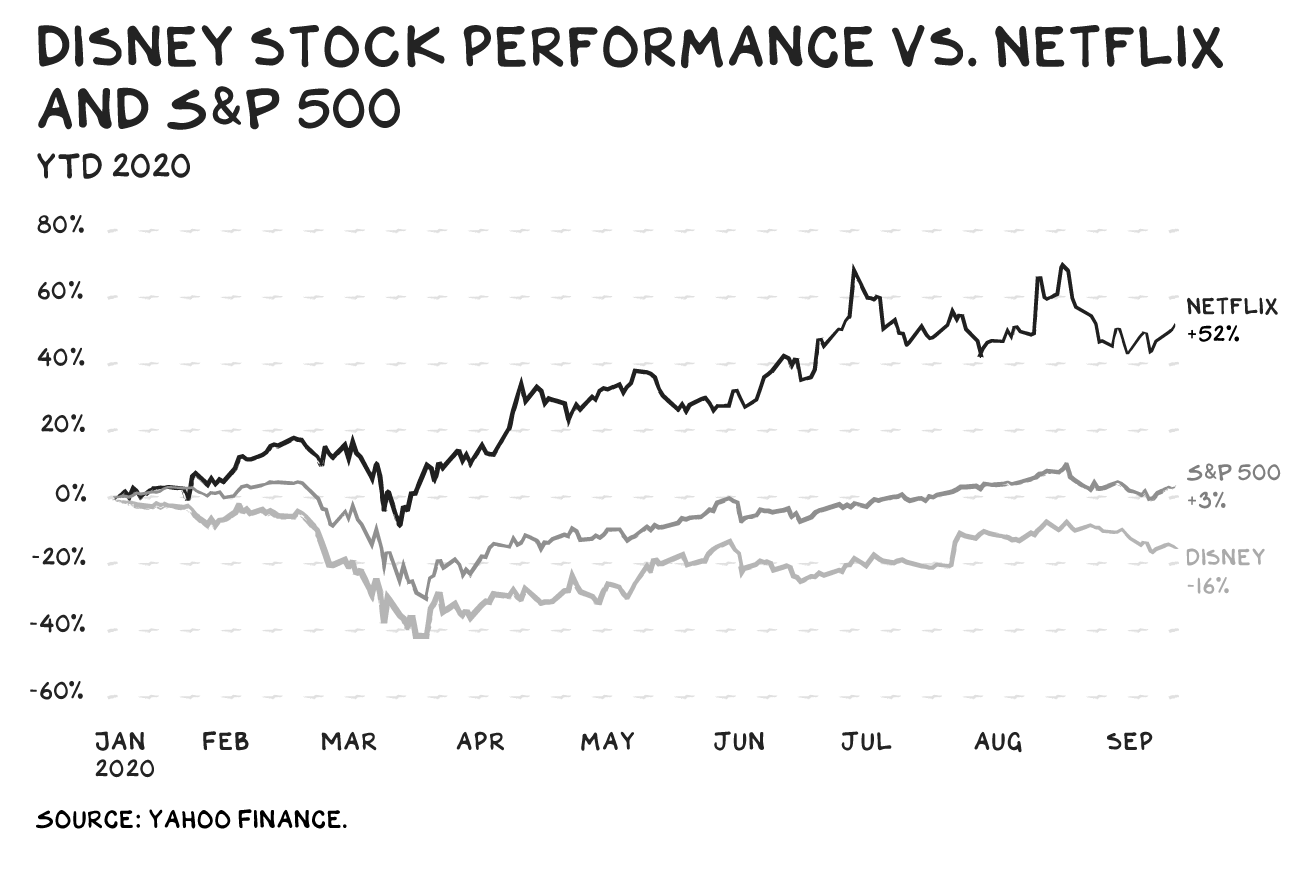

The assets here are staggering, but the whole is less than the sum of the parts. Corporate fiefdoms, compensation structures that inhibit cross-division cooperation, and nausea at the prospect of the short-term earnings hit required to move to a rundle, prevent the Mouse from commanding the space it occupies. The result is a stock that, despite this embarrassment of riches, has underperformed the market.

Stocks are a function of the narrative and the numbers. Increasingly, the narrative drives the valuation across equities that outperform the market — a phenomenon my colleague Aswath Damodaran refers to as “story stocks.” Recently, Disney has lost control of the narrative, and CNBC has become obsessed with the cyclical downturn of the parks … and forcing female anchors to wear sleeveless dresses. Why does Joe Kernen get to cover his arms? Btw, I’d pay cash money to see Andrew Ross Sorkin’s milky, sublime deltoids. But I digress.

