The Algebra of Wealth

Audio Recording by George Hahn

The news of the (second) impeachment seems strangely pedestrian after the blowtorch intensity of Reddit vs. The Hedge Funds. The good news is that the hedge funds didn’t conspire with market makers and trading apps to suppress a (warranted) generational revolution. The inevitable Netflix/Hulu/Starz versions will not be so romantic; Reddit mainly inspired a transfer of wealth from one hedge fund to others. It was a pump and dump masquerading as a movement … with many retail investors left holding the bag. There was a conspiracy behind it, though: Society has conspired for decades, through low interest rates, tax policy, and most recently the stimulus, to transfer wealth from the young to the old — the opposite of a healthy society, in which the ballast is a thriving middle class and optimistic youth.

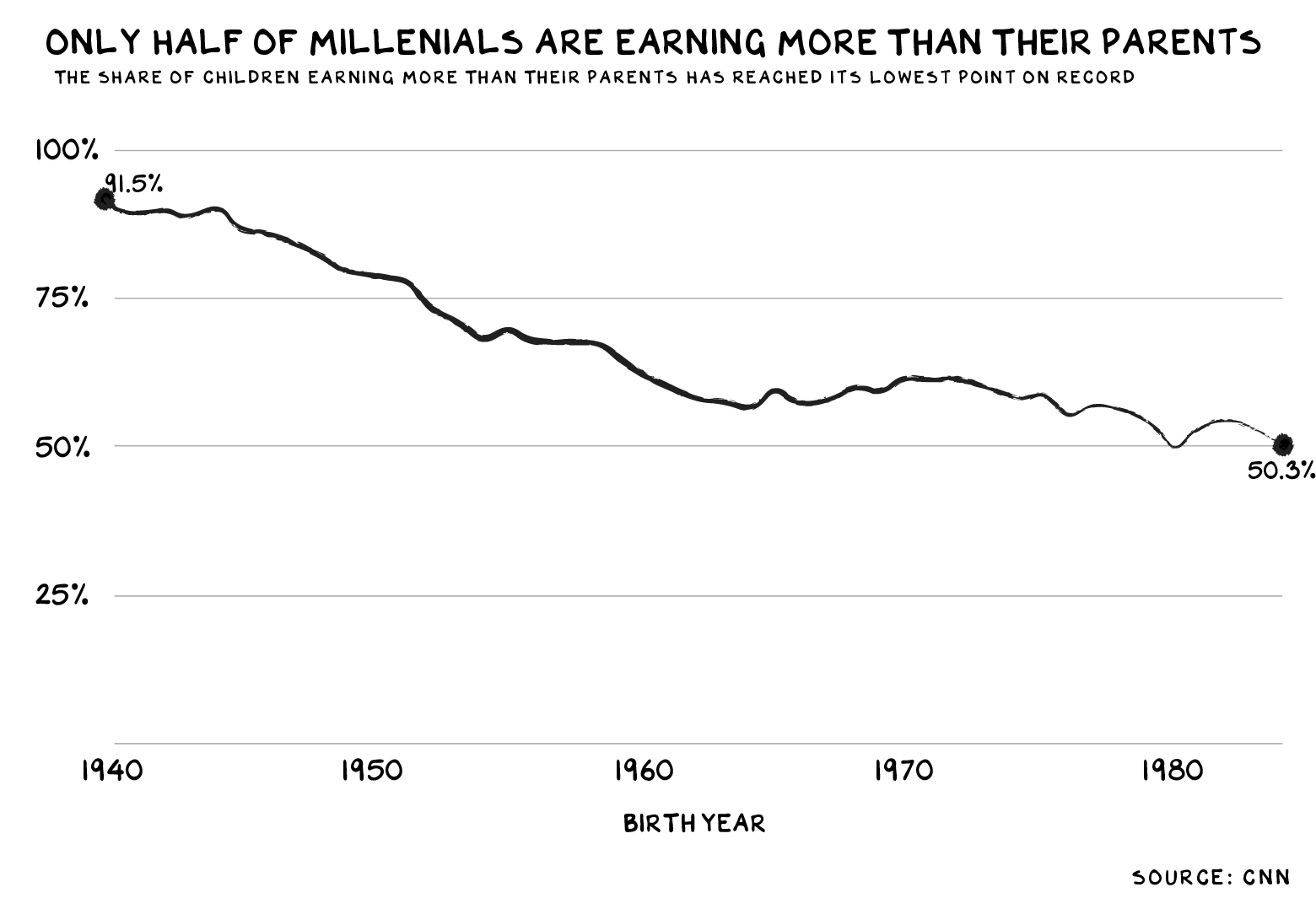

Since 1989, people under the age of 40 have seen their share of the nation’s wealth plummet from 19 percent to nine percent. For the first time in U.S. history, young people are no longer better off (economically) than their parents were at the same age. And, the distribution of this shrinking wealth remains unequal across race and gender. Fading economic opportunity and mobility is a disease, the symptoms of which are shame, frustration, and rage.

