The Martian

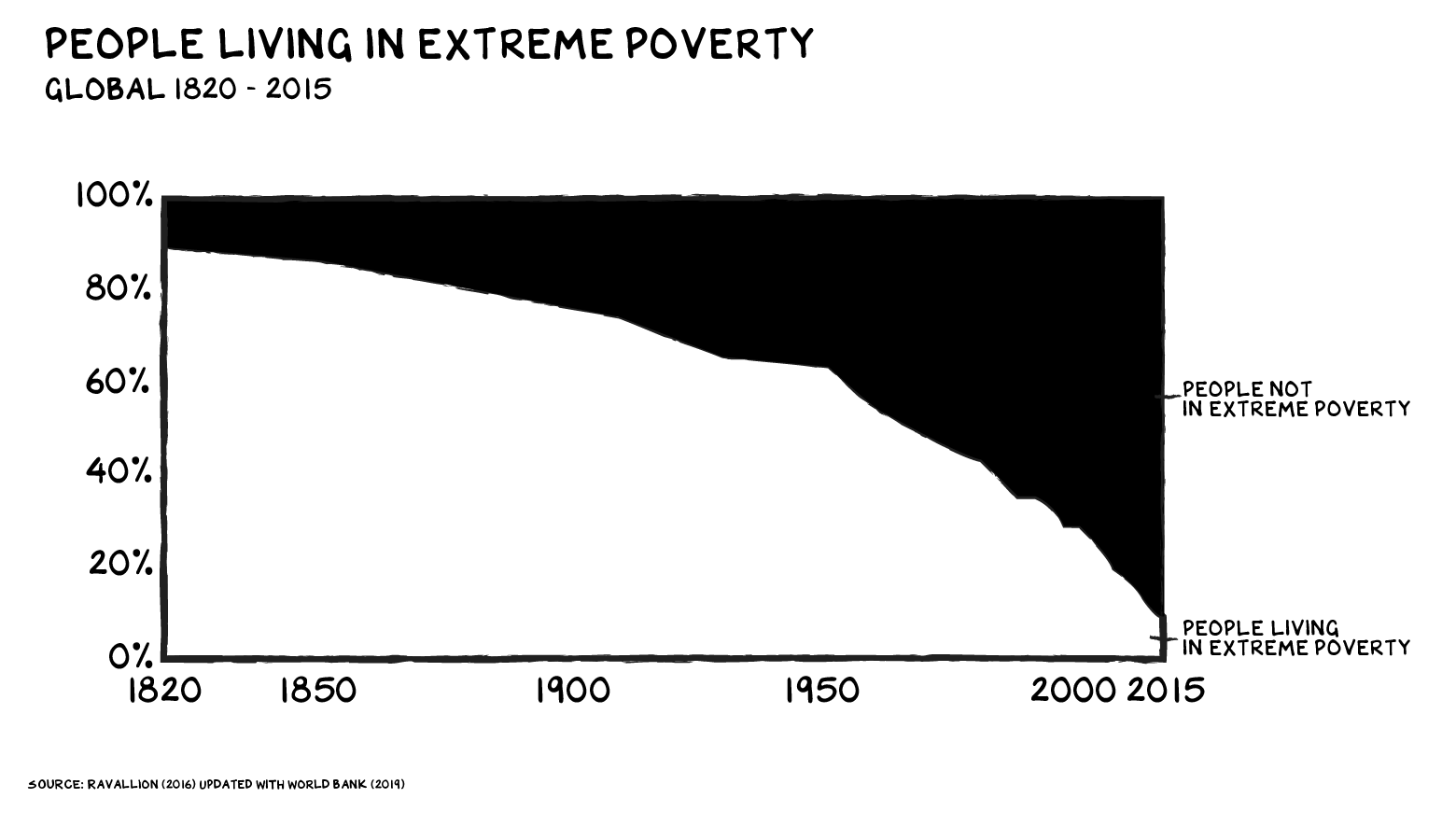

I often write about platforms (iOS, Amazon Marketplace, etc.) as they are a source of value creation and power. The platform of unprecedented wealth creation is the free market of capitalism. The global adoption of markets has corresponded with the greatest expansion of prosperity in human history. But similar to tech platforms, free markets are neither naturally occurring nor immune to collapse. The “free” market can fail.

Live from New York

This Saturday at 11:29 pm ET, we’ll witness the latest manifestation of market failure. A new king will seize the Iron Throne from Mark Zuckerberg, whose empire has been disarticulated. (He just doesn’t know it yet.) I wonder if Professor Tim Wu or Senator Amy Klobuchar visits the Night King in his dreams? Or maybe depressed teens, the GRU, or the ghosts of people dragged out of their cars in India and hanged because of falsehoods spread on WhatsApp. OK … that escalated quickly.

Anyway, the social network’s CEO has ceded the Iron Throne to the Launcher of Dragons, Borer of Tunnels, and Father of X Æ A-XII. The coronation will take place before a live studio audience, with Tesla long bots and adoring CNBC personalities shaming anybody who doesn’t surrender to the narrative. Elon Musk is now the most influential individual in the world — so influential, he can distort the modern world’s premier platform, our free market system.

Is Mr. Musk a net positive for society? 100% yes. It’s the word “net” that is the problem. We do basic math on a person/firm, issue a thumbs up/down, and decide (if thumbs up) to ignore the externalities. This is tantamount to deciding pesticides are a net good (they are), so we should disband the EPA.

Naked examples of Musk’s influence/externality: the tweeted endorsements of his favored assets. Bitcoin is a trillion-dollar cryptocurrency that could reshape the world economic order … and Musk can manipulate it with (many) fewer than 280 characters.

Researcher Lennart Ante found “significantly abnormal returns of up to 18.99%” after Musk tweeted about bitcoin. “I believe that cryptocurrency traders are looking for role models and validation,” Ante told us when we asked him about his research. But, “we are facing a moral dilemma” he pointed out, between free speech and the protection of investors. When Musk changed the bio of his Twitter account to “#bitcoin” on January 29, the cryptocurrency rose from $32,000 to more than $38,000. Is it free speech? Yes. Does that mean it won’t destabilize the markets and end badly?

