Least Bad

Least Bad

Audio Recording by George Hahn

For decades, America has predicted — arrogantly and repeatedly — the imminent fall of a nation. The doomed nation, according to Americans? A: America.

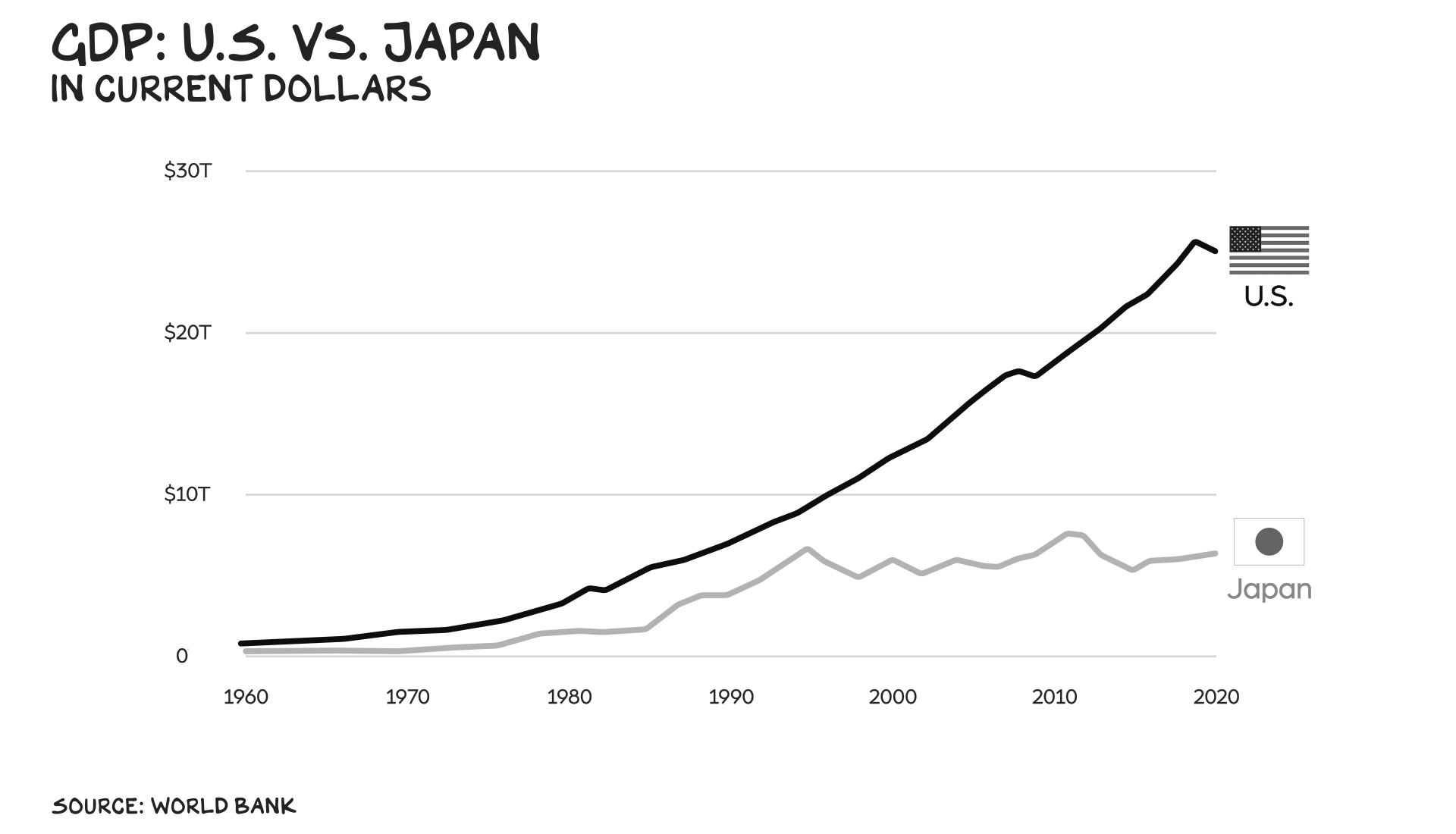

In the ’80s, we decided Japan was doing to us economically what they couldn’t do militarily four decades prior. My second year in business school (Berkeley ’92) was devoted to a forensic analysis of our loss to Japan. Computers and cars were the future, and Japan was building them faster, better, and cheaper. In 1984, Walter Mondale asked Reagan at the presidential debates, “What do we want our kids to do? Sweep up around the Japanese computers?” Three years later, Paul Kennedy wrote a book about it, The Rise and Fall of the Great Powers, comparing the U.S. empire to the British empire. Japan’s GDP soared to 40% of ours, and we feared what might happen when that number hit 100. It never did.

In the early aughts, our soft tissue was geopolitical. The tragedy of 9/11 was described as an “inevitable outcome.” Our subsequent invasion of Afghanistan inspired books including Dark Ages America: The Final Phase of Empire, and Are We Rome? The Fall of an Empire and the Fate of America. Each offered a similar theme: Our time was running out.

