Think Slow

A media ecosystem that focuses on engagement vs. enlightenment will get you to whatever conclusion sanctifies your beliefs. The recent murder of a health insurance CEO immediately triggered my go-to thought: The shooter had to be one more alienated and overlooked young man, another product of the struggles facing all young men in our society. But here’s the truth — I don’t know … and neither do you. At least not yet. We don’t have nearly enough information to draw conclusions, but we live in a society where everyone fast-forwards to the end, believing we know what happened and why. We are increasingly deferring to our guts and emotions vs. slowing our thinking. The Jedi master of the importance of the pace of our thinking, Daniel Kahneman, passed away earlier this year. Several media outlets have contacted me re the murder of the United Healthcare CEO, and, in a nod to Professor Kahneman, my comment has been … I don’t know.

This post describing the Israeli-American psychologist’s work was published in April. Here’s what I had to say about Kahneman’s ideas following his death last March.

Daniel Kahneman, who died last month, leaves an extraordinary intellectual legacy. Few people have unpacked our behaviors with greater insight than Kahneman and his longtime collaborator, Amos Tversky. In the wake of his passing, we’ve been reflecting on the many ways his work has shaped our thinking. Something I wish I’d figured out when I was younger is that greatness is in the agency of others. I have often tried to identify a guide or sherpa for different aspects of my life. Jesus and Muhammad Ali are my Yodas around social issues (love the poor, be fearless and poetic) and Peter Drucker informs my views on the economy (the purpose of an economy is to create a middle class), etc. Professor Kahneman helps me navigate the strait between instinct and decision. Some thoughts:

Homo Irrational

Kahneman studied how humans make decisions, and the shortcuts our minds take, unbeknownst to us. These shortcuts are efficient; they foster a key skill for survival, the ability to make rapid decisions with incomplete information. We have to make thousands of decisions every day, and we couldn’t leave the house if we had to objectively analyze every choice: breakfast, outfit, route, music, etc.

Our efficiency comes at the cost of accuracy: Many instinctual decisions will be poorly calibrated (i.e., wrong). To facilitate the requisite speed, our brain buttresses our decisions with artificial confidence. Kahneman’s body of work demonstrates that we are often wrong but frequently confident. These shortcuts and mistakes are present in the structure of our brains, and impossible to avoid, but recognizing them helps us discern between trivial and important decisions and invest the appropriate intellectual capital. Put another way, take a beat and you increase the likelihood of making a better decision.

Though he was a psychologist by training, Kahneman got his Nobel Prize for economics. Before him, economists “relied on the assumption of a ‘homo œconomicus,’” as the prize committee wrote, a self-interested being capable of rational decision-making. But Kahneman “demonstrated how human decisions may systematically depart from those predicted by standard economic theory.” That dry language obscures an intellectual nuclear detonation. Expectations about human decisions — whether to work at a certain job, how much to pay for a specific good — are the foundation of economic theory. Kahneman showed those expectations were incorrect.