I. Don’t. Know.

Mr. Musk can even move markets accidentally. When he tweeted “Use Signal,” referring to the encrypted messaging app, shares in Signal Advance, a Texas medical device maker, increased 5,100% in three trading days.

The musk of Musk’s influence gets stronger this week. He’s established an informal alliance with Dogecoin, a functioning cryptocurrency that’s also an extended practical joke. In the week leading up to Musk’s SNL appearance, and following his tweet claiming to be The Dogefather, Dogecoin briefly reached $85 billion in market cap, more than Moderna or Airbus. By midweek it had registered an astounding $45 billion in transaction volume in 24 hours. Click here for a detailed, scientific video rendering of what this level of trading actually looks like.

Reality Distortion Field

The theory of relativity dictates that massive objects distort the space-time continuum, and light and matter slide toward it. Musk has become a similar celestial force in our markets — but in this case, the graviton particles are genius, attention, id, and capital.

In a healthy market, resources flow where they’ll generate the best return: Workers move to cities with strong job markets, capital flows to companies with robust growth prospects. But in Musk’s case, the power of celebrity in a social media age, a rising class of retail investors with stimulus funds, and our idolatry of innovators have combined to create a vacuum that may cauterize other naturally forming celestial objects. I’m especially proud of the last sentence.

Show Me the Money

None of this is by accident. Despite being one of the wealthiest people in history (on paper), Musk constantly needs more cash. He recently acknowledged that SpaceX will need “to pass through a deep chasm of negative cash flow” just to launch its satellite internet service. The company has already raised more than $1 billion this year, and $7.5 billion over the course of its history, while continuing to burn billions in revenue. Musk’s other projects, including Neuralink and The Boring Company, have raised another half-billion dollars with little revenue so far.

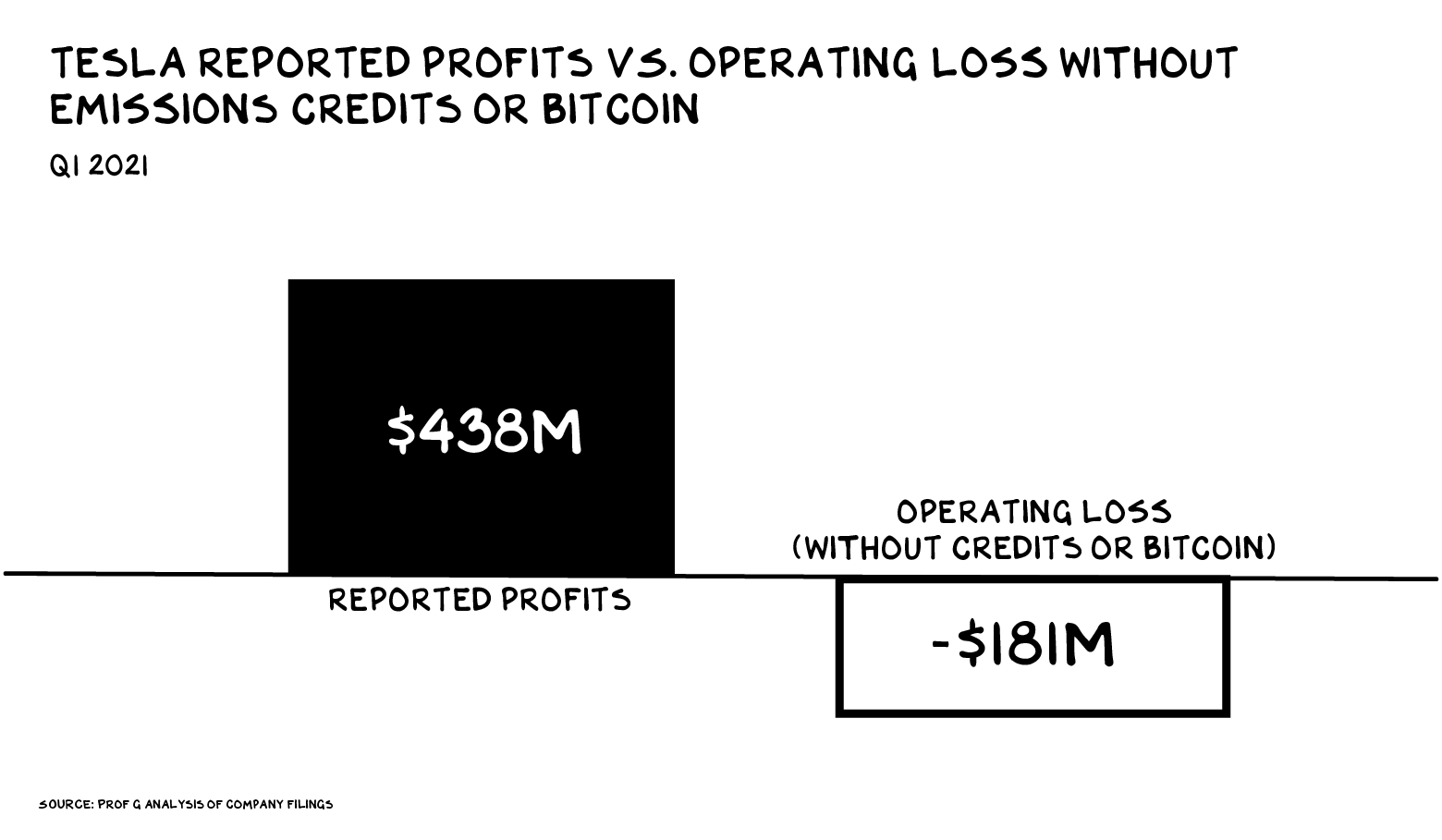

Tesla posts an accounting profit, but in its most recent quarter, it was emissions credits (a regulatory program that rewards auto companies for making electric rather than gas vehicles) and — wait for it — $101 million in bitcoin trading profits that morphed earnings from a miss to a beat. What Tesla did not do last quarter was produce a single one of its two premium cars, the Model S or the Model X. Promised redesigns have apparently snarled production. On this topic, Musk has been uncharacteristically CEO-like (that is, discreet).