CNBC fails to realize business travel has registered structural decline, but resort/family travel declines are cyclical and will experience a flight to quality. Disney parks are singular and will reflate, dramatically. In addition, the Disney communications department is infected with an old-world virus — integrity. Disney consistently under-promises and over-delivers, not acknowledging that the way of the Force is to over-promise (“We’ll have 1 million autonomous Tesla taxis on the road within 12 months”).

The narrative that has put Disney on its heels also ignores the most successful media property launch in history, Disney+. Put another way, Disney is the best storyteller in history. However, Disney Inc. is one of the worst.

The Disney2 rundle would be unrivaled:

- D2 member-only access to parks — special events, fewer crowds

- D2 member-only cruises, proprietary itineraries/ports of call

- Tentpole films delivered for in-home viewing at D2 households seven days before release in theaters, turning the cadence of film releases on its head

- Algorithmic modeling that sends families merchandise their kids want automatically (viewership of The Mandalorian = Baby Yoda figurine)

- Access to artisanal events/media including Marvel cruises, Princess Cinderella experience, video birthday wishes from Rey, etc.

- Potentially layer in access to ESPN+

- Edutainment (the profound opportunity): who is better at capturing and sustaining a child’s attention than Disney? Disney should launch a (remote) educational product for kids in grades K-12.

The market opportunity is substantial. There are 140.8 million primary and secondary school-age children in the US, Japan, and the EU. That’s approximately 84.5 million families with kids K-12 (assuming 1.93 kids per family in the US; 1.55 kids per family in the EU; 1.44 kids per family in Japan).

If we assume D2 has an addressable market on par with Amazon Prime memberships: 82% of American families with kids K-12, 50% EU families with kids, and 40% of Japanese families with kids translates to 52 million households/subscribers. At $50 a month (would any parent have a real choice?), this is a potential $30 billion a year recurring revenue business.

The multiple on these revenues (6-12x) would dramatically overcompensate for the decline in advertising and affiliate revenues lost as a function of sequestering content and assets to D2 members. Much of the value accretion would occur even before the realization of the potential, as vision and growth, in this market, pull valuations forward. Disney stands to recognize a doubling in market capitalization on a short-term decline in revenues, but only if the move is bold.