Loss Aversion

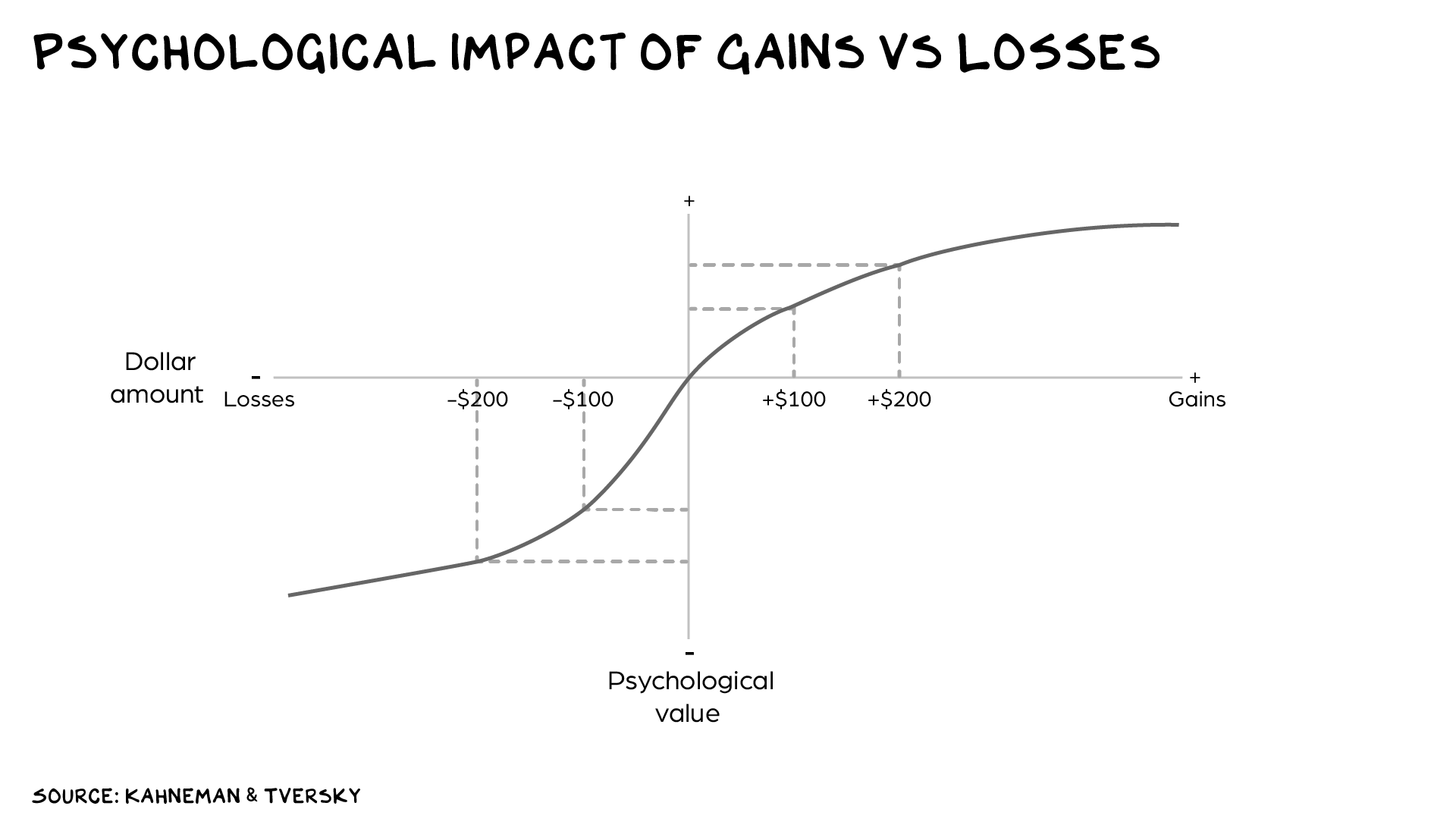

One of Kahneman and Tversky’s earliest insights was the simple observation that we feel the pain of loss more intensely than the pleasure of profit. It’s irrational to an economist, but we put more value on not losing $100 than we do on gaining $100.

We also have a skewed perception of probable gains and losses: We overestimate the likelihood of unlikely things. Insurance is a profitable business because people would rather suffer a series of guaranteed small losses (premiums) than risk a single but unlikely catastrophic loss. The healthy profit margins of insurance companies reflect our tendency to overestimate the likelihood of calamities. Overestimating an unlikely outcome is also the secret behind the lotto, which offers terrible odds. Some examples of how this has influenced my actions. (Note: I am not claiming these are the right way to put Kahneman’s insights to use, just my way.) What I’ve done:

I actively limit the number of decisions I have to make to preserve neuron power for the key ones. I have other people order for me at restaurants; I have a uniform for work/working out, wearing the same thing every day, and someone else buys my clothes. I delegate the majority of decisions at Prof G Media — I participate in a one-hour weekly editorial meeting and check in with my executive producer 2x per month on business issues. I have not planned a vacation in 20 years or put anything on my calendar in 10. Despite having made more than 30 investments in private firms over the past decade, I review few documents, and rarely even sign them. (That’s all handled by counsel.) I try to reserve the largest possible cache of gray matter for research, thinking, storytelling (writing, presentations, etc.), and investment decisions. Over the next five years, I plan to outsource all investment decisions so I can focus on storytelling.

Seven years ago, I canceled all my insurance coverage — health, life, property, flood, etc. I don’t own a car, but when I did, we purchased the minimum amount required by law. This is a position of privilege (don’t cancel your health insurance), as there is no disease or property loss that would cause me financial strain. Since adopting this strategy, I’ve saved $1.4 million in premiums.