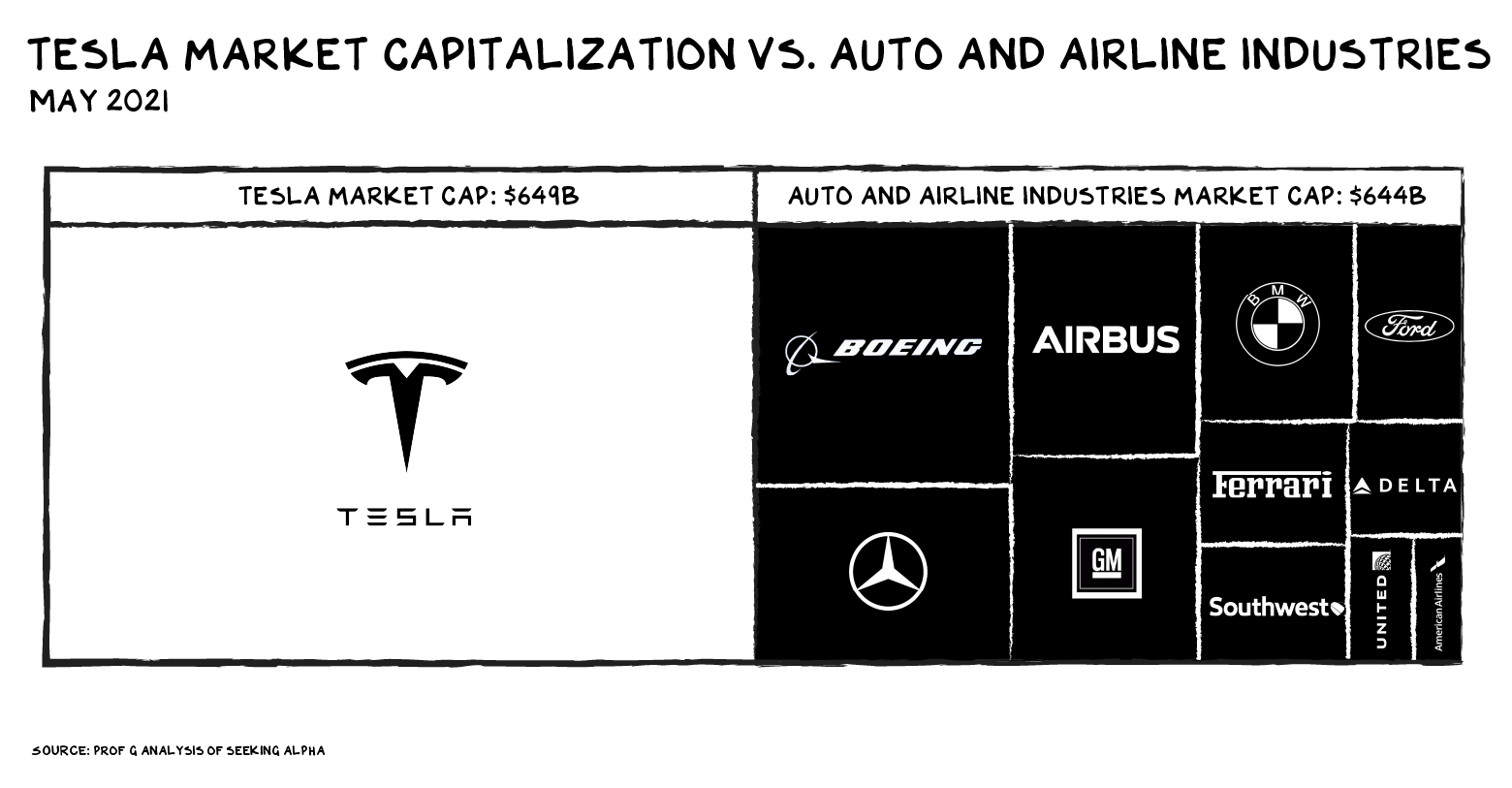

Cash burn isn’t the only challenge facing Musk’s companies. Tesla, his flagship business, now has a market cap that dwarfs that of any auto or airline companies. Tesla achieved that value, in part, because for a decade it operated without a serious competitor. There’s never been a car like the Tesla Model S, and if you want a high-performance, luxury EV, your choice is easy … and singular. Value creation via disruption is as much a function of the incumbents as the disruptor. Imagine a world in which the only phones were flip phones and the iPhone 12. That’s the auto industry since the Model S arrived in 2012.

Or that was the auto industry. Because the Germans are coming. And the Swedes. And the Japanese. On May 2, we got a glimpse into a post-Tesla future when the New York Times ran an article titled: “Mercedes EQS Electric Sedan: The S Stands for Stunning.” The innovation gap is closing. And it’s not just car companies coming for Tesla’s fat margins. The industry’s shape-shift from a $100 billion low-margin manufacturing business to an $800 billion high(er)-margin software business has attracted some enormous sharks. The first overnight $100 billion-plus transfer of shareholder value will occur in 2022, when Tim Cook stands onstage in front of an automobile bearing an Apple logo.

What is the shark repellant for these circling great whites? Musk must keep capital and talent flowing into these enterprises while distracting us from anything regarding fundamental analysis (P/E ratios) or sobriety (it’s a car company). The embrace of crypto serves both needs: It’s consistent with his techno-utopian vibe, and it directs the conversation away from the Mercedes EQS or Apple car while providing a shock absorber for earnings misses. The SNL appearance, Dogecoin tweets, Elvish-letter-named kids, tickling of our senses with 420 references and suggestive emojis: It’s David Copperfield, plus 60 IQ points. To be fair, landing two rockets on barges concurrently is genius and inspires awe. But does it warrant consensual hallucination?

Carbon Costs

Pumping bitcoin might buttress Tesla’s earnings, but it blows open a bigger hole in Tesla’s narrative. The narrative police demand we link Tesla’s valuation to solving the climate crisis, to reducing carbon emissions by replacing gasoline cars with electric ones. And it does that. According to the EPA, the average 22 mpg gasoline car spews out 4.6 tons of carbon every year. Powered by the U.S. grid, an EV is the equivalent of a 68 mpg car, generating about 1.6 tons of carbon per year. (In other words, each Tesla on the road saves three tons of carbon every year.)