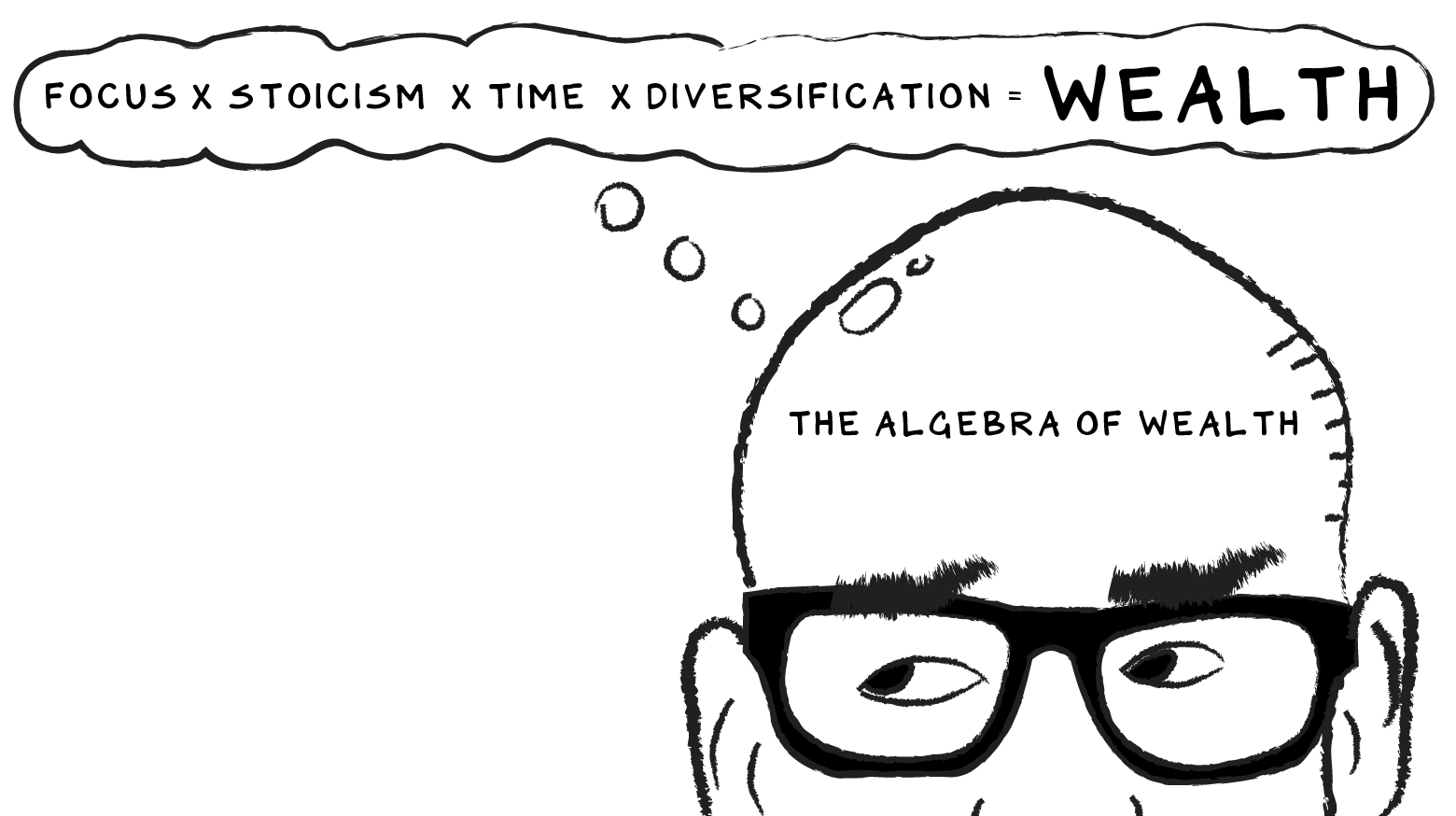

But that’s another post. This one is about how to rebel against the conspiracy: the algebra of wealth, or… how to get rich.

Opportunity remains abundant, even as the headwinds of policy make it increasingly difficult for the young to capture their fair share of the spoils (note: this is not sustainable). The less novel path to success does not change, although it is overshadowed by outliers including Charli D’Amelio, President Putin, and Oprah, who illuminate narrower paths. Successful people often unwittingly head fake young people with the humblebrags of “follow your passion” and “don’t think about money.” This is (mostly) bullshit. Achieving economic security requires hard work, talent, and a tremendous amount of focus on . . . money. Yes, some people’s genius will be a tsunami that overwhelms a lack of focus and discipline. Assume you are not that person.

What Is Rich?

I know a lot of people who make an extraordinary amount of money, but few people who are rich. Rich is having passive income greater than your burn. People on a path to money focus on their earnings; people on a path to wealth also focus on their burn. Joseph Heller said, “It takes brains not to make money.” (Note: I think he was casting a favorable light on his starving artist friends). This may be true, but it definitely takes brains to hold onto it (i.e., money).

My father receives $48,000 per year from Social Security and his Royal Navy pension (he was a frogman). He spends $40,000, and it’s enough to make him happy. He swims every day, watches a shit-ton of hockey (Leafs fan), and on Fridays goes to The Taco Stand (an actual restaurant in La Jolla) where he orders something called a michelada. (Apparently it’s medicine delivered in a chilled salt-rimmed glass — he claims his hair is regrowing and that he’s sleeping better. I believe half of that so … I believe it.) Anyway, it’s not your income, but your income-to-expense ratio, that determines if you’re rich.

So, how to increase the odds of reaching economic security (i.e., get rich)?

My observation is that there are four factors in the algebra of wealth: focus, stoicism, time, and diversification.

People conflate a lack of focus with a lack of talent. Intelligence and talent are correlated with success, but the strongest signal of future success is your perseverance and resilience: what the books in airport bookstores call “grit.” Unless you are supremely disciplined, your career will have to be something that gives you some enjoyment, but don’t mistake focus for your “passion.” People who tell you to follow your passion are already rich: Follow your talent. The accoutrements that accompany being great at something (relevance, admiration, camaraderie, money) will make you passionate about whatever “it” is.

Focus on putting yourself in a position to be financially successful. Get certified: In a digital world, much of the corporate world decides whether to swipe right or left based on the logos (aspirational universities/firms, vocational certifications, etc.) on your LinkedIn page.

Sector dynamics will trump your talent (I realize how awful that sounds). However, someone of average talent at Google has done better over the last decade than someone great at General Motors. Be thoughtful … any opportunity you have when you are young to choose among different paths is a profound blessing.

Look for the best wave to ride. Twenty-five years ago, I chose to paddle into the e-commerce wave. My first effort (Red Envelope) failed. Even worse, it failed slowly… over 10 years. I stuck with it and started a firm that helped other firms develop e-commerce strategies (L2) and have owned Amazon stock for 12 years. It took me a while, but the strength of the wave kept me moving, and carried me to the beach. I just read the last sentence and am fairly certain I will never be a truly great writer. Anyway.

Focus on your relationships. Family and friends are essential to long term happiness, and the most important relationship is your spouse. The most impactful economic decision you make will be who you decide to partner with or, more specifically, who you decide to have kids with. Married people grow their net worth 77 percent more than single people. Marry the right person, and then invest in that relationship every day. You’ve wagered 50 percent-plus of your net worth, and value in the marketplace, on that partnership. Don’t keep score, and bring forgiveness, generosity, and engagement. In sum, show up.

Determine what you can and can’t control. You can control your reactions to temptation — a lack of discipline is the antichrist to economic security. Our society of superabundance makes this difficult. Billions of dollars are spent every year on schemes to manipulate our natural impulses into spending more money, consuming more fat, and believing everyone around us is more successful than we are. The upgrade from economy to premium to business to first class to private jet can seem like an investment in yourself — it’s not. The most powerful forward-looking indicator of your financial freedom is not how much you earn, but how much you save.

A specific activity accelerates in a bull market, conflating luck with talent and dopamine with investing. Diabetes, high blood pressure, and sharing a screenshot of your Robinhood gains are maladies of industrial production that exceed our instincts. Trading — distinct from “investing” — can feel like work and productivity. It’s not. It’s gambling, but without free drinks and with worse odds. One study found that over a 12-year period, only 5 percent of active retail traders made any profit at all. This time around, apps including Robinhood, with its dopamine-triggering confetti, and 24-hour-a-day, volatile crypto trading are the drugs of choice. Most day traders will be fine, and will suffer affordable losses … most. However, for many there are darker outcomes. Young men are especially vulnerable, as they are more risk aggressive. Between 80 and 85 percent of day traders are men, and 23 percent of men who gamble become addicted (as opposed to seven percent of women). Most of us can gamble without becoming addicted, just as most of us can drink without becoming an alcoholic — but, know the risks.

Stoicism is not just about being stoic in the face of temptation. It means having good character. Succeeding in life is much easier if other people want you to succeed. We have a mental cartoon image of rich people as grasping and cruel. The reality, in my experience, is that wealthy people, in general, demonstrate strength, acumen and … kindness. Economic security is in the agency of others and you want others to want you to win.