My belief in the market’s collective loss aversion has reshaped my investment portfolio over the past decade. The majority (90+%) of my investments used to be in publicly traded stocks. That share is now less than 20%. Instead, I lean into my access to private companies, as I can absorb big losses and withstand illiquidity. Per Kahneman, there have been periods of real pain. In the last 12 months I’ve registered four wipeouts — four investments that dropped to zero. However, two other investments registered a 4x and 25x return. My net return has beaten the market, but it’s been more taxing (emotionally) than just investing in SPY, as I have trouble shaking the big losses — again, making Kahneman’s point.

Take a Beat

Prospect theory won Kahneman his Nobel, but he’s best known for his seminal book, Thinking, Fast and Slow. The titular concept — that we have two thinking systems, a fast one for intuitive, emotional insights, and a slow one for logical, calculated decisions — is something that has saved me from … me, dozens of times.

Our fast-thinking system is an incredible tool. It allows us to drive cars, compare prices, recognize friends at a distance, and play sports. But its availability makes us lazy. Why do the hard work of thinking through a problem when we can just “go with our gut”? In any decision of consequence, it’s good policy to slow down, get out of the stimulus-response cycle, and let your slow thinking catch up. That’s not to say we should disregard our gut — just don’t let it take the wheel.

Specifically, I try to be vigilant about not letting my fast system make decisions that merit the attention of my slow system. Often these are reactions to things that upset me. Last week, a journalist who’s active on social media posted on Threads that Jonathan Haidt and I were “grifters,” and that I did not care about young people. This pissed me off.

Feeling threatened, my lizard brain took over, and I saw the situation as a conflict, a threat to my standing in the community. That framing, courtesy of my instinctive fast-thinking system, dominated my consciousness for the next four hours, distracting me from my kids and vacation. I drafted an angry response to counter the threat.

Then I shared the situation with several members of my team. Able to evaluate the situation dispassionately, they were universal in their response. “Let it go.” I was just playing into an attempt to draw attention with ad hominem attacks the algorithms love. (e.g. Trump or Musk.) The learning, other than social media is a cancer? Speaking to others, before acting, is a great way to slow your thinking.