But bitcoin mining generates a lot of carbon, too: Current estimates put it at around 53 million tons of carbon production per year. (Yes, miners use a lot of renewable sources and may catalyze greater renewables investment — but does that compensate for incremental electricity demand rivaling that of Argentina??) Here’s some back-of-the-envelope math that’s definitely going to raise the army of the undead (i.e., TSLA longs and bitcoin bots):

In the short term, bitcoin’s carbon emissions are a function of its price — the higher the price, the more miners are willing to spend on electricity to mine. Assuming a linear relationship (a convenient if aggressive assumption), for every $1 that Musk’s pump has increased the price of bitcoin for one year, miners expel another 1,000 tons of carbon. That wipes out the annual carbon savings of 300-plus Teslas. If Musk’s bitcoin evangelism increases the price by $4,500, that effectively eliminates the ongoing carbon savings of every Tesla on the road today.

The deeper problem? Our elevation of Musk as a capitalist idol has distorted the flow of capital and talent. Healthy markets don’t take cues from the tweets of one man.

Man in the Mirror

As SNL’s Lorne Michaels likes to say, “Here’s the thing.” Musk is going to keep tweeting, appearing on SNL, and ensuring he has a bigger rocket than other masters of the universe … because it works. While we’re watching the fireworks, he’s building cars and rocket ships. Is he the best person to build those things? Is the most efficient amount of capital flowing to his factories, versus those in Ingolstadt or Toyota or Detroit? A healthy market is supposed to answer that. It’s the allocation platform. It’s also hard to deny that Elon has inspired an extraordinary flow of capital into EVs and innovation in transportation.

But our idolatry of innovators and the algorithmic media ecosystem have distorted the allocation platform. In the spectacle economy, it’s about the show, the now, the short-term hit. We’re the richest country in the history of humanity, and we can’t garner the political will to fix our bridges, let alone reach for the stars.

This all raises the question: What do we expect? You only have to drive a Tesla around the block to know that Musk is not a grifter. He is a genius (see above: rocket ships landing on a pad floating in the ocean). Maybe a world-saving, visionary genius should deploy any weapon at his disposal to garner the resources, fend off the challengers, and most importantly, buy the time to achieve his vision. Maybe.

We say we want straight shooters. We say we want wealth to be fairly distributed. But 53 million of us follow Musk’s Twitter feed, and tens of millions of us are going to watch him on Saturday night, and the Elon show will go on.

If there is a glitch in the matrix, it’s us. One in five U.S. households with children is food insecure, and we have a man telling his 53 million acolytes to purchase a digital currency so he can sell it at a profit to pad the earnings of a company that’s worth more than automakers producing 60 times the vehicles. And why wouldn’t he? When you tell an innovator he’s Jesus Christ, he’s inclined to believe you. Once we idolized astronauts and civil rights leaders who inspired hope and empathy. Now we worship tech innovators that create billions and move financial markets. We get the heroes we deserve.

Live from New York, it’s …

Life is so rich,

P.S. At Section4 we designed a new sprint taught by Berkeley Haas Professor Sara Beckman (fun fact: she was my professor in business school). She’ll teach you how to test and launch successful customer experiences using strategies proven to drive growth and value. Join us.

The net income is after deducting income taxes, income attributable to NCI, interest income and expenses. You are cherry picking numbers to exaggerate your point. You should focus on income from operations to make your adjustments reasonable. You can’t deduct bitcoin gains and still include income taxes when the income tax will include a provision for taxes on the sale of bitcoin. Same analogy for income attributable to NCI.

There’s no evidence that Musk is anything other than yet another of these self-absorbed grandiose public figures who are long on self-promotion and short on delivery.

Your graph shows Tesla’s *capitalization* because if you showed actual fundamentals like sales or revenues, you’d see an entirely different picture.

I’m so bored with these juvenile antisocial personalities. Where are the compassionate and wise adults?

Professor Galloway always makes me feel like the scope of my thinking is being boosted from the last, linear thinking century, into something akin to a nova bursting forth, shattering stagnant thinking, and revealing new parameters of meaning and value to synthesize within.

Thank you for the great article and insight.

Elon Musk is a genius, yes. However, he has made egregiously false claims about science. Those two things are part of the same human. If you want the full timeline of stupid things he’s said, look here: https://www.forbes.com/sites/joewalsh/2021/03/13/elon-musks-false-covid-predictions-a-timeline/?sh=514426b85b6d Words DO matter and saying “the coronavirus panic is dumb.” in March of 2020 is a dumb thing to do, especially as a CEO who should know better. The United States reported just under 2,000 new coronavirus cases in a single day in March 2020, but Musk predicted the country was headed toward “zero new cases” by the end of April. Come on. No matter how smart we know him to be, you must admit that this claim was pretty stupid. I fully support Galloway’s claims. The minute you feel that you can sum up a person in a word, “genius” or otherwise, you have oversimplified the person. He is a genius, but he also says and does incredibly stupid things somethings.

You take a man who has done more to solve the issues we face related to climate than anyone else on the planet and focus on his social media “gaffes” and mannerisms caused by him being non-neurotypical?

To be honest, you always did strike me as the type of person to bully neurodivergent kids in the playground.

How is this piece of intelligent analysis and constructive criticism ‘bullying’? Musk, the 2nd richest guy in the world, is the bully. Being ‘neurodivergent’ is no excuse for tweeting outrageous false claims about people, like when he called someone a ‘pedo’ because they wouldn’t work with him. Autistic people know the difference between truth and lies.

IF WORLD IS FULL OF PEOPLE LIKE YOU, THERE WOULD BE NO F INNOVATION!

Scott,

This post reeks of small man syndrome. Elon Musk is a genius and an innovator. You are a professor of marketing. Elon Musk is better than you, and you need to accept that. Don’t waste your time or our time with posts that try to bring him down for the sake of your own ego. You have tried to do the same with Steve Jobs and it’s literally beyond embarrassing for you.

Couldn’t agree more!!

While I’m a huge Elon fan and think he’s doing far more good for the world than bad (just look at all the CEOs of car companies who had years to do something good and sat on their asses doing nothing), I think your comment here is far worse than Scott’s post. He makes good points. You don’t have to agree with them. See the comment below from Bob Jones, much more constructive and brings more to the conversation than your comment.