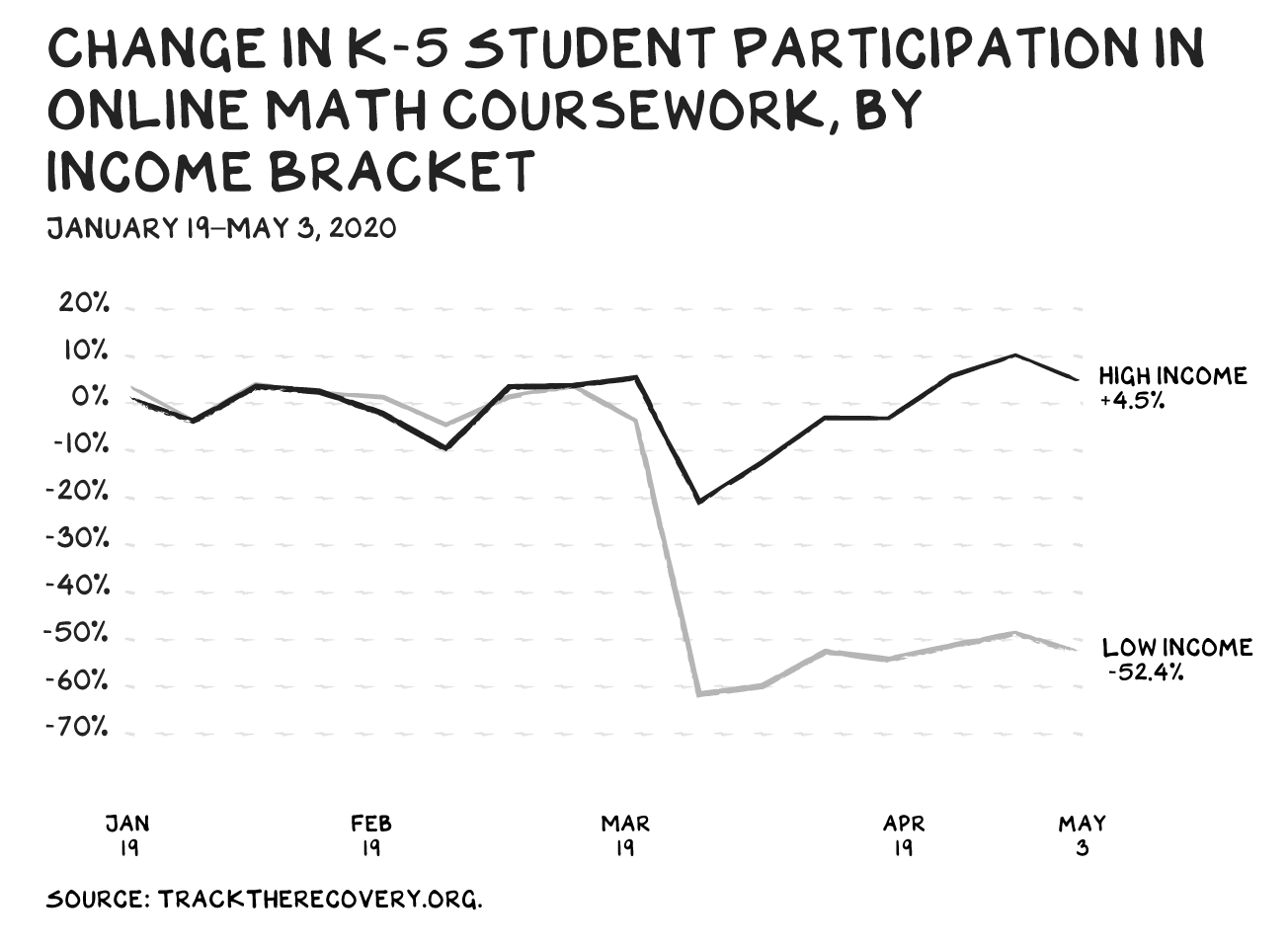

Disney has a meaningful opportunity to increase shareholder value with a crisp move to a rundle. However, the profound opportunity is to provide children with compelling edutainment that addresses one of the greatest challenges presented by Covid-19: the disturbingly high number of children from low-income households falling behind in remote learning is a threat to the future of the US.

50% of low-income kids are falling behind in school as a function of a K-shaped recovery where lower-income households don’t have internet access or a stay-at-home parent. The result is an educational apartheid.

Disney has the gravitas, capital, and leadership to collide storytelling and education to provide, at no cost, online learning opportunities for our neediest households. It’s likely that a telco and hardware manufacturer would partner with Disney to ensure that the emerging divide is repaired before it becomes permanent.

“In a dark place we find ourselves, and a little more knowledge lights our way.”

— Yoda

UBI to UDI

Just as Andrew Yang proposed a leveling up via Universal Basic Income, Disney is in a position to lead several firms in an effort to provide Universal Disney Instruction (“UDI”). To be clear, I don’t believe this is structurally sustainable, and we should not depend on companies to solve problems the government should address (educating our children). But we are in a crisis, and the White Moronacy that has infected Pennsylvania Avenue creates a need so great that many/most subscribers to D2 would be willing to sponsor a UDI household. If 50% of children fall off the map in STEM, we are 50% less likely to solve climate change, find vaccines for future pathogens, or develop apps that help us find a mate or the fastest route to an In-N-Out Burger.

Reminiscing

In December 2019, I wrote a letter to Omid Kordestani, Chairman of Twitter. In the letter, I expressed concern over a part-time CEO planning to move to Africa and suggested Twitter move to a subscription model. I invested 50 years of my salary as a professor in Twitter stock — purchased 332,000 shares. I didn’t hear back from Omid. Some consolation is his son Milan tweeted at me suggesting I shouldn’t criticize Sheryl Sandberg, as she is the most powerful woman in tech. Milan is an impressive young man — before the age of 17, he started several media and tech firms, and enjoys raising, riding, and racing horses. Milan and I had similar childhoods, if my childhood had been … nothing like my childhood. Anyway, I didn’t hear back from Milan’s dad.