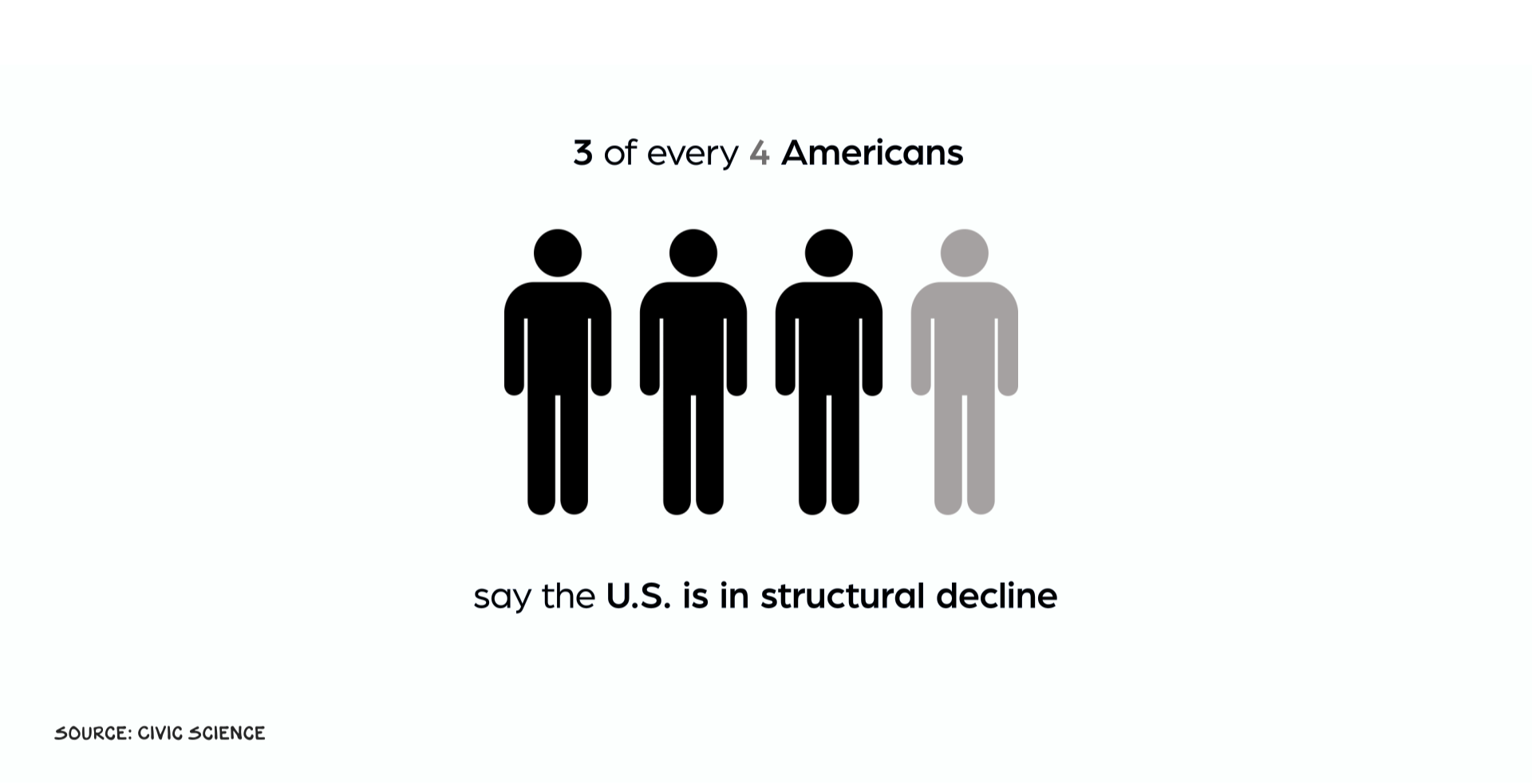

Today the decline is (supposedly) more imminent. January 6 was the “beginning of the end.” Russia’s invasion revealed a “great unwinding.” Nations view us “with pity,” and we are “on the brink of collapse.” Just last week, the New York Times opinion page compared us to Rome (again). These headlines are click bait, and we still take the bait: Three-quarters of Americans believe our country is in structural decline, and the song of the summer is an ode to our demise.

It’s not just the public. Among economists there’s a growing school of thought that our situation is dire. Two months ago, ratings agency Fitch downgraded America’s credit rating due to “fiscal deterioration” and “erosion of governance.” The debt ceiling debacle didn’t help: Investors “should worry.” Our debt-to-GDP ratio is hovering around 120%; back when it was 70%, Brookings called it “the real national security threat.”