I felt there’s something wrong here. Instead of buying tesla stocks, will buy the other stocks.

You praise “free” markets and pesticides while joining the masses in “cauterizing” awareness of the pain and corruption that both inflict. Please do some research on how many lobbyists work in Washington to keep our system anything but free. Also acknowledge the sick and hungry in our country who don’t have paid lobbyists working for them. Finally, research the depleted soil and illnesses caused by pesticides. Can you quantify the number of people killed or made sick by Roundup?

It sound like it’s you that needs to do more research- especially with respect to the context of Scott’s reference to pesticides. He isn’t overtly endorsing them at all. He’s discussing them as a necessary evil… you might consider what global food production would cost without them. A whole lot more people would face food insecurity and potentially starvation without them.

Scott, I have appreciated your insights for a few years now, but lately the posts have been more virtue signaling than anything substantive. On TSLA, even a cursory glance at their current balance sheet would make it clear that you are plain wrong and making comically bad and outdated arguments. Not only are they profitable with just the core EV numbers, but the tired cliche of holding other revenue streams against them is sad grasping at straws. They are using funding from their competitors (EV credits) to strengthen their moats (manufacturing). They are not leaving any money on the table. Their market cap reflects this accretive reality, one that has been realized and voted on by shareholders over the last year with increasing obviousness. It is clear that you have missed the boat on this by a mile, having campaigned against TSLA as soon as the rally began. If you are going to continue spreading FUD, please at least do a modicum of research and offer something truly valid instead of stale Gordon Johnson tier sound bites.

Excluding Regulatory Credits and Bitcoin gains, Tesla actually makes money on every car they sell. The Auto segment made $140m in Q1 excluding Reg Credits and the Bitcoin gain.

https://teslamotorsclub.com/tmc/threads/tesla-tsla-the-investment-world-the-perpetual-investors-roundtable.139047/page-13034#post-5491109

Wow, you are a good writer — very adept at engaging language. Unfortunately, I think you thesis is misguided. While I agree that the disparity between rich and poor is disgusting, I think hitting on Musk is a poor choice. He is motivated to solve big problems, and invested all of his (smaller) fortune into two enterprises that he thought had 10% chance of succeeding, when he could have lived happily ever after on his own island if he had chosen. His wealth at this point is, as you stated, paper. He has pushed the USA toward renewables by force of will. He deserves kudos (and brickbats for the bad bits).

That comment is already ‘aged’. Tesla is no longer dependent on ‘government handouts’, which by the way are available to all auto manufacturers — that they chose to continue to make ICE vehicles is on them.

Scientific video was amazeballs

The 68 miles per gallon vs. 22 miles per gallon that are cited reflect the ratio of 1:3 between the efficiency of an internal combustion car to the electric motor . ( gasoline cars have a 30-34% while electric delivers about 90%).

However that is a mistake to look at it like that because electric energy was not captured from lightning. It was coal and wind and oil and nuclear etc. with all the renewable energy, still the production of electricity has a huge carbon imprint and it would not dramatically change in the next 30 years or so when most cars would be electric.

It does not end there… after you lose when converting to electricity. You lose some more when transferring it and still more until you charge your battery and still more when you keep/ store and still more when you discharge the battery.

When you combine the carbon footprint average of US electricity production today with all the transfer and conversion losses you get to the result that electric cars have a much higher carbon footprint than regular cars.

I know I will be attacked for this comment so I want to make things clear:

1.I do not and never had worked for any of those industries, allways at service industries.

2. I have an engineering education and I actually did do the calculations.

Its good to get a healthy dose of perspective. Hype cycles influence smart people/companies to buy stuff that they wouldn’t otherwise. This is a good buyer-beware post !

Are you buying dogecoin?

Scott – You are an incredible writer that is stuck in an old paradigm. Writing about the obvious consequences of an economic system that REQUIRES inflation (and will manipulate money to get it) without understanding that it is the SYSTEM itself that is causing those consequences. Climate change, inequality, racism, the divide of society and the ever growing power of platforms – all signposts of the impending transition. The sooner we deal with the root cause, (that technology = growth where prices fall) the better the transition.

Please look deeper. It is important. Happy to send you a copy of the Price of Tomorrow – why deflation is the key to an abundant future if interested.

Joke article.

You can’t just say profit minus one thing inus the other, and there you go it’s -. If you want to not add that bitcoin gain, then add the cost of buying that bitcoin, $1.5 billion they spend.

Tesla cars run on electricity, bitcoin run on electricity. Mostly from renewables. You can continue cry and have double standards on that but you don’t have any point.

If you don’t like how he uses social media and bitcoind etx are pumped, what do you say on short sellers who short companies and then trash them on twitter or on the TV? What’s the difference? It’s that people listen to Musk, not at them. But that’s not Musk’s fault.

What’s wrong with worship of tech innovators that pushed the worls into electric cars and renewables to tackle climate change, and make spaceflight possible and send humans beyond? Nothing wrong. The only wrong thing is that he doesn’t pay the media for ads, while Ford, GM. VW, oil industry etc are paying billions to the media, and since all fo them got their asses kicked by Musk, they’re paying more in order for journalists to bash Musk and his companies.

Last thing, competition is coming?? Seriously?? We’ve been hearing that for 10 years.Competition came, their cars are not comparable to Teslas. Model S, 8 year old car, and still noone can beat it. The competition is coming joke is over. Talk about it, when it’s here. In the present!

Do you understand the responsibilities that a CEO of a corporation has with insider information versus an investor who has a view in our financial markets?

wait, what? “mostly from renewables”? That is a crock. From the get-go, you have zero cred. But I’m sure Elon appreciates your fan-boism.

O beware my lord of jealousy.

it is the green-eyed monster

which doth mock the meat it feeds on.

One of the best posts so far. Looking beyond the numbers to really dissect the why (applause)

This article is written by someone who has not spent the time doing his homework on Tesla. I highly recommend starting with the podcast series between Dave Lee & James Douma about Tesla’s AI efforts : https://www.youtube.com/watch?v=iMtujONU_0I&list=PLfibpgBinf9R7KIedEU3y-YjrA63LSKHX&t=0s

Is Tesla overvalued? Yes, in the short term. Would Tesla be overvalued if the truly dominate EV and roll out autonomous driving and also ramp up their energy business? No. How you choose to value tesla depends on how much you choose to read and find out about the business and then making up your own mind about the probabilities of their success. This article talks about Elon Musk in a very “not well thought” out way.