I spent the first 40 years of my life chasing some form of Western relevance so I could register more dopamine surges. It was never enough. More, I want fucking more… now. The pursuit always managed to distract me, and I was unable to get the engines of success and fulfillment firing on all cylinders. This stage of my life was characterized by fits of progress, getting close, but never achieving anything resembling the potential my opportunities warranted. In one moment that all changed for me: When my first son came rotating out of my girlfriend 13 years ago. In sum, shit got real. I was young enough to be selfish, but old enough to recognize it and acknowledge that I needed to change. I decided at that moment (no joke) to bring more focus and discipline into my life.

“Time is the fire in which we burn,” says the poet. It is our most inflexible and valuable commodity, the one thing with which you should not be generous. Squander money, you may earn it back. Squander time, it is gone forever.

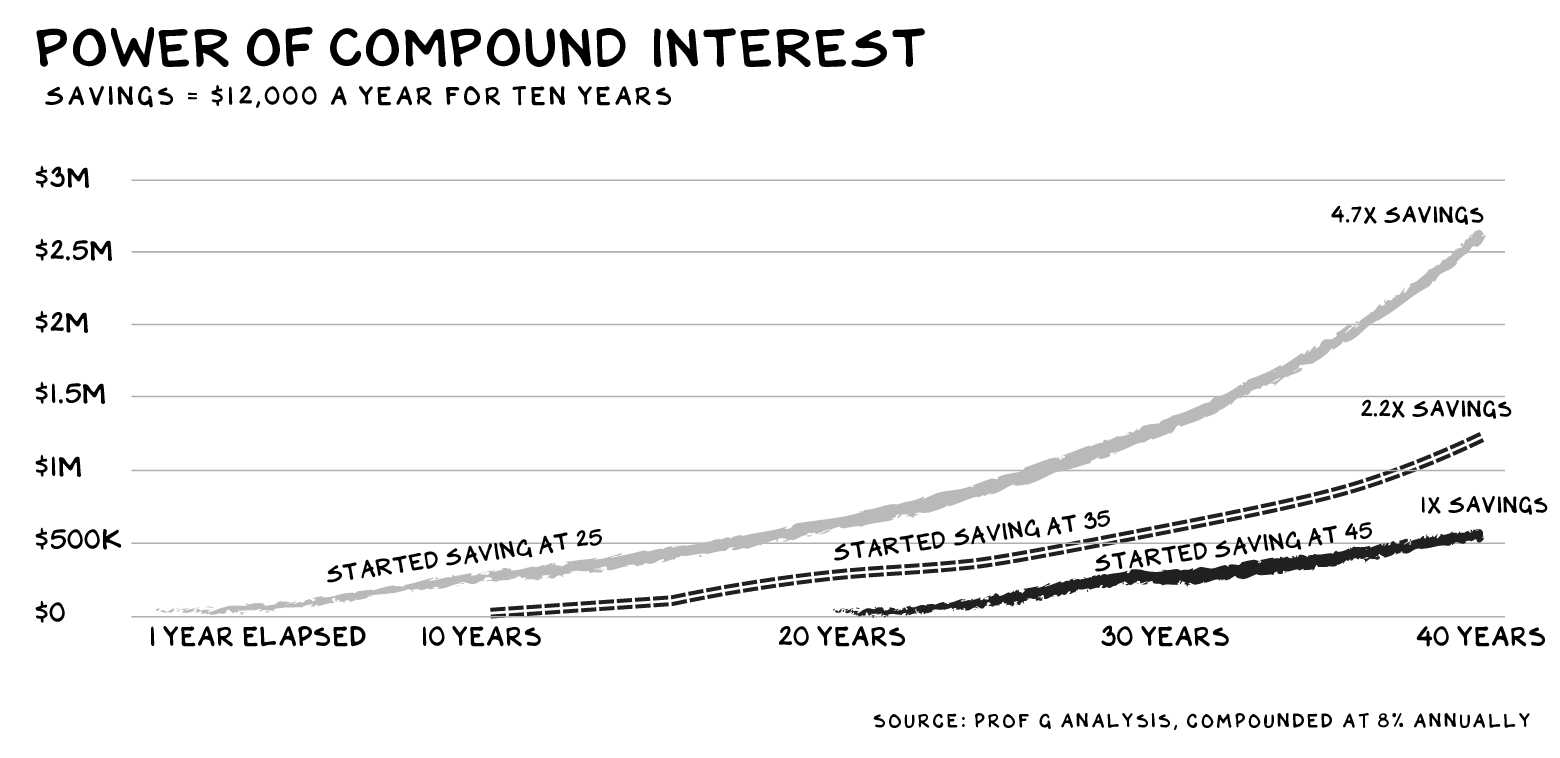

Re investing, the long-term is our ally, the short-term our nemesis. The gangster authority on time, Albert Einstein, supposedly remarked that compound interest is the eighth wonder of the world. Yet our brains are not wired to understand this. When I was 26, I thought of being 46 as the distant, irrelevant future. Now that I’ve reached that age (actually I’m 56… ughh), 26 feels as if it was last year. But small investments I made a decade-plus ago have grown into the base of my economic security.

Compounding is not just a financial thing. The most important returns in life come from the compounded effects of our investments over time, whether in our finances, careers, hobbies, or relationships. Change the timescale of your life, and you change your life.

In your life, focus is key. Plan A for financial security is being great at doing something that the market values highly, and leveraging that into income and/or equity in a business. But Plan A squared is investments. And with investments, focus is to be avoided. Diversify and, unless your plan is to be in the finance industry, be sure that your time spent tracking/trading does not distract you from what is/should be your source of income and savings.

Investing over the long-term pays out, but there are always dips along the way. Diversification is the kevlar that protects you — with it, bad decisions will still hurt, but they won’t prove fatal. Diversification, in other words, is your bulletproof vest.

A few of my many egregious investing errors:

- Red Envelope: I was so emotionally involved (I co-founded the firm in 1997) that I kept putting money into the business and ended up losing 70 percent of my net worth when the firm declared Chapter 11 in 2008. I had no kevlar, as I was terribly concentrated in one asset.

- Netflix: Yes, Netflix. I believed in the company, respected its management, saw its potential, and bought a lot (for a professor) at $12/share. That’s the good news. The bad news is that I sold it six months later at $10/share to capture a tax loss, and never re-bought. Today it’s at $558… not that it doesn’t haunt me… every day. Nope, definitely not.

Most of my major mistakes in investing can be distilled down to two things: not diversifying, and trading.

Mistake number one (Red Envelope): Almost fatal. I was 43 and outwardly successful. However, with the birth of my first son, I was feeling more economic anxiety than I had since I was a kid (I lived in a household with a single mother who worked as a secretary). Mistake number two (Netflix): Painful but nowhere near fatal. I had eggs in other baskets (i.e., Amazon, Apple, Nike, Oracle). In the end, my kevlar has been not allocating more than 10 percent of my net worth to any one investment. That doesn’t mean I don’t look for opportunities that offer asymmetric upside — I do. I just don’t ever take off my kevlar. You don’t need to be a hero to get to economic security.