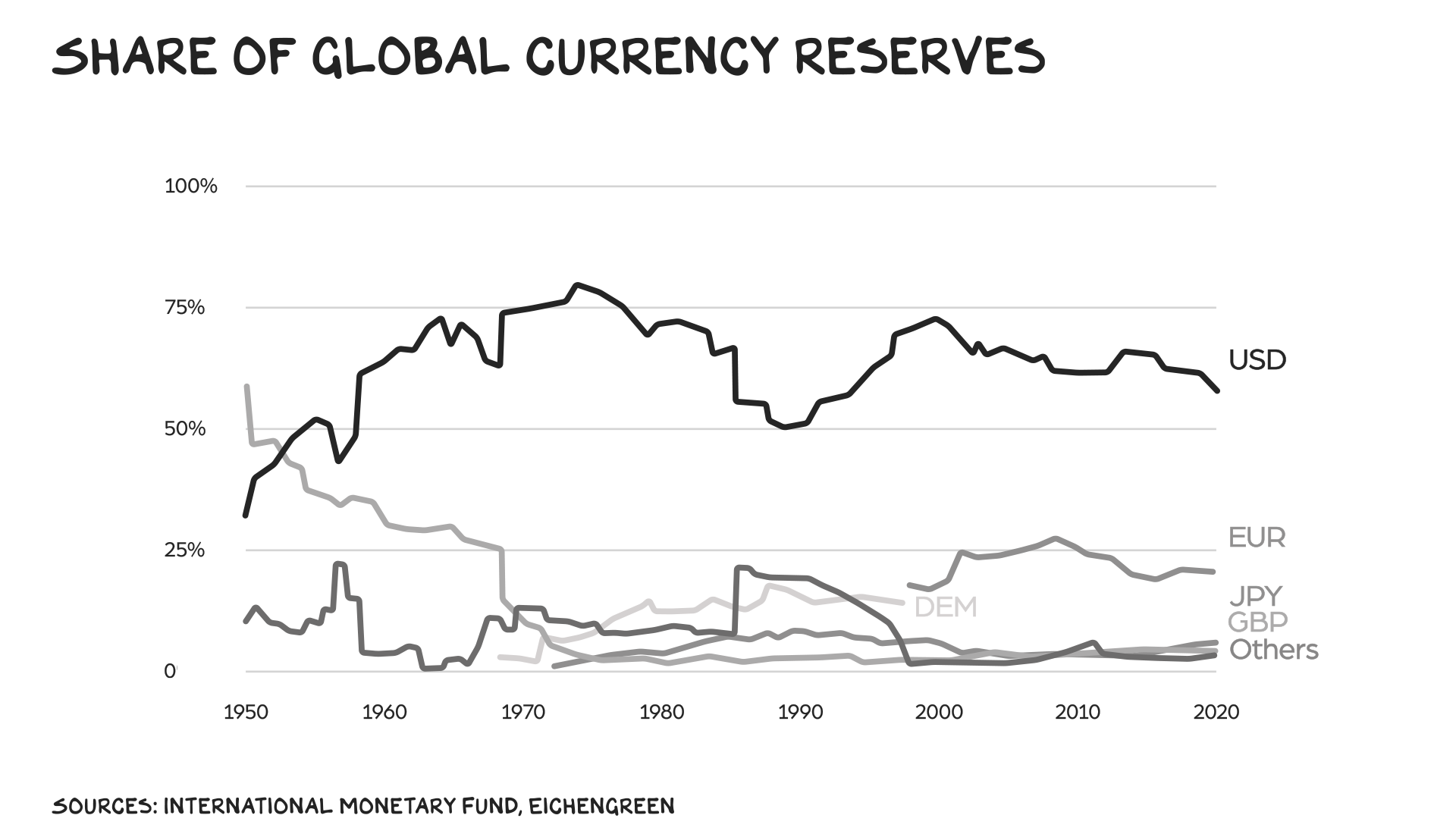

Many believe we are in the midst of “dedollarization,” ceding our status as the world’s reserve currency because of our unsustainable spending habits and an overall loss of faith globally. JPMorgan recently flagged it, an ex-CIA adviser plainly predicted it, and one prominent tech investor bet $1 million on it. Ray Dalio, the founder of the world’s largest hedge fund, hinges his recent bestseller, Principles for Dealing with the Changing World Order, on America’s inability to adapt to our loss of status and power. Empires win and lose their hegemony depending on their reserve currency status, and in Ray’s view, we’re near freefall.

We’re Not

Culturally you could build a compelling case. National pride is at an all-time low, and the “vibe” in America is that things are not good. (See above: the song.) But these are functions of perception, and as I’ve written before, human perception is flawed.

This is an economic discussion. And when you look at the data, you’ll find every diagnosis of our supposedly terminal illness is proof the doctor is jonesing for us to die. We’ll examine them, but first, a brief summary of the doomer’s economic vision for America. It goes roughly as follows:

1) America keeps borrowing more money, leading to an increased burden of interest payments.

2) Foreign nations increasingly question our ability to make good on our debts, leading to low demand for U.S. Treasuries and thus low demand for dollars.

3) Once dedollarization takes effect and the dollar is supplanted as the world’s reserve currency, the U.S. will be forced to ratchet up Treasury yields to increase demand for our debt, leading to even greater interest payments.

4) This will crowd out private investment, as well as public investment in our own infrastructure. GDP growth will grind to a halt, and eventually we’ll default on our debt.

5) At that point we’ll be unable to borrow or finance our growth, and

6) America will collapse.

Dedollarized

Doomsday is due next century or next year, depending on who you ask. (That ex-CIA adviser said it’d be last month.) But the catalysts are consistent, and one of them is this notion of dedollarization.

The argument is that foreign central banks are losing interest in the dollar. The stat dedollarists point to is that the dollar has fallen from 70% share of the world’s currency reserves to 60% in the past 20 years. That may sound significant, but the scope is comically small. When you zoom out you find that in the ’80s our share was 50%, and 30 years before it was 40%. The only accurate description of the dollar’s reserve status over the past 75 years is … unwaveringly dominant. At 20%, the next-best option (the euro) is not within striking distance.

However, it’s not the euro dedollarists are talking about, but the currencies of ascendant nations, including China. A common headline is “Yuan’s share of global reserves hits record high.” Less common is any mention of that “high”: 2.6%. The president of Brazil made headlines recently calling on the BRICS nations (Brazil, Russia, India, China, South Africa) to join forces to create a new global reserve currency. The world’s reaction was lackluster — and even South Africa’s own central bank governor played it down: “If you want it, you’ll have to get a banking union, you’ll have to get a fiscal union, you’ve got to get macroeconomic convergence.” Translation: pipe dream.