Is his behaviour bad? Depends. I like the guy and how eccentric he is. People like that are divisive.

I’d rather Prof G spent his time writing better articles than this. Feels like I wasted my Sat reading this and the articles of late have been a little too “holier-than-thou”

You may want to revisit the autonomous driving thesis.

https://techcrunch.com/2021/05/07/tesla-refutes-elon-musks-timeline-on-full-self-driving/

The value proposition in TSLA is as a long term play and betting that compounding effects on its data gathering and analytics advantages will play out and become an insurmountable moat. Anyone buying TSLA for less than at least a 10-year investment horizon is a gambler, not an invester.

Musk tends to overpromise on timelines. This is true. However, he has always delivered. Late for sure, but what he says he will do, gets done. Do take time to watch the long form videos about how Tesla is working to make autopilot a reality instead of reading shorter TC articles that don’t dig deeper into the tech. L5 will take years, but Tesla is so far ahead of everyone else in their ability to gather video data, put it into an extensive training model and send it out as iterative updates. The process keeps repeating and compounding. No other firm has the sheer number of cars on the road and has the software skillset to pull this off. Google arguably has better software engineers, but it isn’t putting out 500k cars a year to capture all that real world driving data.

Google is not a car company so I do not understand the comparison. Secondly, Tesla does not own all the talent in the world. There are other companies working on the same exact thing.

Google owns Waymo. The other company working on autonomous driving is MobilEye which Intel owns. Both are fundamentally different to Tesla’s approach. Waymo + Mobileye use LIDAR and high definition maps. They have to map the car’s environment before the car can drive. Maps are problematic because scaling them is difficult. Imagine if the car can only drive somewhere that has a high definition map. Even worse, maps change all the time, so you are reliant on a team to update these maps. Tesla is taking the vision approach. Teaching to car to understand what the cameras around it are seeing. No other firm is doing this because it is really expensive and difficult. The fact that you think Google isn’t a good comparison worries me because you clearly haven’t done your homework before commenting. Any person who deep dives into autonomous driving will know about Waymo and MobilEye.

To say that Scott has not done is “homework” means that you have not done the due diligence he has pointed out in the article. Tesla layed the ground work for EV’s , now the “big boys” will come in and do it better, ie: Mercedes with a 350 mile range in a sleeker and better designed car

Great post as always, but I would say one big thing differentiates Tesla to Mercedes. Velocity. Mercedes, FIAT, Toyota may be gaining ground but at tesla they’ll make c14 improvements to their cars every 90 days, their competitors are lucky to do that in 12 months. thus what Mercedes FIAT or Toyota innovate/ improve in 4 years Tesla’s done that in 1 year. The gap will just widen.

Until Tesla looses the talent. As the article states, that’s his problem. Paying the talent.

Are you kidding? Tesla and SpaceX are the most coveted companies to work for by engineers.

You’re not wrong in pointing out that retaining talent is a potential weakness. But it is the same shared weakness between all firms. You’re not being objective and thorough in your bear thesis if this is really the best you can do Stefan

I really don’t get Musk as the God like Genius. He is brilliant at marketing. Fundamentally though it is his willingness to challenge the status quo and expend money that makes him what he is. Tesla is a clever car with great software but it’s not innovative in the sense of a paradigm shift (and there are already better cars on the market the Jaguar I-pace is a far better car). The Tesla is still built using fundamentally early 20th Century tech, if he’d built the car out of carbon then I’d be impressed the auto industry has had the know how to build cars with a 100mpg ability for a while but not been inclined to change. The response over Tesla reminds me of a cowboy seeing a Model T Ford for the first time, awesome, but 30 years later old tech and passe. As for Bitcoin, I’m wondering how it will respond to its first major hack? With quantum computing where will that leave crypto currency? I don’t know. Landing rockets again is 1950s Sci-fi but technically not that difficult. Where Musk makes a difference is his willingness to gamble, to ask people to do what hasn’t been done before, it’s not genius and not new. rMNA is genius, solving nuclear fusion would be genius. Musk is the court jester of social media, and that’s not an insult, jesters play a valuable role at court. They say the unspeakable, challenge the status quo. Playing with other people’s money is not genius. But in the land of the blind the one eyed man is king.

Musk got into the car industry,kicked their asses, created the most valuable automaker, and evryone now is trying to copy them.

Then he went into the space industry and kicked their asses too, with reusable high tech rockets and everyone else is left behind.

But yeah, nothing genius about that. Only marketing. lol

PS And now he’s going into the internet industry…

Your rest of comment is pure joke man. jeez

1. He is an engineer in both companies; 2. Both companies uses materials science and unique processes; 3. iPace is generally a failure; 4. If landing rockets was easy, others would have done it; 5. You are obviously misinformed, and hence have mistaken opinions.

Healthy markets don’t take cues from past failures disrupted by sustainable solutions.

Another great analysis of the short term. I still believe that in the long run the market will prevail and Tesla will either run effectively, or go under. What’s most important though, is that Elon got everyone, and I mean everyone except the biggest morons amongst us, to go – hey, maybe this electric thing isn’t crazy. For that alone, he should be rewarded. Life’s not fair in the short run, but everything eventually everything comes out in the wash! Right now, I’d be focused on creating a battery technology that doesn’t require lithium, and investors- bet hard!

Wow! – I’m Shocked at this article! Almost every article for the past year I’ve read has resonated well with me but this one I feel completely missed the mark.

Apple is not a phone company. It is a tech company that builds phones.

Tesla is not a car company. It is a tech company that builds cars.

I think this article misses the insight that other car companies do not have the software expertise to develop tech like this- let alone the vision or commitment to do disrupt their org structure to get there.

Take it from me – I worked at Toyota / Lexus for 3 years as an Engineer feeding into vehicle design teams before I switched into consumer electronics & software tech.

This my friends is a classic case of missing the forest for the trees.

“other car companies do not have the software expertise to develop tech like this- let alone the vision or commitment to do disrupt their org structure to get there”

Based on your misguided assumption that Tesla has a monopoly on talent?