Happiness, Diminishing Returns, and Taxes

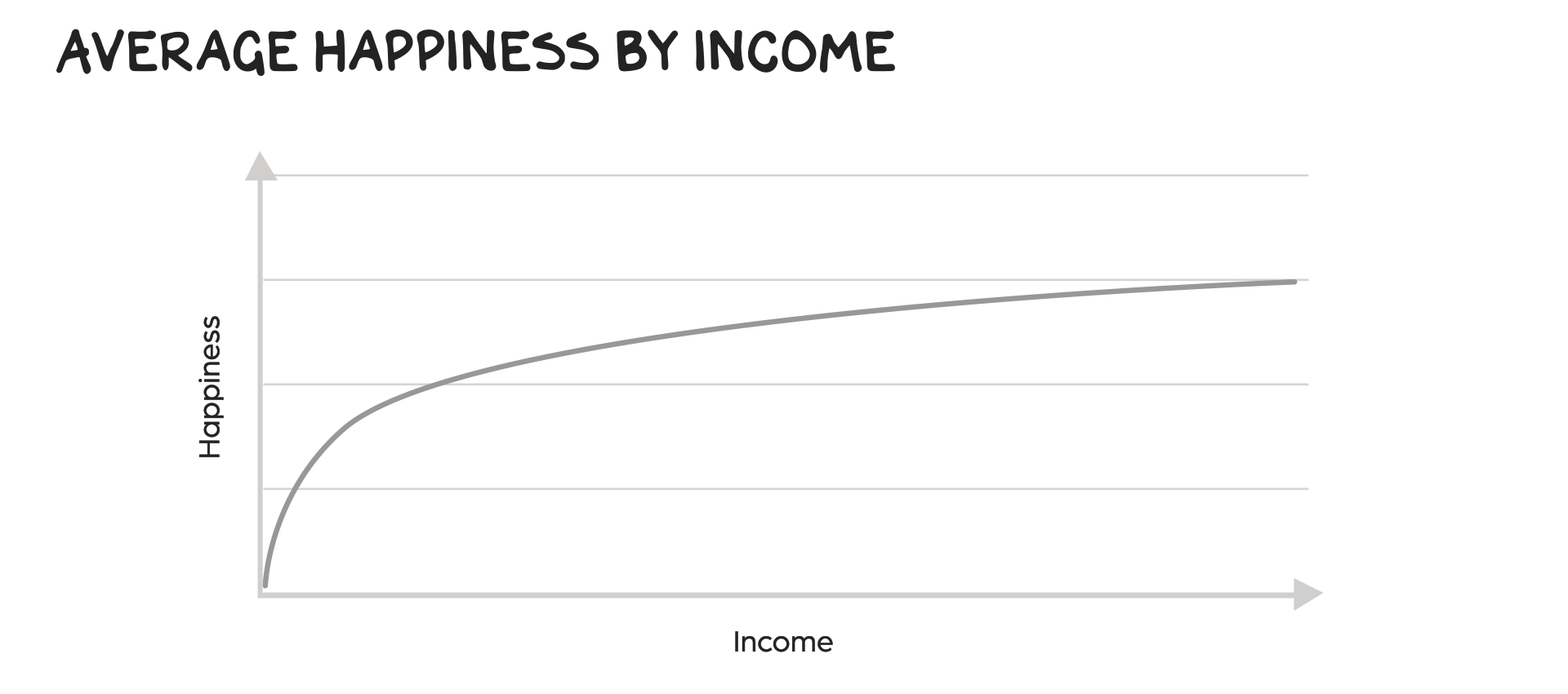

In 2010, Kahneman and another Nobel winner, Angus Deaton, published a study which appeared to show conclusively that income was strongly correlated with happiness at low income levels, but that income above $75,000 had no impact on happiness. The study was widely celebrated, but in 2021 a much less famous academic, Matthew Killingsworth at Wharton, published a paper reaching a contrary conclusion, based on a sophisticated smartphone-based happiness tracking system.

Rather than ignore the unknown academic challenging him, or using his global fame to undermine the upstart, as is the norm in Congress or pretty much anywhere else, Kahneman teamed up with Killingsworth. They engaged in a collaboration alongside a third academic neutral to the dispute — a process Kahneman pioneered. Working together, they found that Kahneman’s original study had measured the decrease in unhappiness but hadn’t captured the upside high-income people enjoyed. When more carefully measured, happiness did continue rising with income. However, there were dramatic diminishing returns. There were real gains to happiness in moving from $100,000 income to $200,000, but to see that same gain again required another doubling of income to $400,000. Extend the curve, and it flattens further.

I believe this should influence tax policy. A substantial increase in the progressivity of income tax would offer a net positive in overall well-being. According to the IRS, 26,576 U.S. households reported income of over $10 million in 2020, totalling $824 billion in income. We collected $210 billion income tax from these filers, or 25% of their income. If we collected an additional 25% of just the income over $10 million, there would be little impact on the lifestyle or happiness of these taxpayers.

But the additional $140 billion in revenue could cut child poverty in half ($100 billion) and end homelessness ($20 billion). These investments would generate a massive increase in the well-being of our commonwealth and a huge economic boon. (These societal ills cost us trillions in lost productivity.) Plus, we’d have enough left over to pay for most of NASA ($25 billion). And rich people love space.

Disassociate

Ideas are yours to play with, disassemble, shape, and apply where needed. I’ve taken the idea of “slowing down” and mixed it with atheism and stoicism to enhance my personal relationships. When my kids are disagreeable (i.e., awful), or my partner is upset/angry, I often respond as if it’s a threat to my authority or value. I reflexively escalate and get back in their face(s). I now try to disassociate. What I mean by that: I take myself out of my “self” and see someone I care about upset. Being an observer, vs. being in the line of fire, inspires different emotions.

When my kid is agitated, I recognize it’s more about what they are experiencing elsewhere, and they know that — no matter how unreasonable they are — I will still love them unconditionally. When my partner is upset, my role is to notice it, to give witness to their life. Their emotions matter, regardless of my ego or the perceived criticism. I can take arrows, get shot in the face, and never lose sight of my role as their protector. I am the man of the house. If that sounds like we digress to traditional gender roles, trust your instincts. I’ve slowed down, thought about it, and determined it works for us.

Life is so rich,

P.S. Last week on Prof G Markets my co-host Ed Elson spoke with Morgan Housel on how to make the most of your money in the New Year. Listen here on Apple and here on Spotify.

45 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

Atheism is self-refuting:

1. “God does not exist.”