Not Your fault

These principles have served me well, especially as I have been more disciplined about following them. But while I wasn’t born into wealth, I did benefit immensely from the circumstance of my birth. My smartest move was to be born a white male in California in the sixties. An America that loved unremarkable kids presented me with a world-class education (at the time, UCLA had a 60 percent admissions rate and cost just $400/semester), thrust me into the financial boom of the 1980s and, through sheer luck, positioned me to catch the internet wave.

Since I set foot on the UCLA campus in the 1980s (feels like just last year) we have told ourselves we remain the Land of Opportunity, and that we were making progress to remedy our historic imbalances. Yet as illustrated by one metric after another, economic security is harder to obtain, not easier, and is becoming less a person’s individual fault and more a result of circumstance … America is becoming less, well, American.

Are we headed for another revolution? I don’t know, but we are due for another righteous movement. What can you do in the face of a system that profits off you becoming overweight, indebted, divided, and addicted? Answer: Rebel.

Focus on what matters. Be a Stoic in the face of temptation. Use Time to your advantage. Diversify your investments.

In any economic climate, how do we build economic security, foster love, and find joy? How do we get rich?

Slowly.

Life is so rich,

P.S. Registration for my next Strategy Sprint closes Tuesday. Here’s what will go down over the two week Sprint: two live lectures with me featuring Q&A (think Reddit AMA but it’s live over video and no one from r/wallstreetbets will be hawking weed stocks), excellent prerecorded video (check out our preview), and a Slack Community of everyone taking the sprint simultaneously. The experience wraps with a final project that you’ll share via Slack, and I’ll review a selection of them in my final live lecture. Get in there!

176 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

You grabbed me on this one Prof. G.

I’m currently defining in my own life the difference between what it is to seek being rich and what it is to pursue being financially free. I’m and ex prof. due to much of what you mention in your writings.

More thoughts on this dichotomy will be appreciated…

Also, insights on how your Scottish heritage informs your world view would also be appreciated as well.

Cheers…!

Ah well then too intelligent fir your own good. I can relate to that having called for the demise of the Canadian housing sector and bank stocks for the last 2 decades 😂

Michelada’s are amazing! try one! I prefer the recipes without tomato juice. very refreshing in summmer.

Professor G, as a reader from Jamaica. Very good read!

I’d also like to follow up with a venture that everyone here should follow up on:

1. Blockchain is the best venture of all millennials

2. Bitcoin is still relevant as education for the masses

3. the crypto crypto currency HEX has gross 1600X in 16 months

4. Respect the future you are in and sell you mothers house thats she bought you and become a hodler

Still maintaining this standpoint? 😏

Someone’s shorts are too tight.

exceptional advice. Wish you wrote it 30 years ago and i read it at the time! Kidding aside, the time to plant a tree is now.

I’ve always agreed with Prof’s critique of “follow your passion”. As he suggests, I followed my talent — for problem-solving, pattern recognition, clear writing and communication, and team-building — to build a career as an executive in the retail industry. It was not a passion, but it was fine, and quite lucrative, enabling me to acquire a portfolio of cash-flowing rental properties that cover my expenses, and leave my corporate career at 39.

Now I write about real estate, and coach others to become rental property investors. (www.rentalincomeadvisors.com) And I wake up without an alarm every day, and basically do whatever I want. Now THAT is rich.

Prof’s explanation of wealth-building here echoes what adherents of the FIRE movement have been preaching for more than a decade. “Make more than you spend, invest the rest” is the inescapable, one-sentence answer to the question of how to manage your money and build financial security.

As always,succinct, precise and presented in a humorous and logical fashion.Sad to think about all those wasted years you spent trying to make money. Academia’s loss!

I just subscribed. I’m 46 and fucked. Reading this informative, no-nonsense piece makes me want to put a gun in my mouth.

The best time to plant a tree was 4 months ago right after you sent this! 🤗

Nice piece and good investment advise. It would have been better if you had used “consume more sugar” rather than “consume more fat”. Consuming sugar is the health killer. Consuming the right kind of dietary fat not at all despite what the government says.

Could also be interpreted as what you consume that gets you fat. 🤔

Either way, eat healthy and grow wealthy!

Just saw you on Bill Maher. Outstanding!! You nailed the issues (now if only voters who go blindly into the voting booth would listen to you). Hope you are on the show again very soon.

Just watched the professor on Bill Mayer haven’t heard that much sense in a long time. Now I’ll look for more, thank you

I have not followed this advice. 40 years too late. Life is shit, but getting better.

Huh, I didn’t realize the economy was a zero-sum game.

Great article!

Brilliant Great read

A suggestion: resend/reshare this same article every year at the same time. Update it slightly if you like. nearly all your writing is good. most of it is great. But this is timeless.

Also, having no debt is a very good thing.

Becoming rich is very simple if you do two things: from the day you start working, put 10% of your pay into a low-cost target date fund, and spend less than you earn. Anyone, regardless of income level, who does that will end up rich 30-40 years later

I think I needed to read this at this exact moment. I caught lightning in a bottle with Gamestop and made more money in 3 weeks than I have in about 2 years. Combined. But that is the most dangerous kind of “win”. I actually did perform some level of due diligence and actually thought the company was a good investment when it was trading in the teens. But I freely admit I got caught in the mania and plowed more money into a single stock than was reasonable. Thankfully I came to my senses and pulled the ripcord before I got smoked but it was these basic concepts you detail (and my father taught me a long time ago) that truly stand the test of time and pulled me back from the brink. Now a father myself I cannot agree with you more regarding TIME. To me money = time (optionality) and those few weeks during GME January I lost sight of that and was only concerned with the money. Thanks again for this article.

Good piece, but you’re still in the 80s when it comes to nutrition. Fat is not bad.

100% spot on.

Excelente medley of theory and experiences. Thanks

Wonderful, spot on

Nicely done for a guy with a public school education. Go Trojans!

In 1980 I quit a very good job, with a great retirement package. At that time there was $15,000.00 in the account. I could no longer contribute to it but had the choice of leaving it or withdrawing it. Though I could have used the cash, I left it. Today there is $650,000 in that account in addition to the regular withdrawals that I have made

That’s a beautiful piece of writing – don’t tell yourself otherwise. The truths in it are priceless. Like many younger folks, I fell for the nonsensical tale of older folks, “follow your passion.” I lost over ten years of my life to learn the mistake. You are a true American hero for bringing that to life and speaking so candidly of your wins and failures. A long time friend, also (like your father) hailing from beautiful La Jolla.

Great article……I am probably older than most readers of this article and with less education, but there are a few things I have learned in life that I will share with regards to successful investing. The first thing is to look at the chart of stock indexes over the last one hundred years and note the direction of the trend. The second item of interest is to note that the trend has not been a straight line. What information can you gain from those dips. The third is to realize that most of us are probably in need of information that we must pay for. And last of all is to diversify and have a cash reserve to take advantage of those dips when they come!