No, but it attracts the best talent, and it takes more than talent to pull this off. It takes commitment, funds, and the willingness to try and fail.

https://robbreport.com/motors/cars/gms-self-driving-tech-beats-tesla-in-consumer-reports-test-1234577947/

It is widely agreed that CR was way off in its evaluation. Just look at the scores. AP did better in the operational aspects. CR had to invent a new category to ‘fail’ AP on. Money talks.

Scott – you hate wealthy people. admit it. it is okay but your narcissism is increasing every year and it’s so obvious you ENVY all of these people who have more than you.

Pity the nation that needs a hero.–Galileo

love that Scott, the problem is we want perfect geniuses but we only have humans to select from. He is both someone i respect for what he can do, and someone I worry about for what he can do

Scott has a brain and isn’t afraid to use it!

Wait is he comparing Elon to Wework at the end?? (Btw I think Elon would rather be seen as howard hughes 😉 )

Still shorting Tesla I guess? “Operating loss with out xyz…” Well that might be, but they didn’t not have xyz, so how can you discredit those earnings as anything but earnings? Tesla does a lot of things, so they make money on a lot of things…duh! And that misrepresented “loss” you speak of is pretty minor when you look at all that they’re doing (building 2 factories at once, with likely an additional 3 battery factories being built as well). That kind of capital expenditure is insanely hard to overcome…yet they did it! And all you have to do is talk trash? Tesla will easily become the largest company on the planet…they’re just getting started.

>>a rising class of retail investors with stimulus funds

Where’s the actual evidence for this vs people actual needing/using the stimulus funds for surviving? Pretty sure the stimulus fund recipients are segmented a lot more than “they’re all using it for meme gambling”

Much wow. The dog video almost made me soil myself. Elon’s not going to change, but this is a fair analysis of whether can afford any more like him.

Well, well I been movin’ down to Florida

And I’m gonna bowl me a perfect game

Well I’m gonna cut off my leg down in Florida, child

And I’m gonna dance one-legged off in the rain

Then I’m gonna buy me some Bitcoin

Instead of using my brain, child…

TL;DR It’s not the emperor but we ourselves who have no clothes.

Scott, thanks for feeding my all too often assaulted (by my own doing) frontal cortex. Want to see the Tesla induced future and what it means to blue collar jobs? I stumbled upon these guys (@grubermotorcompany) on TikTok and learned about the 7,104 batteries in a Tesla. At first, I was like whoa, this is expensive repair, do people realize this? Then I thought this is game-changing in terms of jobs. What do you think?

The Tesla as all automobiles uses Artificial Intelligence (AI). An excellent book on the history of AI is ” Genius Makers” by Cade Metz. Enjoy!

Strikingly something similar I wrote two months ago “Halon Musk”

https://manugupta.substack.com/p/i-am-scared-of-halon-musk-you-should

I have a few things I wish you would mention just to keep things fair minded:

BitCoin = Perhaps a better way to address the BitCoin issue is this:

1) FinTech companies like SQ, etc. make money on crypto transactions.

2) Therefore, FinTec encourages it, and they make purchases seamless.

3) Eventually, paying for everything in crypto becomes a standard.

4) The protection of the US dollar is a FED & Treasury primary duty.

5) Once it gets too far along and too many people have too much money in crypto you cannot turn back – it becomes de facto our currency and it is starting down that road.

Don’t you think the US government has a duty to demand that businesses only use “legal tender” in transactions of everyday goods?

Average people do not know the problems FinTec companies are putting them in. All average people know is that the restaurant said it is OK to pay in BitCoin.

Instead of targeting the issue, you are wasting our time blaming the issue on an personality – Elon Musk. Let’s all get our pitchforks and torches and go after him?

No, he is insignificant to the issue – our government not addressing BitCoin is the issue and it gets exponentially worse every day without journalists addressing the issue.

TSLA profits or non-profits

The story you are promoting is “TSLA cannot be profitable without government help.”

A great many of the analysts’ models that show a one-year PT of $900 or so do so without the contribution of governments credits.

Here is Gary Black – former CIO of GS:

https://twitter.com/garyblack00/status/1390317191137013765

Why don’t you go argue with him?

There are many others too.

There are a lot of ways to show a profit if you are a large corporation, you can reduce expenses, etc. However, if you have a profit with government donations, then you have a duty to just use it in your financial statement and avoid having to decrease expenses.

Here come the big guys, here come the big guys – look out TSLA:

Yes, they are coming but it would be a much better article if you presented both sides of the issue. There are lots of issues against TSLA.

Let me number them:

1 – ChiComs can kill TSLA business in China anytime they want.

2 – German unions and big German auto companies will sue like crazy and put tons of political and social roadblocks in the way of TSLA. TSLA just won one suit over this in Germany this week. FUD is rampant in German media circles.

3 – In the USA, GM and F will not roll over and play dead. They are the biggest funder of ad revenue for the news media, and they are using that power now. Also, GM and F have big political pressure (e.g. We own Michigan) that they can use which TSLA does not have. TSLA is the super underdog in this fight.

Now for the other (missing) point of view:

TSLA hopes to win with their technology. TSLA factories are state of the art. They are constantly reducing cost of manufacturing. They hope to reduce the cost of everything and produce the best cars at the cheapest price and their hope is that will win the day.

It might be a good idea for you to really go after where BitCoin is taking us because a country that cannot control its currency is doomed.

We get the heroes we deserve…..or whatever the media feeds us.

Franz

As usual Scott, great post. Agree with much of it. Yes, he is a genius, but what he lacks, imo, is basic common sense. Many geniuses do. If he had common sense, and not a pure sense of greed, he would have some compassion for the millions of accolytes who will someday in the future, again imo, lose a fortune that they can’t afford to lose. The market is full of froth in so many ways, but none greater than in the many forms of crypto…imo.

Actually I would say Musk’s best attribute is his \basic common sense’ (which isn’t common), in that he looks at problems with fresh eyes, absent dogma, so that his solutions work. Instead of throwing away boosters, he said why can’t we land them? And he had the wither-all to push and fund his engineers to make it happen, despite them undoubtedly claiming it ‘can’t be done, because’.