2. By excluding even the possibility of a Creator Deity, one is exhibiting the property of omniscience.

3. Omniscience is a characteristic in the exclusive domain of a god.

4. The atheist, by virtue of his claim of omniscience, has made himself a god.

5. Therefore, a god indeed exists.

There is in fact lots of evidence for a Mind that designed our universe, if we will only spend the (slow) thinking to perceive. Just one field of evidence: Why is there something instead of nothing in the wake of the Big Bang? Answer: The universe is fine-tuned to exist. There are ~26 fundamental (non-derived) constants that physics has uncovered, and each has worked synergistically to allow the existence of matter, energy, space-time. One of those constants is the magnitude of the force of gravity. If that constant was different by just one part in 10 to the 14th power, stars and galaxies could not exist, and thus not us.

I enjoy this forum! Thanks Prof G and staff – I am always enthralled by your content.

Thank you Always great ti read/listen to you! I love the disassociate decision. Off topic: You and Prof Haidt have done so much for children by courageously exposing the harms platforms ugly business and their desire to continue exploit and abuse children by avoiding accountability (KOSA), the world is grateful. But not journalist seeking Zuck approval obviously. Olivier Siboni co-authored Prof Kahneman’s book “Noise: a flaw in human judgement” covering additional fascinating elements influencing human decisions. Siboni When asked whether Social Media contribute to the Noise answered “Social media are the largest Noise factory of the world”.

Excellent!

Terrific. Appropriate for the challenges ahead.

“The shooter had to be one more alienated and overlooked young man, another product of the struggles facing all young men in our society. ”

An alienated and overlooked young man from a wealthy family who went to private high school and the Univ. of Penn?

What, only poor/uneducated kids can be alienated? What an unhelpful and classist notion.

Rich and poor across the connected planet all under the undue influence of malign algorithms of irresponsible (to use and euphemism) CEOs.

Thank you for paying homage to this amazing psychologist/behavioral economist. His work transformed/informed my perspective and problem solving in significant ways and I’m grateful for it. Excellent post, Prof.

$200k per year in personal insurance premiums? Whew, trying to wrap my head around that. Even with a dozen or so Lambo’s it’s still hard for me to get to that number.

Add to car insurance life insurance, homeowners insurance (they have multiple pricey homes), flood insurance, health insurance, umbrella coverage, and it’s not hard to get there.

Thank you and your team for this article.

Thank you for always being so honest and upfront in sharing your thoughts, learnings and wisdom Mr.Galloway.

The entire post is extremely valuable with Mr.Kahneman’s findings (God bless his Soul) and your take on it with its applicability.

However, what resonated with me most was Disassociation as most of the times I find “my” self/ego to be the most obvious if not the biggest hurdle in moving ahead or handling a situation/conversation/communication well.

I hope to remember to keep it in check on a regular basis especially since its coming from you who I highly regard as one of the most original, unique and accessible personalities in today’s time.

Wishing you and your family well and a Happy New Year.

Great post Professor G. Slowing down and observing is so key. So harder to do in our personal life when emotions are high and as you say the arrows are flying. I find it especially hard because I see my worth in the reactions of others something I know I need to change as well.

But this slow down mentality in spending and managing money is a great insight and I’ll continue to practice.

Thanks for the great insight.

Love your comments and thoughts, thanks for taking the time to share. Happy New Year – stay visible!!

Thanks so much Scott for sharing this one, Thinking Fast should be mandatory reading once a year to keep us all grounded in reality. DK was/is a national treasure!

Great read Scott. Thank you for sharing.

Nice work as always! Agree with your assertion that those earning over $10m prob won’t miss the income the extra tax takes but my guess is it still wouldn’t work in practice without some very persuasive incentives.

My usual Saturday morning read and a very good one this week. I very much liked the balanace of this post. I tried to conquer Kahneman’s book some years ago but failed – I will go back to it in the New Year and try again. I particularly liked the part of the post about saving the “grey matter” for important decisions – will try that. Clearly being more thoughtful about important stuff is important.

Some good thoughts, feels a bit pompous at times but useful otherwise, thank you.

This is brilliant, absolutely brilliant. Finally an economic benefit for the wealthy to support tax policy changes. Hopefully it will work better than the “unfairness” argument that us progressives have used for years.