Aside: I really, really loved Red Envelope and was so sad when it shut down. You were a go to when I needed a gift.

Wow what a nice read. I actually feel better because it reaffirmed my strategy of spending less then we make and saving more. I’m 36 and my two kids college funds are on track for being close to 100k each 16-19 years from now when they are ready for college. And my 401k is on track for a 60 year old retirement age. I focus on my job and my job loves me. I focus on my wife and my wife loves me. I focus on my kids and my kids love me. I save my money but don’t focus on it, and it loves me. 10 years ago I obsessed over finance books and stock market and the trend of advice from the most successful was o clear and so simple: make money, have no debt, and save money (with help of index funds). That’s it really. I switched to self control books and a book called ‘the art of not giving a duck’ and obsessed over those. I think that’s where a lot of young people lose or skip is the focus on better understanding how selfish and immature one can be, and how they should control there urges a little better and breath easier. I should also note I ditched all social media around that time too ;).

Nice analysis. However, review your first graph. You’ll note the steepest slope is from 1940-1960. From 1960, we’ve only dropped a few percentage points. What might the data conclude should we examine the processes for that period?

Need help to turn my life around.

Focus on your talent and persist till you become a force to reckon with.

Well done piece here. I’m not sure I agree with the statement that America is becoming less American. Admittedly, one of your greatest strengths is being white and being born in California in the 1960s. I’m not sure that America was any better than today, (at least for the greater society) as is being felt in our current social climate. Perhaps the answer to if there will be a revolution or righteous movement is in how we choose to deal with our prodigal sons.

Great article on a Sunday morning and it is something to pass down to the young generation or should I say ‘Alpha’ generation.

Nice. Enjoyed reading this with my Sunday morning coffee.

Superb article

” It took me a while, but the strength of the wave kept me moving, and carried me to the beach. I just read the last sentence and am fairly certain I will never be a truly great writer.” Great writing is about truth. You need to read more Bukowski.

This is a must read for my 22 year old son, employed as a Cable Technician with only a HS diploma.

Has the U.S. gone from a bank, investing in itself and sharing it’s value – when it makes sense- to a grab bag for non-contributors and citizens who prefer to trade versus invest in their very own home/country? So, now we need to rebel – and we know it. And, in a sense, we are. But, our weakness is focusing on the division and not on the cause; Where the malnourished war against the obese – and vise versa – versus focusing on the more difficult to reach actual cause. The masses have become lazy in this regard, where human nature loses in it’s propensity to focus on low hanging fruit, and the machine of the actual cause revels because of it.

Every now and again, I come across something and say, “I wish I had written that.” That’s the nature of this article. Little in life saddens me. But the prospect of leaving a troubled world to my children and grand children where the deck seems to be stacked against them does. I have subscribed to the newsletter and look forward to seeing more of what you’ve to say.

Great article, reminds me of principles from ‘the richest man in babylon’. Where do you recommend allocating capital to receive 8% interest per year that can then be reinvested for the purposes of compounding? Does this need to be in a dividend paying company like Apple or Disney? Also, any thoughts on a Dalio-style ‘all-weather fund’ but tech focussed diversification strategy?

Read “The simple path to wealth” and “quit like a millionaire”

Absolutely wonderful article. This should be taught to every kid in every school. As far as-income greater than “burn” it is something to aspire to. Young people can not accomplish this. It is the long term (slowly) with patience that must be learned. Compound interest over time in all areas. Patience. An aside – I used to order gifts from Red Envelope back in the day and I loved the company!

Very good article! Thank you

One of the most insightful, honest and thought provoking articles I’ve read in years!

Wow great article! I just arrived by SUP to the beach of freedom with a ratio of wealth over expenses that has freed my sole. I have been thinking about your article in my brain, but you artfully put it in words. Thank you.

Great piece. Keep it up. Tattoos, coffee, drugs (all), frivolity…all poison.

Great simple equation. Professor, could you talk more about the dispersion wave of change? Thanx!

Agreed – diversification is always key, no matter how good the one idea maybe. Gokulram Arunasalam

Good advice, but dude, coming from a long-time reader, did you get a new writer? You’re lacking the spark you usually have, you can no longer spell millennial, and you have a phallic thing going on with the surfboard that I can’t tell if it was on purpose or by accident.

Maybe I’m misinterpreting this but Scott’s definition of “rich” as “Rich is having passive income greater than your burn”. I don’t know anyone else who has that definition of “rich”. A student, living in a dorm room with 3 bunk beds and 5 other people in the room can probably have “passive income greater than your burn” but would anyone consider them rich? Further, the example of dad only spending $40k of $48k year is certainly not my definition of rich. That’s one medical emergency away from insolvency. Yes, we can rant about health care but the point is, just having enough to get by is not most people’s definition of “rich” “Rich” to me means the freedom to do what I want and in relative comfort. If I want to go to Berlin for 6 months just because I feel like it, as it is I can’t. I need my job and my income. If I was “rich” I could just decide and go, rent a nice apartment (not staying in hostel), make it happen. If after that I want to spend a year in Singapore I’ll do that next. And, I don’t mean as a backpacker. Other examples, I want a new computer, it’s $5k, rich, I just do it. I want to go to some fancy dinner, rich I just do it. I’m not saying I’d do these things all the time, rather only that “rich” = not having to think about whether or not I can afford it, only whether I really want/need it or not. I have friends that fit this definition of rich. They’re in their late 40s early 50s. They decided to spend a year in Seoul to be near one of their kids in school, followed by a year in Paris, now they are living in Amsterdam. They are not struggling. They probably rented a 4 bedroom house / condo in each place. They still have their house back in California. They spend their time as they like, flying to visit their adult kids in 3 different countries, pursuing tech hobbies that might become something, socializing with neighbors, and going to investor meetings to see if they feel like either investing or mentoring startups. They have nearly total freedom. They have no financial worries. That’s “rich”.

As they say, “for 20% more than you can afford you can go first-class.” Rich is being able to tell your boss goodbye.

You don’t need to have a high burn rate to be rich either. When you realize you have everything already, the world belongs to you.

“It is not the man who has too little, but the man who craves more, that is poor.”

Excellent

“The more you know the less you need.” Scarcity is a construct. Once you know that, you can have anything you want. Focus. Feel your wealth. It’s already here.

Loved your article. It was written in plain english not internet jargon. Great advice, especially since I am female. Did not start saving till I was in my forties, but then I did big-time. It paid off. Retired in my late fifties. Then I lost my husband to cancer. Now was the time to reevaluate. Thats where you come in with your wisdom.

I’m curious how many years of work experience the two generations have at the same age–my father was gainfully employed when he was 13. I at 15. My kids will probably not work until they’re 18 because most places don’t hire minors where we live. How much does that work experience play into your earnings when you’re 30 over generations?

Just sent this to my son. Great advice.

I enjoyed reading this article. Excellent.

Great article with good advice to look at your decisions and their results insted of looking for ways to blame your bad decisions on the “bad” guys who made profits by catering to a market.