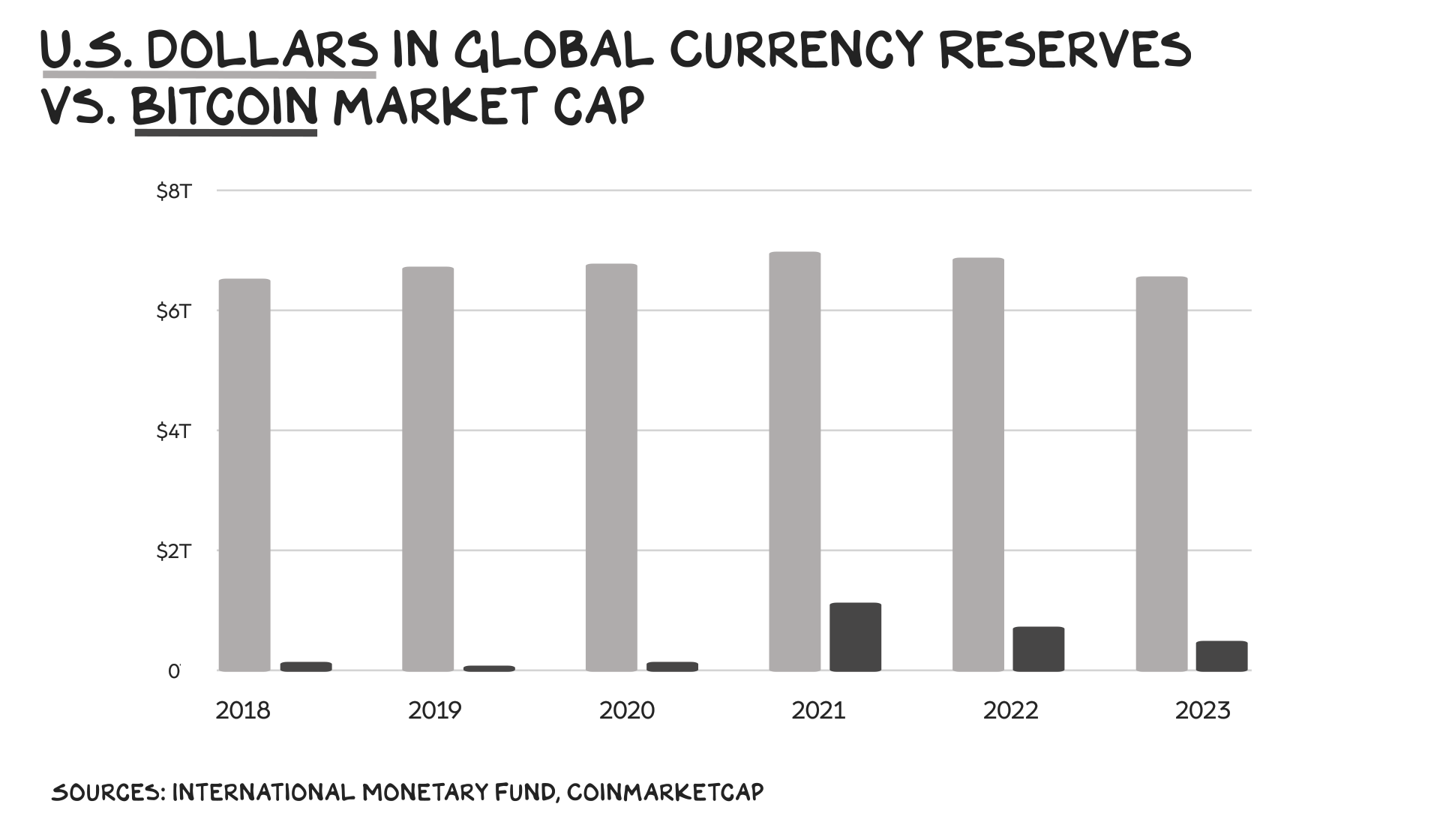

Another pipe the hallucinations flow through is bitcoin. Among its many use cases is its potential to supplant the dollar. The argument: The value of the dollar is predicated on faith in the U.S. government; the value of bitcoin is predicated on faith in, well, bitcoin. Many bitcoin bulls argued the latter will ultimately win — and for a second there in 2021, it looked feasible. As with every other dollar competitor, though, the cryptocurrency ran out of steam. Today the total value of bitcoin is 12 times smaller than the amount of dollars held in global central bank reserves. So next time someone tells you the dollar will be replaced, ask: With what? By any metric, the most innovative payment platform or store of value has been, and remains, USD. More good news: Minting dollars doesn’t require the energy consumption of Argentina. But I digress.

Theory of Relativity

Arguments for America’s decline are rarely accompanied by a credible alternative. This is true of the dollar, and it’s also true of U.S. debt.

Take Fitch’s downgrade of our national credit rating, for example. What should have been a seismic shock to the global bond market by the premier ratings agency turned out to be a catastrophist headline. The bond market barely registered the news, with the 10-year Treasury yield inching up 4 basis points. Goldman put it deftly: “We do not believe there are any meaningful holders of Treasury securities who will be forced to sell due to a downgrade.” Jamie Dimon put it better: The downgrade was “ridiculous.”