Additional consolation is that several weeks later, Elliott Management signed my letter with a $2 billion pen and just days later (unprecedented) secured three board seats. Jack reconsidered his move to Africa and, soon after the new directors were seated, Twitter announced they were exploring (wait for it) subscription services. Since the letter, Twitter stock is up 55%. To be clear, Twitter suffered from poor strategy and execution, and a negligent board that tolerated a part-time CEO. In contrast, I have nothing but admiration for Disney management and a culture that producers great leaders. I don’t know Mr. Chapek, but believe Mr. Iger is twice the leader Jack Dorsey is, every day. A nose ring and silent retreats are not a reason to abdicate responsibility for a rage machine that continues to damage our psyches and discredit our institutions. Btw, I know Messrs. Chapek and Iger are reading this, as 93 people at Disney subscribe to these missives.

So, a prediction. Within 6 months, someone with a much bigger pen will sign this post. There is an opportunity for this to be your idea and pull a Mulan here — go straight to video, take back the narrative, and under the cover of the reduced earnings due to Covid, announce Disney is making an aggressive move to a bold rundle and announce a UDI plan.

In sum:

- Forget what you know;

- Command the space you occupy; and

- Unleash the Mouse.

Life is so rich,

P.S. Spoke to law professor Zephyr Teachout about monopolies: The fastest-growing part of our economy are monopolies and duopolies, suppressing new entrants. Plus #officehours keep an eye on the fintech space and diversify your portfolio — have a listen.

White Moronacy?

Most of us want to have good income but don’t know how to do that on Internet there are a lot of methods to earn huge sum, but whenever Buddies try that they get trapped in a scam/fraud so I thought to share with you a genuine and guaranteed method for free to earn huge sum of money at home anyone of you interested should visit the page. I am more than sure that you will get best result best Of Luck for new Initiative…Here For MORE INFO PLEASE just COPY AND PASTE this SITE…………..www.right75.com

Your rundle concept is an intriguing one for Disney, but incredibly complex vs. Adobe or Apple. Too many varied and unrelated components of the rundle. $50/month is too high…but of course, it ultimately depends on the value offered in the various rundles they may offer. But yes, choice is bad. Confuse ’em and lose ’em. Also, people are being monthly-billed to death these days. There will be a limit…at some point…and you will start to see churn of recurring revenue services like you’ve never seen before. It will happen one day. Disney+ is incredibly successful because of its’ low price relative to the great value. But D2, at $50, will significantly limit the # of takers. Scott, you are absolutely on to something, which should get Disney thinking hard. But for now, they should simply follow Dan Loeb’s lead and add more content, at the expense of the dividend, and make a fantastic streaming service that competes head on with Netflix, at a more competitive price than Netflix. This is step #1. Then they can work on D2.

How does one get a proprietary port of call, without owning the island? Do you buy it out?

Can you have non-algorithmic modeling?

D2 at $50/month still cheap. Park tickets are more than $100/day and disney lovers have no issues paying up. DCL has 4 new ships (at $1B each) rolling off the docks starting next year. Divide up the Kingdom

Hate to piss on the Disney love-in, but there’s a portion of the population (myself and my family included) who just don’t like the mouse. Hate the movies (sanitized revisionist pulp), hate the theme parks (Florida is a humid hades), hate the TV shows (overt sexualization of minors), hate the over-exploitation of everything they acquire (e.g. Star Wars spin-offs). Sure, we had small kids and they watched a few of the classic cartoons when they were younger, but they’re past that phase now. We would far rather have them galavant around the obscure and more educational parts of the globe, than be extorted at an all-inclusive resort or cruise just because that’s what their class-mates do. The entire company is founded on a myth of American exceptionalism and the idea that we all have a right to numb ourselves to the horrors of the world via entertainment. They can go ahead and do a rundle but I won’t be buying.

Some great ideas here – but I am not surprised your suggestions to Twitter fell on deaf ears. Nor surprised. Nor will I be when, I daresay, it gets chucked like stale bread. Besides, your idea relating to remote ed needs conviction about edu per se, not an idealogical stance to pulverize and selectively promote divisions based on entitled reading of society. That’s what Mr. Dorsey is up to, along with several of his billionnaire friends. Authenticity is someone like that billionnaire Chuck Feeney, not one with an Ego Board to drive his persona. I liked Dorsey when I first heard his interview several years ago at Stanford, but he’s not that guy anymore. I think you’re onto something significant: Disney, more than any of the tech folks in Silicon Valley, are the ones most eligible and able to undertake what you’re suggesting.