As for risk to the (small) investor, a longterm investment is likely a good investment. Tesla is not just a car company, but a tech company that makes cars, solar, storage, AI. It moves fast.

Shameful article, ridiculing musk for personal aggrandizement. Scott you are much better than that.

The capital intensity required to mass produce and then the sales volume required to reach profitability make it initially hard to show profit, and you know that . Teslas production run rate is now there and you will eat your words.

Agree. It is almost impossible to build a successful auto company, both because of the huge expensive gap between prototype and mass production, but also because of the wrath of the OEMs, and their acolytes. Tesla passed through danger of failure three times (S, X, 3), SpaceX also almost failed after early launch failures.

Relax Scott. SNL is just a comedy show. The content is appropriate.

Perhaps Elon will show his garage on fire due to a battery event.

Good thing our Constitution prohibits non-US born individuals from ascending to the Presidency. Because this megalomaniac would surely aspire to hold the office. Though I wouldn’t be surprised if he and his ego tried to amend the Constitution to facilitate such a coronation.

Id vote for him over a dunce like Trump or a war criminal like W.

I’d vote for a traffic cone over the Tangerine Ball Bag or 99% of GQP lawmakers.

Totally awesome article. I’m in Hawaii where EV combined with great solar and a pro-environment mindset are the norm. Elon is both a hero (I drove a Tesla to the top of Mauna Kea once) and a wild card, but having lived all over the world, Americans are uniquely primed to think only Disney-esque binaries of good or bad.

Who is engulfed in the Reality Distortion Field now? I don’t remember Steve Jobs needing the government to make his companies profitable, but Elon does. And he STILL loses money on EVERY car he sells. If he’s such a genius, why hasn’t he been able to turn a regular profit all these years? Any idiot like Elon can lose money. MAKING money takes genius. Have you considered what might happen if even one of those stupid SpaceX satellites crashes into something up there? SpaceX is contributing to the amount of junk orbiting our planet without any concern for the consequences. Musk IS a grifter, and a criminal, violating securities laws with impunity. In the meantime, established auto manufacturers waited for him to build a market big enough that they could make a profit selling electric cars. And Apple…tell me, who has competed against Apple and won? Palm is gone. LG is exiting the smartphone market. Microsoft can’t make a tablet to rival the iPad…or even a smartwatch or smartphone. Apple owns the wearables market. If Apple enters the car market, Tesla is finished. Apple has no debt, but Tesla carries an unbelievable amount of debt. That’s not genius. That’s incompetence. Negligence. Elon is P. T. Barnum, not Ford.

This comment will not age well.

That comment is already ‘aged’. Tesla is no longer dependent on ‘government handouts’, which by the way are available to all auto manufacturers — that they chose to continue to make ICE vehicles is on them.

Fix our bridges?

https://www.youtube.com/watch?v=1dq17-kXWYA&ab_channel=MrRobot%C3%96

Fun Fact 2: “Berkley Haas Professor Sara Beckman” works at UC Berkeley. The Dawg needs better proof-readers

You’re welcome.

Scott, time to practice what you (almost) preach – how about doing an Elon Musk/Tesla detox? What would happen if you were to turn all this amazing sharp analysis toward other industries and companies, and help illuminate the problems, mismatches and potential opportunities through the metrics? You just might inspire folks to get busy innovating across other business sectors. As much as I love EV’s and own a non-Tesla one and want to see the entire EV/Solar industries thrive, we still can’t eat those things. Big Food, Big Pharma, Big Ag, wow, entire universes of business activity that could use a rundown (takedown) by your great mind. There are a lot of people who do not hang on every Elon Musk tweet. #notthe53or74million

The net income is after deducting income taxes, income attributable to NCI, interest income and expenses. You are cherry picking numbers to exaggerate your point. You should focus on income from operations to make your adjustments reasonable. You can’t deduct bitcoin gains and still include income taxes when the income tax will include a provision for taxes on the sale of bitcoin. Same analogy for income attributable to NCI.

Thank you for this article! I can’t stop thinking about how greedy and compassion less we have become as a nation and couldn’t find the language to describe how our idolatry of wrath and the wealthy is making this worse. You have e me the words. Thank you.

@Matt – please elaborate. It seems that your thesis is that Businesses used to be, at some point in time, “nicer.” I do not find that to have ever been true. Business is ruthless. Business is competition. I think it has always been that way.

MARKETs – Markets are any space where people converge to exchange. SuperMarkets are an example, for foods. Scott – why are you so hyperfocused on the Apple’s pricing/strategy for controlling the App marketplace? SuperMarkets do the same thing to food manufacturers. And, prior to the 1980s, Malls used to charge the renters a combined monthly fee PLUS a percent of sales.

“Food for thought”

caveat emptor

Let the free markets have their freedom; after all, “Freedom’s just another word for nothing left to lose.”

When both WSJ and NYT reported on TSLA q, they failed to mention no earnings from cars. Good to have a professor who both reads and writes.

As a nation, we have lost our way. But I’m confident, that eventually, we will get it figured out. Lessons to be learned – again.

Today, Tesla’s p/e/ ratio is 263. How can Tesla ever generate enough profit of Tesla to have a reasonable P/E ratio?

What’s a reasonable PE ratio these days? US bond PE ratio is 66, UK bond is 133, France is 700+

Bonds do not trade at PE. Bonds have yield and risk. Bonds have a priority in bankruptcy (in the USA. I dont know about UK and Europe/France bankruptcy)

P/E is just an inverse of yield. Bonds compete with stocks. Certainly stocks are riskier because they are lower in the cap structure. But if bond yields are out of whack, compared to history, you can expect the same with stocks.

Historically, the S&P 500 P/E ratio is about 15. I don’t

think there are any good investments right now.

you as silly question. Just hold your investment for 263 years and hope that Tesla has the same earnings for all those years. It’s quite basic math. Just be patient.

A month ago, Tesla’s P/E was over 1000. A week ago, over 600. Now it’s 263. Tesla EPS in 2022 will be $7-$9 range. You do the math. When economies of scale hits on all cylinders, this company will be disgustingly profitable.

Discreet

Thanks. I learned something today!

If nothings else will be entertaining!

No problem