As with currencies, creditworthiness is relative. The question creditors should ask isn’t “how likely am I to get my money back,” it’s “who’s more likely to give me my money back?” And when it comes to sovereign debt, there is no better option than the United States. Sure, Xi Jinping may make Biden look like a web browser with 19 tabs open, not knowing where the music is coming from — but the Chinese Communist Party also systematically withholds, suspends, and lies about the nation’s economic data. The Party has even ordered its own economists to stop talking about negative trends. Who would you rather lend to?

False Prophets

This extends beyond national debt. There are several linchpin data points declinists point to that are supposed to forecast our imminent undoing, but the people who cite them also forget to compare those metrics to those of other nations.

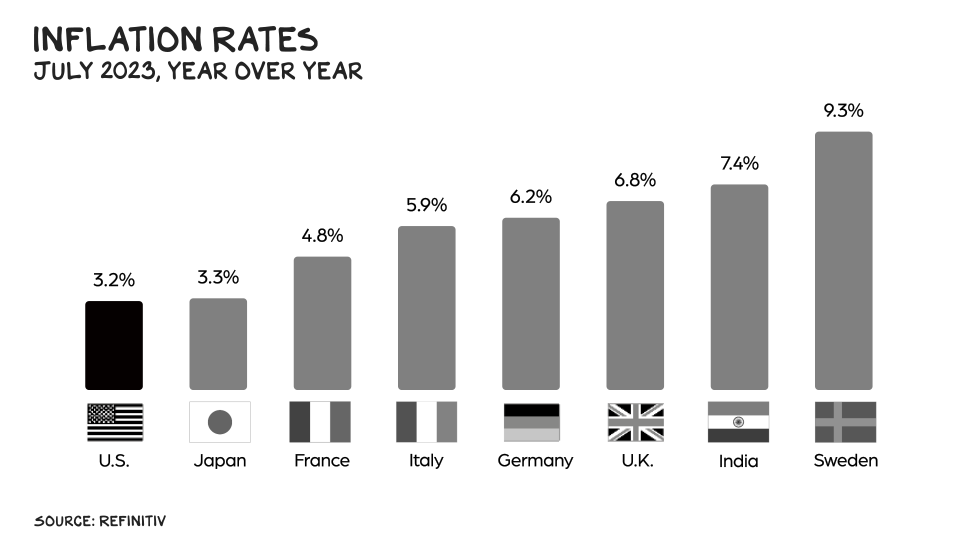

For example: inflation. Last year, inflation hit a 40-year high. Some predicted America would enter a period of hyperinflation. However, when you compare our situation to those of other nations, it’s less bad. Significantly less bad. In the U.S., prices have risen 3.2% year over year. In the U.K., it’s 6.8% — more than double. In the eurozone, it’s 5.3%. And yet — despite U.S. inflation continuing to come down and wage growth recently surpassing it — 74% of Americans still believe inflation is headed in the wrong direction.

Another catastrophist go-to: the debt-to-GDP ratio. Currently, our national debt amounts to 120% of our GDP. In other words, we’re borrowing more money than we’re making. Sounds bad. Until you look at other nations and realize it’s, wait for it, less bad. Singapore is at 130%, Italy, at 150%, and Japan, at 260%.

For years, economists have been drawing red lines around “no-go” debt-to-GDP numbers, but time has shown these red lines are also meaningless. The Maastricht Treaty said don’t go higher than 60%. The World Bank, 77%. One landmark Harvard study, “Growth in a Time of Debt,” claimed 90% was the tipping point. That study caused panic until three years later researchers found the data was faulty and the conclusion wrong. The reality is there is no magic number. Japan is at 260% and Botswana, 20%. Would you rather hold Japanese yen or Botswanan pula?