Disney education..should attempt to take over testing organisations like Pearson, book suppliers like Macmillan, and programme makers likr Entertainment One, and a number of small high quality British producers that need a lifeline like Ragdoll. (Get a hold of the under 3 market..Night Garden, Tellytubbies, Peppa Pig etc.) Rundles in grocery: Costco, Tesco Clubcard+ (grocery incl. delivery, mobile phone, insurance)

[ USA PEOPLE COME HERE ONLY ] ★My last month paycheck was for 1500 dollars… All i did was simple online work from comfort at home for 3-4 hours/day that I got from this agency I discovered over the internet and they paid me for it 95 bucks every hour. URL COPY & PASTE Try it your self….W𝐰𝐰.J𝐨B𝐬35.C𝐨𝐦

Has Iger called yet?

Scott, I agree with your Disney2 ‘rundle’ idea. I once produced filmstrip lessons for elementary school classes. We used Mickey, Donald, and Goofy cartoon characters with the actual voiceover talent. The production was funded by a forgotten little company called Walt Disney Educational Media, dubbed anagrammatically WEDEMCO. I’d like to hear Donald Duck say, “WEDEMCO Redux!” Joe Hartnett

Truly Genus and thought driven. Your insights, while not always right are deep and appreciated. Even when you make an error (see Tesla) you own it and the idea of thought had substance. I am grateful to get to be provoked by your insights. Thank you. Hopeful to meet you for a coffee or series of scotches in NYC one day in the future. I have a #mancrush

Bring back Schoolhouse Rock!

How about Disney’s long-running mega gangster recurring revenue / mega-retention play, Disney Vacation Club? How many other brands are so damn strong they can charge a 5 figure pay-to-play fee and 4 figures annually to keep them on board to commit decades of vacations to one spot?! They’ve been running this racket successfully for decades. How about you sell me my hyper premium rundle of DVC, Disney+, park tickets for life and throw baby yoda and donald duck at my kid’s birthdays on top.

What a vision… totally outstanding!

What ever you did this week keep it up. Best musing so far…

I’m in

Nice

For the ride of a lifetime?

Ive been bullish on Disney for a while. The parks comment above is interesting. My only concern is what challenges Netflix: amount if content. Disney has the best entertainment assets for families. But after 6 months as a subscriber to Disney+, its not enough. Netflix churns more content, with lower production value. This may end up where Disney needs to go to keep interest in Disney+. Excellent production value is expensive. I am still bullish, just not as bullish as Prof Galloway.

I’m guessing you don’t have small kids.

@Snake I have to kind of agree with Bruno. Disney is great for kids but even with that once they get to a certain age it does get a little stale. When they do have new content like Marvel the production costs are so high. If there is a miss (like Mulan might be) it really hurts. Netflix and Amazon have new content at a much higher rate and it seems lower cost. I think Iger is arguably one of the greatest CEO’s of all time so not sure how they are going to top that. Scott, as always you are so generous with your time and energy. This was another wonderful post and thank you.

So, pull a Mulan not a Milan then? “Rich is so life.” — Yoda

This was a great missed opportunity – though to be pedantic Yoda would probably say “Rich life so is”

Disney cannot even cross-collateralize between streaming, television, and movies within the Marvel Cinematic Universe. Even if this the rational play, I don’t know if it is in Disney’s corporate culture to pull off.

They need to do this! Get this over to Bob!

So interesting. I love the graphics, content, style, and it really could be done. Disney, come on! The Mouse is in the house!