First time reader and new subscriber, stumbled into this today via Barry Ritholtz site. Great article! I am forwarding to my 20-30 something kids (age not number) with my old admonition about getting rich slow. I recently revisited Random Walk Down Wall Street after the Gamestop bubble. It appears you and Malkiel have somewhat similar views on disciplined investing and get rich quick schemes. Thanks.

Spot on…have passed along to my entire family and a number of friends!

Great article. I passed it in to my kids. Yes, time helps. And diversifying helps. I’ve bought all of my kids (all in their 20’s) entry level investments in Vanguard’s 500 Index Fund. I hope they all regularly add to those investments; in 40 years that could serve as the base to comfortable retirements for each of them.

“Not Your fault” – never is in this world of participation trophies.

One idea, piece of advice I left out, is avoid a second home. You will never use it a much as you think, hoping for appreciation is dicey, VRBO and Airbnb and offer you a chance to rent, avoid the yearly upkeep and change vacation destinations at will

Bruce, I’d mostly agree, except for the real estate point you made. I’ve personally enjoyed gains in equity up to 100% over the last 10 years on different properties I own, on top of receiving rental incomes. If you buy smart and set yourself up for growth, with the right properties, you can bet on gains. Same as investing. Don’t count it out.

@Mike

Found this to be a great and insightful article. I would add some additional points: 1. Even if you are in a non-glamorous slow growth company maximize every tax deferral and matching feature from your employer: 401k and match, bonus and salary deferrals, health care accounts, discounted stock purchase plans, etc. 2. From the expense side, live two to three years behind your current compensation. 3. Besides having a sold marriage make sure you both have the same views on saving and spending. 4. If a dual income household try to live on one or one and a half the two incomes. 5. If you receive a bonus, try to save or defer as much of it as you are able. Always spend a little. 6. Avoid a divorce. I am an attorney, so I would tell my friends that divorce is financial demolition derby. 7. Adopt a healthy life style to avoid medical expenses and long-term care.

Hi Scott. Really interesting column in which I saw much of myself and my history reflecting back at me … indeed, we’ve had some parallel tracks and I totally agree with your thoughts on discipline, character and stoicism. I also locked in for youthful adventure over get-rich-quick and that proved a boon for personal development and growth of my soul. And I’ve encouraged my daughter to “strive for enough, resist too much.” Of anything. And I like to think this has helped her find her path in her 20s. Your dad’s a Leaf fan? Poor guy … well, here’s a story to share with him. I grew up in Toronto and I remember the last time the Leafs lifted the Stanley Cup in 1967 (i was 9) with the oldest team in existence. Their captain was George ‘The Chief’ Armstrong, a stoic character if ever there was one, toiling 19 years as a Leaf (for which he gets a special throne in heaven). Anyways, your dad probably knows that ‘Army’ just passed away at age 92. It turns out Army and his family lived a few blocks away in TO and I went to HSchool with his son, Brian. We chummed a bit, played some hockey together, and I occasionally went over to his house, met his dad who just towered like a pine tree and oozed respect and leadership. On summer nights, Army and his wife headed to the local ball park to watch whatever single A or junior game was on under the lights, and he was constantly shelling out change to snotty nosed kids who begged money for a hot dog or soda, and he never turned away an autograph seeker. He was one of a kind – a generational spirit of good will and resolve. Say hi to your dad from another Leafs fan stuck in the past.

Mr. Micawber: Copperfield, at present, I have nothing to bestow but advice. Still, that advice is so far worth taking. I have never taken it myself, and am the miserable creature you behold. Young friend, I counsel you: Annual income, 20 pounds, annual expenditure, 19 pounds, nineteen shillings and sixpence. Result? Happiness. Annual income, 20 pounds, annual expenditure, 20 pounds and sixpence. Result? Misery. Charles Dickens, 1850

Thank you for serving this!

Reading this felt like eating my favourite meal…and then also being offered dessert. Thank you, Scott.

There are two ways to be rich – have more than you need or need less than you have.

Hi Professor, great insights and thanks for sharing your experiential learning! The one most important thing for creating and retaining wealth is the character. I have found that people who have managed these four resources well (Focus, Stoicism, Time and Diversification) have retained their wealth due to their character. Character is what drives your perseverance and resilience. If you lose character, you eventually lose your wealth, even if you were principled enough to generate it. Your thoughts?

Willing to learn.

This is my favourite No Mercy / No Malice post in a long time. Insightful but also, just so damn good that it resonates.

Scott, this is really good. I love my sunday readings!

one of the best things i’ve read in a long time.

You should add a text-to-speech feature to your articles, similar to what WSJ is already doing for their articles. Makes reading easier AND more accessible. Hope this can happen!

Not a bad idea, he could read them him self put the clip in the top. Then he / his team would also have more content for everywhere else. Snippets for re use and sharing. Prof G talks a lot about producing content.

Excellent hindsight

Hello Prof Galloway, Always look forward to reading you blogs. Stellar! A note on the Al Einstein quote, may have been Al Bartlett of CU Boulder fame. Cheers!

Very clear analysis, with a majority of useful ideas but not as such applicable to each and all. Still, I enjoyed it and some lines will hang on for a while.

I found this to be your most earnest, wise, and insightful article to date.

The Taco Stand is the bomb… smart Dad.

Great piece.

Brilliant

The older generations have more wealth now, but they’re not going to live forever. Much of the wealth will be passed on to younger generations.

True, they wont live forever, but let’s say someone lives to 85 and passes their wealth to their kids. Those kids are likely around 60 when they inherit, which really isn’t passing wealth on to the younger generation. As life expectancy increases, the age when “kids” inherit will also increase.

@Ciara Close That’s an interesting take. I would argue that having folks inherit wealth in their 60s, close to retirement, is maybe a better thing than having them do so while young. That way they get to work hard, and are “rewarded” by inheritance giving them a more comfortable retirement. If they just get the money in their 40s they piss it away on fast cars and vacations in hell holes like Orlando. Everyone I know who inherited a lot in their 30s became a lazy bum. Another interesting topic here is what form that wealth takes? For many, it’s locked up in real estate in shitty places that will be uninhabitable by mid century due to climate change (e.g. the desert southwest). Good luck offloading a 2 bed ranch in Naples FL once sea level rise takes hold. A lot of folks in their 60s are gonna be left with a lot of worthless assets.

@PaulyPoo Don’t be so sure that the guy who says Naples is going to be under water knows what he is doing either. At 70plus years old and fairly successful financially, never believe that what you are being told will necessarily happen. There is so much money in the world now that it’s hard to trust “science “.

@Mac You remind me of a higher level physics class in which I told the professor that I didn’t believe him. He said, “You don’t have to believe it, just fear it.”

Thank you, Scott. Great piece that I’m rereading and sharing with my family. Keep it up.

Best article on money management I’ve ever read!

So powerful, I related to most of the time scales. I was at the University in 1980. But being born in Africa ,I had no vision of the coming of the tech industry. My history and my exposure mapped the new strategies within my time horizons. My whole tribe nobody had ever bought shares. The word shares was Greek to. Yes location and time playes a huge influence in shaping your road map to.wealth.