Vitals

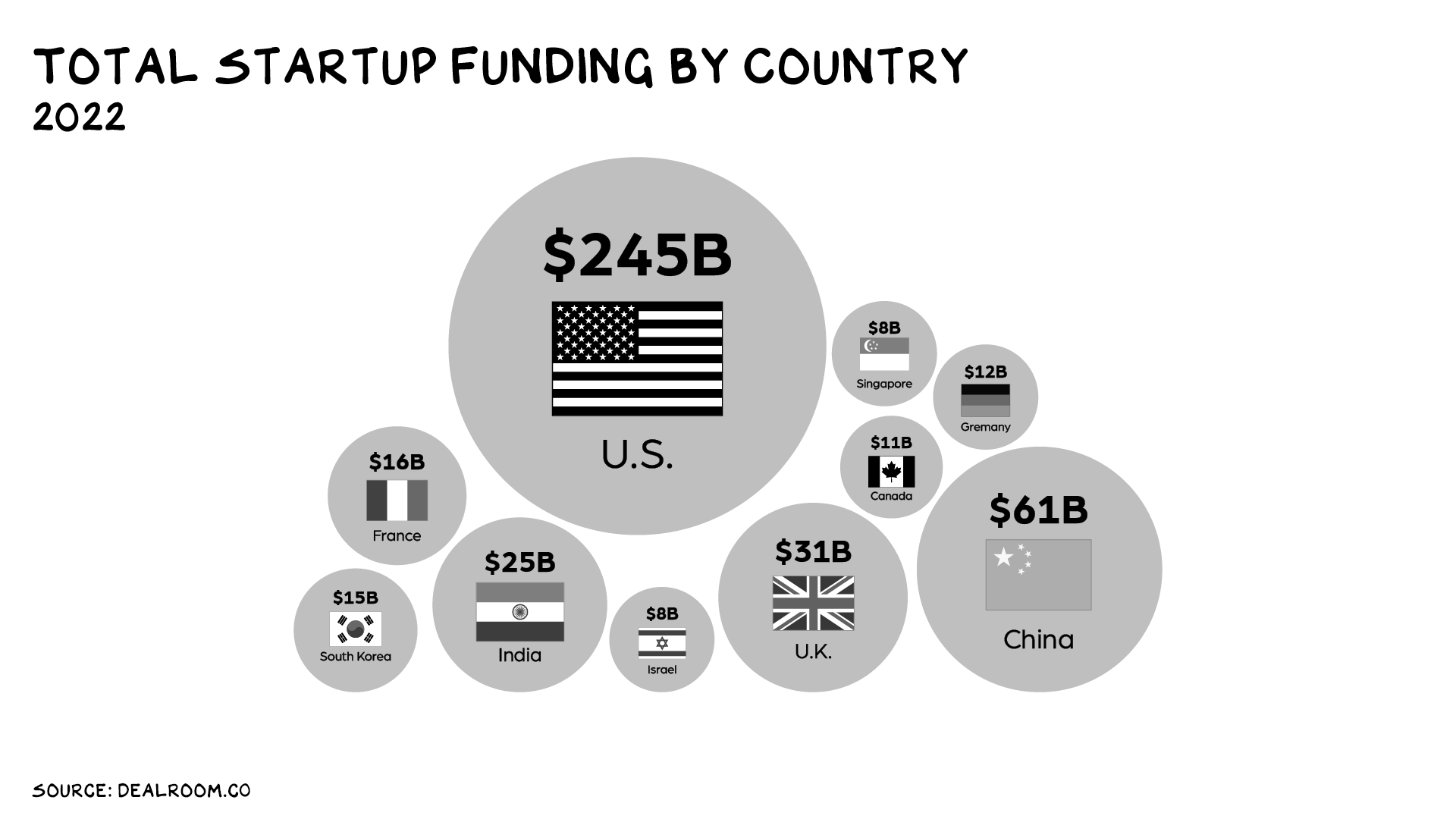

By nearly every measure, America is doing just fine. Better than fine. Our annual GDP is $26 trillion — 40% greater than China’s, whose population is four times larger. And, despite our enormous output, our economy is still growing, with 2.4% GDP growth last quarter. China’s is higher, but slowing faster than expected. Meanwhile the yuan continues to slide and this week hit a 16-year low. We have many unique advantages, including unrivaled innovation, the best universities, the best military, strong rule of law, a willingness to embrace risk, and a culture of doing the right thing (I believe this). Last year, U.S. startups received $245 billion in venture funding — roughly equal to the rest of the world combined.

Upstream in the public markets, we remain dominant. Nine of the ten largest companies in the world are domained in America. Nvidia, the undisputed leader in AI, the next world-changing technology, is headquartered in Santa Clara. Investors have reaped the benefits, and continue to wager their money on America. In the past decade the U.S. stock market has returned 10% per year. Compare that to Europe (2%) or China (0.09%) or Australia (-0.2%).

Meanwhile, our near-term economic prospects look good. Unemployment is hovering at record lows. Inflation has fallen precipitously and is low relative to our peers (see above). Poverty rates are in decline. Disposable income is higher than any other country. We have a lot to be proud of.