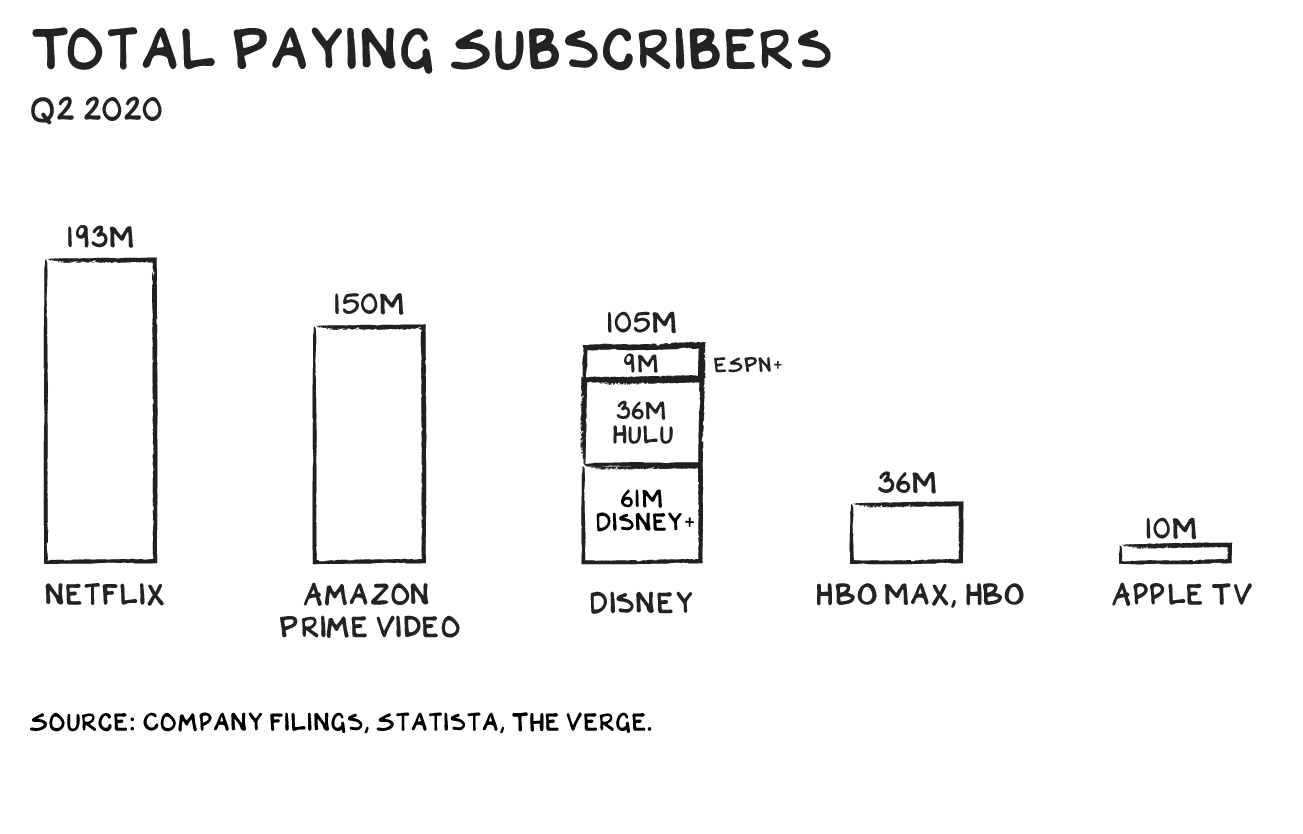

This is brilliant. Disney may have more untapped value than any company in the world. As you show, Disney already has 1/2 as many total paying subscribers across their media properties as Netflix. Yet, they have substantially more ways to add value for those subscribers than Netflix does.

Talk about seizing a market and giving your customers an entrance ramp to the high road of public service in the short run that benefits the whole nation / world in the long run. Brilliant.

Great story !

Great narrative! Mr. Mouse let it rain!! Thanks

If Disney goes D2 and UDI, sign me up!

The online educational market is valued at over 175b for 2019. It is projected to almost double by 2025 to over 300b. Edutainment would be a smart move for D.

The real educational apartheid is the inequities in internet access. Urban v. Rural, 5G v. low bandwidth. the prohibitive cost of maximizing content delivery. A great Trumpian deal would be to “convince” the Silicon Valley plutocratic elitists that it is in their collective best interests to fund free internet nation-wide. That would do more to level the educational playing field than anything imagined in the most fervent SJW college admissions officer’s fever dreams..but also hasten the ultimate demise of all but the most economically stable “name” colleges.

“Sheryl Sandberg, the most powerful woman in tech.” HAHAHAH I nearly fell out of my chair. I bought Twitter around the same time you talked about it on Pivot and sold immediately after it came out Jack wouldn’t be ousted or at the very least *gasp* going full time. People who don’t follow the markets or business look at me so puzzled when I tell them the CEO of Square and Twitter are the same person with a soft tone and a beanie.

Probably good advise for Disney, but have you seen Disney’s Pocahontas? Or any of their other movies “inspired” by history? Entertainment yes, education? No!

Brilliant, Prof. Engage, Entertain, Educate. Farewell 3 R’s Hello 3 E’s. Shall observe Disney’s trajectory and hope they don’t stop with kids.

Scott, yes you are awesome! The government certainly hasn’t done a great job in the K-12 education domain. There seems to be little incentive to really change that fact. You yourself talk about the Medieval Guild called “tenure”. Is that the biggest obstacle? How would you fix our K-12 schools if you really had the power to do so?

Amazing. When is Scott Galloway going to launch his own rundle, instead of giving away gold for free?