Smart data.

Every 18 year old needs to read this along with: The Richest Man in Babylon.

This was excellent! Really great and helpful stuff.

Great post– this should be the commencement speech for every graduation.

Nice article ! Thanks

Thanks, interesting article. But this statistic grabbed me: “Since 1989, people under the age of 40 have seen their share of the nation’s wealth plummet from 19 percent to nine percent.” Inconveniently, that parallels the rise of bullshit degrees in woke fields that folks over 40 were never offered. I smell causality.

Bingo!

Seems about right. And incurring lots of student debt for a degree that has no or underperforming market value.

There seems to be an unfortunate contradiction underlying modern economic security. To be wealthy, ride the best wave. But what have been the best waves to ride of the past 10 years? Overwhelmingly, they have been waves that profit from people becoming overweight, indebted, divided, and addicted (or otherwise exploited). At best they can be described as unlocking the potential of fallow assets held by individuals and democratizing the market (which is what the corporate raiders of the 80s said at the time, except it was corporate assets). The fact that an average talent at Facebook (profiting by division and addiction) gains more economic security than a great talent at GM (which produces something useful) should give pause about what sort of rebellion is needed. If the best and brightest young Americans ride the wave towards economic security, and economic security is increasingly predicated on making most of the country a desperate underclass, then the country is lost. A country doesn’t survive when its best and brightest spend their days manipulating people into clicking ads for politically-branded weightloss supplements. The economic boom you grew up in was built by a generation of men and women who, in their formative years, put their life on the line for the country. They came back, replete with solidarity and the notion of self-sacrifice for the greater good. It was stoicism along with moral courage and a desire for *common* economic security rather than *personal* economic security that drove them. For their sake, I hope that these new generations have the courage of the generation born a century ago, and will go against the waves that have been pushing ashore since the 1980s.

+1

This x1000. The things we value says something about society. And drives where our best and brightest focus their efforts. It’s a concerning state of affairs when there isn’t material success coming from professionals who build ‘real’ things. Consumer supplies, power grids, infrastructure, quality journalism, public service, social work, etc. All of these provide massive benefits to society but do not attract talent or resources. Marc Andreessen recently wrote “It’s Time To Build.” I could not agree more. And I wish there was a way to shift that value calculus. https://a16z.com/2020/04/18/its-time-to-build/

I’ve heard a lot of this type of reasoning for the system being stacked against the ones who are not being successful and quite frankly, based on my experience, having had no formal education and still doing quite well financially, I feel that the post WWII boom had a lot less to do with character than it did with pure job opportunity and sending our brighter vets to get a science and technology education. This led to more creativity in industry and more good jobs giving us an edge over a lot of the world , creating more opportunities. Unfortunately for many of todays students, they have been told that education alone should guarantee financial success and that’s not so. Demand creates value.

I read your book “the Four”, #1 book I’ve read. Just like the book, you are giving us real and truthful advice to excel. Thank you

Scott, this is truly a fantastic post. I agree with everything you said, except one…to a degree. Diversification is great IF a person is going to be an active stock investor, since he/she will need to have a number of stocks since only a tiny percentage of stocks truly grow to the moon over 20-30 years. But even then, Buffett says you really only need to buy a dozen or so stocks if you have conviction in them. All that said, most people who have day jobs should NOT be active investors… and instead should simply buy the S&P index fund, such as Vanguard, and let it run for their entire life. They may not hit it out of the park like finding an Amazon would (but that’s not easy to do), but they would instead grow their their savings, on average, 5-8% in perpetuity for their lifetime…almost guaranteed. (Note: there is no way, I repeat, no way the S&P index will grow like it has the past few years in excess of 10%, for much longer. So, as i said, no diversification (and therefore not having to find the right stocks) required. (If you are adamant about being an active investor, however, at least add Berkshire to your portfolio for solid returns and solid safety.) Diversification not required….S&P index fund. Good luck everyone. And Scott, thanks again.

Music to my ears! When is the book coming out!?

Do what you can, with what you have, at the time. My eleven year old daughter and nineteen year old son known this mantra.

Looking very forward.

Good read. Thank you

Fantastic post, from a 51 year old buy-side analyst in Boston. Few people understand the power of compounding interest, Buffett constantly refers to it. Scott, I have one worse than the NFLX example. The first stock I bought was ORCL in 1996, basically my bonus money. I sold it later that year to buy Bre-X, a Canadian gold mining company that ended up being a sham. Complete fraud. ORCL was a 4 bagger by 2000.

Everyone has a horror story. I bought $500 in AAPL stock in late 2008 and rode it up to double value in late 2009. Didn’t think it could go any higher and so bailed on it then. Ugh!

This is the best professional/life advice article that I’ve read in many years. Young people — read this. And if you have Scott for a professor, then you are lucky.

Don’t know what to say!

Great read, I’m 22 and I’m sitting for the CFP in a month (PANIC MODE) but I love listening to you and Kara and always look forward to this newsletter. I try to explain to my friends and sister the importance of time. The mentality you explain is something I have and hope to improve on as I’m just starting my career.

Me: Cusp of Gen X/Y (depending on how you slice). Thankful that I socked away what I could during the early/hungry post-college years. Salary was embarrassingly low, but in the back of my mind, I knew anything that went into the 401(k) (got a basic employer match) would be gravy down the road. Feel ya on the NFLX. In school my pops gifted me some stock, with the guidance that that I was free to parlay it and fund college. This was 2002 and AAPL was $0.25. Held it for a while and then sold around $0.40 to buy a PC, post-graduation. Thought I was so damn smart. AAPL’s $135.37 as of close Friday. Ah well, such is life.

Some interesting insights amongst the bullshit. Not confusing passion for talent is critical if money is the goal. Time is a “talent” given to every young person. Most don’t recognize the gift. Surfers know they don’t create the wave. . .they catch it. Riding a train is far easier than starting or stopping a train. If the elites want you to fail, you’ll fail; if they want you to succeed, you may have a brief run of success. Stay below the elites’ radar. Money, money, money is everywhere.

I’ve never read your blog before and was sent to me by my spouse. Very informative. I agree totally and wish more young people believed in the power of compounding and one thing you didn’t mention is the contributing power of delayed gratification, proven in history to be one characteristic to aid in wealth and success. Enjoyed the article and hope others heed your good advice. Thanks for educating all about financial success, and a proven pathway I know works!

You are wrong about Netflix. I made the same mistake about not holding on. But with the many stock splits it has had, that $12 a share is actually more like $5000 a share today (probably way more – I stopped doing the math several years ago when I realized I’d left literally millions on the table).

“Rich is having passive income greater than your burn” and within that passive income having first worked out your bottom line (all fixed bills plus food) so that you never touch that part of your income. Been doing this for over 10 years now and work, just for the fun of it, or to make capital investment in my house.