Exceptionalism

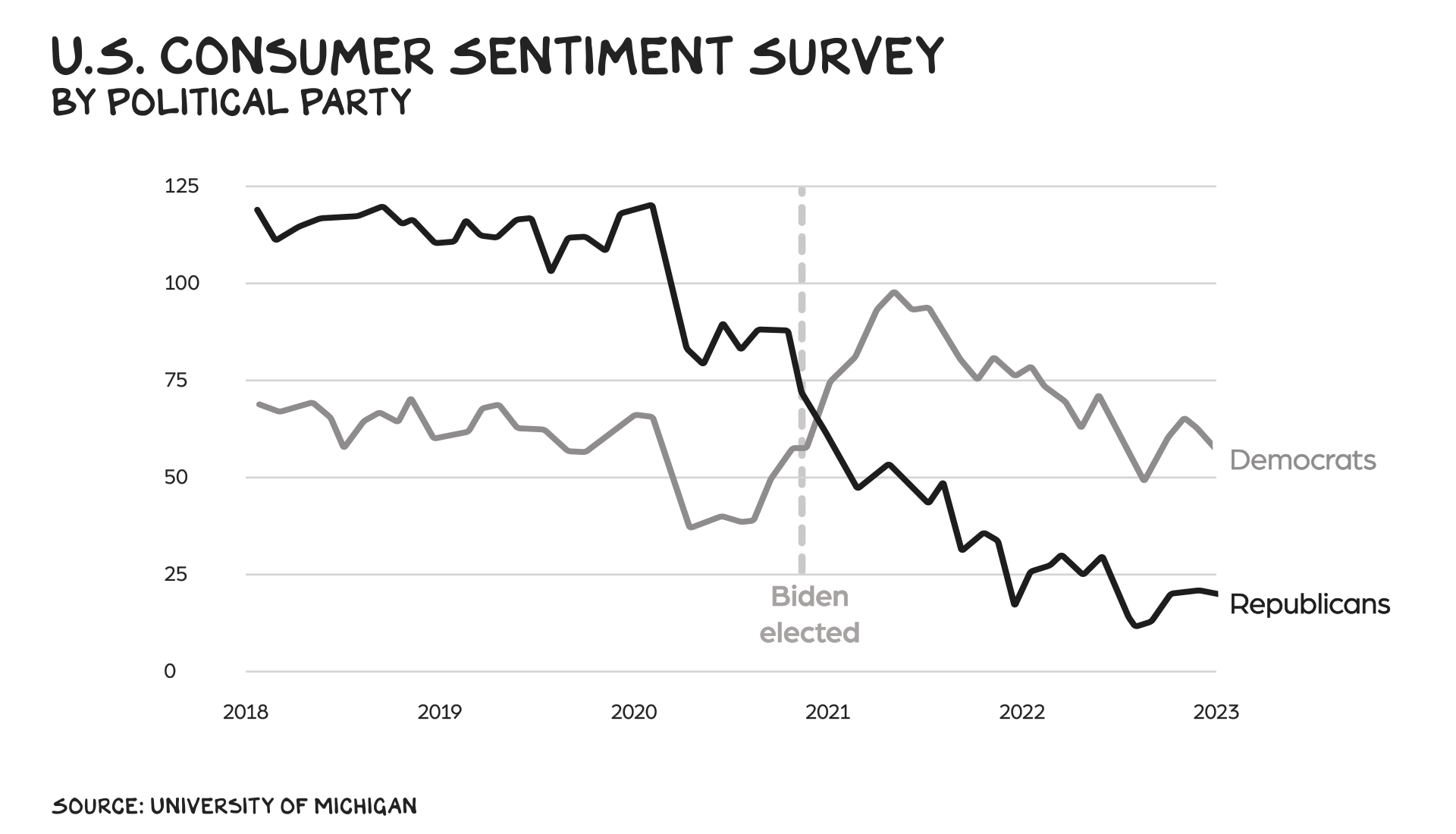

The schadenfreude we feel for our own country when it stumbles is nothing new. In fact, I would argue that in a democracy this is a feature not a bug. Things appear brighter when our favored political party is at the helm, and vice versa when it isn’t. A case in point is the consumer sentiment index, which is supposed to be an economic barometer, but is really a political one. In 2019 Republicans felt great about the economy, Democrats less so. Then Biden got elected and the relationship flipped.

People will argue I’m optimistic because a Democrat’s in charge. I recognize my political bias and intentionally adjust for it. And still, when I look at the U.S. economy and America’s position as a global power, I repeatedly land on a singular conclusion: The glass is half-full.

This conclusion won’t sell books nor grow this newsletter — history has proven that “Things Marginally Better Today” does not get clicks. But it’s the truth. And the truth, as with most things in life, is usually not as good or bad as we’d hoped. We are the least bad of our kind. When I look at the data, much less my personal situation, I can’t help but hate my life less and less every day.

If you are healthy, have someone who loves you, and enjoy a household income greater than $34,000, then you are in the top 1% globally. Think about this — you are 1 in 100. Why? Yes, you’re talented and hardworking. But more than that, you’re talented and hardworking in what is the most innovative platform in history: America.

Life is so rich,

P.S. I’m an AI optimist. Join my free event on Sep. 20, where I’ll share how AI will transform healthcare, education, and finance, and create more jobs than it takes away. Sign up here.

85 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

Thank you for that dose of optimism!

Is the US a doomed nation? Let’s say that Prof G’s macroeconomic analysis is correct. He completely ignores the microeconomic and cultural side. Look at how much more people are paying for housing/rent (as a % of take home pay) than they were in 1975. As a single parent, my mother could buy a 3 bedroom SFH in Austin Texas in 1975 on a legal secretary’s salary. She couldn’t do that today–and not just because Austin’s housing market has exploded. She’d have a hard time buying a SFH (on a secretary’s salary) in any major metropolitan area.

That means more and more metropolitan areas are becoming like San Francisco–unaffordable and crime-ridden . There are areas of San Francisco, Oakland, LA, Portland, Seattle, Chicago, Baltimore and St. Louis that are like virtual failed states. Companies in San Francisco are telling their employees to work from home because it’s too dangerous for them to come downtown to work. As housing becomes ever more expensive, do you think this will get better? You may not be able to see it out of your front door now, but I guarantee you it’s coming. Have you been seeing more homeless people at the intersections you frequent? I call it the fraying of the fabric of American society. And it isn’t sustainable, no matter how rosy a macroeconomic picture Prof G paints.

Less Bad or less worse doesn’t mean something is ‘better’ or more desirable. You’re a smart, rich, liberal who needs a dose of reality in what most Americans face when they get out of bed in the morning as far as paying their bills on time, keeping a job and feeding their family reasonably healthy food. As the BDanner below comment says, $34k is a joke of a barometer to use on wealth. I love people who respond ‘move somewhere you can afford then’.

Wanted to say that the person who hid the legend in underlines for the “US Dollars in global currency reserves vs bitcoin market cap” chart is brilliant.

Biden shuts down the Keystone Pipeline on his 1st day in office.

Biden depletes Strategic Petroleum Reserve

Gas is now $5-$6 in California (SPOILERS: That number will go higher)

Biden caught taking over $10M in bribes

Biden leaves $80B+ state of the art brand new weapons in ridiculous Afghanistan withdrawal for no good reason (Weird, the guy caught taking millions of dollars in bribes leaves billions of dollars of weapons for our enemies to take. I wonder what the connection could be)

Biden gives $700 to Maui survivors

Biden gives $0 to East Palestine survivors

Biden gives $113B+ to Ukraine

Biden gives $6B to Iran on 9/11 (The timing was very much international)

“ President Biden will go down as one of the great presidents” – Scott Galloway

Yes, half full but also half empty.