Retired physician here saying that not having medical insurance is still a problem. I have seen even a multimillionaire (net worth $6 million in 2006) without health insurance delay care for his 60-year-old spouse who happened to be having a massive (and ultimately fatal) heart attack. There are studies showing that rich or poor, those lacking medical insurance will delay getting the care they need in a timely fashion. Your savings will mean nothing if they contribute to a delay in making and treating a time-sensitive medical problem.

And yes, this country needs universal health insurance. Cheaper and it works well in all of the countries that have it (basically all developed countries except the US).

Anyone with $6 million is better off self-insuring and utilizing medical tourism for non-emergency operations.

All depends on how you look at suffering and death. If you see death as a last great adventure and not something to be feared than Death is just another event. If you are not afraid of death, there are many ways to alleviate the pain. My wife had a major aneurysm in her aorta. I was amazed at how Phentenole made everything OK. She elected to have surgery, but life was not the same. My father had prostate cancer. First time he beat it. Second time He elected not to

treat just enjoy Life for 6 months then use Drugs for the last 3 months. Died happy at home. We enjoyed a glass of scotch every night till 2 days before he died. Biggest expense may have been the locale barber who came every other day to shave him. He loved the hot towel and the attention. If you want to fight a diseize every inch of the way that is your choice. Do not discount the end of life experience. I am 75 and an active skier and sailor. I have the beginnings of prostrate problems. The Drs keep saying i have to start treetment soon or increas the odds of treatment not working. I am fine with that I will take my time deciding. Till then I will worry about doing fun things that help others to be happy.

Just to be clear. I am not against medicine. I have had Multiple joints replaced. One shoulder two thumbs and two knees. Those were all low risk and helped extend the fun part of my life. A year of radiation and Kemo does not look as usefull to me.

👏 got things figured out 🫡

“I don’t know”is appropriate for a significant portion of our life.

While I appreciate the sentiment re insurance – I don’t think anyone is too wealthy to purchase truly catastrophic coverage. Specific to health insurance – non “essential benefit coverage” with unlimited max is cheap and protects you and dependents for cancer treatments (garden variety breast cancer is a 600k event), or transplants (a kidney is 200k and a heart is 400k) let alone an accident or emerging infusion and gene therapy that are millions. As self employed or BOD investor, the benefits of group deductions are also beneficial.

No coverage on (home) properties? You’re just inviting a “slip and fall”. Mortgages require some form of property insurance. Even the super wealthy that can afford not to mortgage always play investment cycles to benefit from the return arbitrage and deductibility of interest only debt (and required insurance). Follow the super wealthy and plow that 1.4m in savings (and future premium payments) into a single parent captive. Get deductibility, self insured layers, reinsurance protection, tax savings and distributions for same favorable claim experience.

I’m a massive Galloway fan, but call some BS here.

I find the author’s style to be too choppy and cutesy and hard to read. Someone wins a “a Nobel” as opposed to a “a Nobel prize” for example. Overall, annoying.

As for “The healthy profit margins of insurance companies reflect our tendency to overestimate the likelihood of calamities”, that just sounds wrong. People have to have insurance since it enables them to pay for an unlikely expense by sharing the risk across the population, a risk that without insurance would cost an effectively infinite amount (be impossible to cover). The margins are more a testimony to the effectiveness of marketing private insurance and successful thwarting of single payer insurance by private industry paying off law makers.

I am also privileged to cancel some of my insurance. Once we reached the amount of savings that guaranteed my children will survive and thrive in case my wife or I passed, I canceled both my wife’s and my life insurance. I used to buy the minimum auto insurance required by the law, but once my teen started driving, I maxed out the liability part. You never know what a hormonally driven teen could do on a given day or night.

I too think this is the most important and useful piece you have written and I rarely agree with you. There’s a point of view problem when it comes to redistributing rewards, and my hero Buffett doesn’t quite grasp it. His liberal side takes the view that all people are equal although some are handed greater capabilities as they leave nonexistent to enter the world. The reality is that I am myself, fortunately with some gifts, and while many were not so happily gifted I can only be me. I am not entirely without empathy but I resent being told I must be liberal and empathic because I was given both physical and mental assets. It’s not even random. Only I could have been me. This point of view problem is the root of conflict between haves and have nots and nothing can erase the problem except force. Even Marxists must acknowledge that when capitalist advantages are erased what you get it is the rule of thugs. I can play that game too, but it’s awful for everyone. Can you write something on this?