Scott, Thank you always for inspiring articles. I recently found out you and I crossed pass at Morgan Stanley Fixed Income in 1987. I was at the trading floor on Black Monday. Full of awful people. I quit fast like you. Like you I was a product of California State Colleges where anyone with 3.0 GPA got in. Our top colleges are fast becoming a private club. We need to act…

Very interesting article. Hit a few home runs with absolute truth on time and accumulating money faster than burning it makes you rich. Will recommend to friends and family as a must read, especially for the under 25s who in my part of the world(Accra, Ghana) have a lot of challenges climbing up the ladder!

Thanks for the insight Scott. Digging the new direction. Helpful reminder on focus and discipline… that second rabbit keeps escaping me

Grazie Bello, Must admit, sometimes your Friday NMNM messages have simply been perused for the juicy bits. This one, however, shall be printed for old fashioned sharing and inspiration. I too, have been fabulously wealthy for most of my life, even though, like you, I have squandered plenty of financial opportunities. Unlike you, my career path was chosen before birth, even though, I did, at times waver, the upside was that I basically experienced the best (and worst) of retirement in my 20s, 30s and even portions of my 40s. Being the slow and formerly stubborn learner that I was born as, has, nonetheless allowed me to bloom: now that THE BIG 60 has been attained. Here’s hoping you are enjoying this journey even more than I enjoy reading your monologues. Hochachtungsvoll, Gyuri bácsi

Good article Scott. As you think about work, career and happiness, have you looked at the Japanese concept of “ikigai”. I have found it quite powerful.

So people who don’t want/can’t have children or a relationship aren’t worthy of wealth

Watching the impeachment, I can answer your question Are we headed for another revolution? Yes absolutely Republicans no longer believe in democracy and not sure how we resolve that

TDS much?

A sobering piece that inspires urgency.

Your articles are a must read in our home. Especially for our teenagers. This one resonated for a whole host of reasons but particularly because someone recently forwarded one of those ‘follow your passions’ memes. And the other really smart guy I know ‘snorted’: the Internet is full of rich people telling not so rich people to follow their passions and not to worry about weekend homes and private jets.

Great piece! Something I can save, reread again in a year

One year? Even in a decade, this piece shall resonate.

WE would all do well to remember the frequently quoted Mr Micawber principle. His advice in David Copperfield was this: ‘Annual income 20 pounds, annual expenditure 19 [pounds] 19 [shillings] and six [pence], result happiness. Annual income 20 pounds, annual expenditure 20 pounds ought and six, result misery.’

Very interesting, honest and informative.Thanks

Scott, thanks for the terrific cap on the week with positive reinforcement and inspiration. Your weekly is a dose of insight, part reality check, a smidgen of ‘yeah I should have done that’, a decent amount of wit, and a boatload of honesty.

Wow. Great advice for anyone early or just beginning their career.

One. Of. Your. Best. EVER!

Agreed – only hope these comments don’t go to his head.

Thank you Scott – excellent piece as usual! I will be sharing this as a discussion piece with my teens and soon to be college graduate.

Scott, Wow! Hard to describe how much I appreciate your sentiment and words. Words matter and your perspective on these topics is really outstanding. I find myself battling many of the same scenarios you describe and also discussing these with friends, family, and colleagues. It is definitely a struggle to remain steadfast and slow, especially when faced with vast amounts of temptation and media telling you to do the opposite. I feel encouraged by your words (and statistics) to stay the course. Thank you and all the best.

Beautiful piece of writing. A Friday night blessing in freezing London. Thank you Prof Galloway!

Great stuff Scott! Really resonates!

This was excellent. It should be a graduation speech after high school and then again after college. One of your best yet. Bravo.

All stan Prof G! This post is something I want to give my nine-year-old niece right now. I’d like to add to your post some wisdom around money that I wish I learned sooner (though I’ve always been a mad saver thankfully, since I too have insecurities about money because I raised in a single mom household who worked two jobs to raise and feed my sister and me… all stan single moms too)… anyways both of these ideas are from Paula Pant who runs the Afford Anything blog. First, “you can afford anything, but you cannot afford everything.” Prof G, you’re absolutely right that today’s culture is all about getting people to consume and find faults in themselves in order to have an excuse to buy (largely) useless shit. Don’t give in, don’t go into debt buying a bunch of garbage. Second, she teaches people to “mind the gap” – put simply, every day work towards the goal of increasing the gap between your spending and your income. Really, nothing else matters. Grow that Gap and you will be set! Now if you’ll excuse me, I’m off to my library website to put the algebra of happiness book in my on hold queue. 🙂

Me gustó mucho lo referente a que es mas desastroso perder el tiempo a perder dinero, porque el dinero se recupera y el tiempo no.

I became addicted to your books and blogs and articles after my son spoke to me about your work. This article is one of your best…so far !

Your wisdom has had a huge positive impact on my life and my children’s life. Thank you !!!

Amazing balls per usual! Wish my 8 year old self understood that YOU can define your version of success, I teach my kids that and the secret to life is that there is no secret or shortcut to life, put in the work to work towards your version and enjoy the ride! Love the podcast, killer!

ah, the wisdom of elders is often lost on the youth of today. This resonated with me on so many levels. I hope to be rich as defined here, and since i am a Leafs fan – already 50% there!!

Agreed on the wisdom of the words, as far as the 50% part goes though, you have my condolences – Go Habs Go!

Great article. Have always been a saver. The challenge I’m really struggling with now is that everything seems a bit overvalued. I know you can’t time markets, but it does feel that sometimes it is best to be on the sidelines. Would love your thoughts here.

Man, I spent so much on Red Envelope- I feel like I have Galloway equity. Now it goes to Bespoke Post. You started my addiction.

Amazing post! I’m going to start a slow clap that will trigger a full stadium standing ovation!

Prof. Galloway this is an amazing post. This is something I would have loved to write. This is something I would share with my children (in fact I did). This is something I would like to re-read. You have done an excellent service to many people with this piece. Thank you.

Scott this was an excellent read. Millennial ~ early 30’s. I follow a lot of what your saying TVM, diversification, ect… It’s easy to get caught in the quick reward and FOMO of WSB and Robinhood investing and forget the FOCUS. It’s always good to here some sound advice. Well done

The best piece you’ve ever written. I think “follow your passion” has been and continues to be enormously harmful advice to young people. Very glad to see you pushing back, and very cogently. Lots of other great advice in there as well. well done!

Thanks man!

Great piece, Scott! Just forwarded to my sons and some of their friends I have watched grow up. Many thanks

Thanks for writing this. Truly spot on. I made the same mistake with some Tesla shares I bought in 2014… I married well so that was a huge win, not sure she can say the same :-).

One of your best Friday write ups yet. Tried and true advice given in new and fresh way.

Spot on! Such valuable guidance!! Love your newsletters!!

Man I wish I could afford 15 minutes of your time. Great stuff.

Thank you. I have been telling youth for a long time to pursue their talents, not passion (but have a passion too) and pointing them to Victor Frankl…..not Oprah. Great post.

“I make myself rich by making my wants few.” ― Henry David Thoreau

Excellent advice, true in my era (I’m Gen X) as well. I wish someone had told me this then, it might have changed my trajectory dramatically.

Absolutely agree!

@Chris Coles