I fully doubt that Buffett does not quite grasp the redistribution concept. I don’t think he thinks all people are equal, after all the man preys on his target companies being poorly managed by incompetent managers. He simply said it’s unfair that the wealthy – by taking advantage of tax breaks and loopholes created by their lobbyists – pay a disproportionately lower share of their income than the not-so-wealthy. You don’t have to be empathic or liberal.

When it comes to taxes- more just enlarges the state enabling them to waste more money. In a perfect world increased revenues would provide increasing returns instead of diminishing ones.

Please stop encouraging poor policy that diminishes freedom and increases waste and inefficiency. Private giving is managed much more efficiently and goes much further.

When it comes to taxes- more just enlarges the state enabling them to waste more money. In a perfect world increased revenues would provide increasing returns instead of diminishing ones.

Please stop encouraging poor policy that diminishes freedom and increases waste and inefficiency. Private giving is managed much more efficiently and goes much further.

How do you sleep at night.

Scott, if you could only focus on matters like this, rather than putting us through your left leaning epistles, it would raise the quotient of learning to your politics. I found this article to be an in teuctive, well written piece and I thank you for the insights. Daniel Kahnamen was a remarkable man, with great insights. I believe his work will continue to influence for generations. His collaborations and willingness are additive in nature and I hope that his insights will come up again in your body of work. Well done!

It’s too simplistic to say just raise more $$ in taxes and we can eliminate homelessness and poverty. We have spent $trillions over the years and while we have made progress we still have problems. IMO it’s not the lack of $$ that is the main issue; it’s ineffective programs that just makes people feel good but doesn’t address the real issues. We also have to realize that most poor people are poor due to choice and wrong priorities in life and to aim for zero poverty and homelessness is like trying to aim for 0 unemployment. It’s unachievable due to many factors, many of them beyond our control.

Great thoughts and ideas as usual Scott! The taxes idea is interesting but somehow I don’t think that money would make it where it’s needed most.

I was unimpressed with Kahneman’s book. People try to get though the day hoping to get it right. That’s it.

Why doesn’t this one has an audio? It is one of my favorite features on your blog.

In elite military units, there is a mantra: “Slow is smooth; smooth is fast.”

Initially, it seems counterintuitive, but in practice it is true. The best units practice, practice, practice at half speed until they can do things that are smooth; and only then do they increase to game day speed.

This enables them to operate at full speed whilst reaping the benefits of precise smoothness garnered from practicing at half speed.

How we make decisions, the discipline we impose on decisions, is critical to ensuring consistent high quality outcomes. The rules we impose upon ourselves — but only the ones we follow — ensure we rule out (literally) the landmines we seek to step upon based on “feels” and emotion.

Much of what you describe falls under the heading of “adulting.”

JLM

Again I agree with about 80% of your writing and the other 20% is on the chopping block. To wit: Suggesting that additional taxation can “end homelessness” ignores real-world evidence from high-spending states where money alone has failed to achieve this. A 2024 audit revealed that California alone has spent $24 billion over the last five years to end homelessness (their own audit). There’s also a host of social, mental, and health issues.

Here in Washington state the latest costs from Rights of Way Safety Initiative (ROW) launched to clear encampments from state land and transition residents into housing, this program spent over $143 million. Of the 1,299 individuals cleared, 870 accepted housing, and only 126 successfully exited the system. This translates to approximately $1,137,256 per successful exit. Even when excluding capital costs, the expenditure remains high at about $661,065 per person. That’s about 66 times per person the amount the state spent on veterans benefits and assistance.

Kahneman’s insights remind us that slowing down to think critically and analyze the data can lead to better, more effective decisions. Before we default to simplistic narratives like “more money and more taxes solves the problem,” let’s challenge our assumptions, examine real-world outcomes, and craft policies that reflect the multifaceted nature of this crisis.

Good insight on the homelessness crisis. But while the assumption that the extra taxation would solve the homelessness crisis maybe incorrect, higher taxes – most importantly when used appropriately, would definitely provide a relief to many of the societal issues. The key being “used appropriately”. I certainly am not the best person to know what is appropriate and what is not, but I believe we need a more progressive tax system to solve the child poverty issue, healthcare, etc..

What if AI is able to predict its own death which might come sooner than later

Sir, you and you perspective have been a great blessing to my life this year!!! I am grateful!