HI nice to see some anti-doom news.

Here is a fascinating talk on the coming housing boom in USA. due to DEMOGRAPHICS. Most housing doomsdayers dont understand demographics.

https://www.youtube.com/watch?v=e77jmO-atL8&t=1905s

I’m a Prof G fan, but the $34K a year comment was overly simplistic. Make $34K a year in Fairfax County VA and you’re living on the street. Maybe Prof G can’t see that because he’s sitting on an 8 figure net worth and just jetted his family over to live in London. Got yourself a nice house in Hampstead?

1st world problem…the point is, try taking that USD34k per year and see what digs you can get in Brazil, Russia, India, China or all of Africa (ie. in the 99% of the world that other humans have to live in). or even easier….move to…..wait for it…..NOT a big city in the USA and be thankful.

Try again. Apples and Oranges. If I lived in Brazil, Russia, India, China or all of Africa I’d be making 20 cents an hour (or whatever). I don’t live in any of those places. I live in Fairfax County. In Fairfax County, $34K a year earns me a spot at the intersection of rt 50 and rt 123. It’s okay–until it starts to get cold.

In my 70 years on this planet, I’ve seen most every prediction, religion and fanaticism rise up and flame out. I am a fan of George Friedman who’s book, The Calm Before the Storm very accurately predicts what is happening, and sees the coming calm. I also see the wisdom delivered in this column and am encouraged by your facts. We may not truly be a ‘great’ country, but I remind my grandkids constantly; we’re the best there is for now, and in the foreseeable future.

Thanks, Scott. This was a great (thoughtful as always) post! I couldn’t agree more, I have spent many years in Asia (China specifically), and Europe and I think that America has a lot going for her. Besides the hard-working mentality, there are some other key geopolitical factors. As the world powers re-align and understand the threat posed by China (with little regard to the rule of law), Mexico stands to become the most important country to the US. Mark my words, the next 2 decades will see a monumental shift toward our neighbor. Mexico has skilled and eager workers and remains one of the most stable countries in LATAM (despite corruption issues). This is very exciting to see! As we watch many parts of the world burn, get flooded, or be compromised by dramatic climate changes, geography more than history will come to significance! Beijing, Shanghai, and New Delhi (next Paris?) experienced unbearable heat (110+) for weeks…What does this mean for local populations and productivity?…But I digress… 🙂

Thank you for this! Your argument is beautifully presented and spot on. It’s what I have inelegantly been trying to explain to naysayers, most of whom don’t remember how we all celebrated when mortgage interest rates finally dipped below 12%. I will be referring to and sharing this newsletter.

Thanks for posting this. I am happy to live in both, the U.S. and Germany.

Countries are building alternative payment systems to trade in their bilateral currencies. Do we even need a singular currency (alternative to the USD) for de-dollarization?

How does the inflation picture look after factoring in real GDP growth? If inflation is 3.2% but GDP growth is 2.4%? Is the economy shrinking or growing?

AMEN!!! We are graced by the accident of birth to be born in the USA!

Optimism accepted. Unless .. trump re-elected then all these theories and predictions and hopefulness are out the window, we shall be doomed I fear… Sorry.

Words to live by: “When I look at the data, … I can’t help but hate my life less and less every day.”

With China losing its manufacturing advantage due to wages, transport and energy rise, the U.S. might see new factories opening with robotics/AI, offering better efficiency and economics…

Another advantage the US has is how federal it is. When states become too “socialist” or too “capitalist”, people and companies vote with their feet, moving to greener pastures. However these pastures are still INSIDE the US. No other country has this advantage. Furthermore, people moving within the country create checks and balances to make sure that states don’t go overboard with their radical policies. This is incredibly powerful. People don’t appreciate these differences. Having Texas and California fighting for “their” way of life is, as Scott would say, a feature not a bug.

While I do largely agree with the sentiment of yours about perks of federalism, technically speaking it’s not correct. The US is not the only country using such system. Switzerland works similarily, and there are several other countries that would count as well

Oh, I’m so glad you posted this; it gives me a much needed perspective on macroeconomics. I’ll sleep better tonight.😴💰💵

AI optimist? Of course, there’s no upside to being right side up: AI will steal thousands of jobs and increase global inequality. The BS China threat is just that- more BS.

Call it the way you see it without your glasses off ( is that prescription btw?) Always wondered but not too long.

Were at a tipping point in gold rush AI Tech, cultural discord, a second confedrate war, geopolitical, thick-headed Zealinsky won’t negotiate? H’es crazier than the fat lunatic orange man set to get his second nomination.

I dont live in the States anymore either- too many neighbors with bazookas.

Scott, hope you didnt leave your father here- when you’re learning British English.

God Bless America-

good luck to you mate, oh no, that’s AUD, not Euros.

Easy for you to say – you did a US Brexit.

When are you going to stop critiquing and suggest solutions?

I know- Leave.

I think Ray Dalio makes a worrisome and valid observation (“why Nations Success and Fail”) regarding the 3 major forces that tumble empires; severe debt burden, a challenging rising Nation, and internal discord. Each of these are at extremes currently. The reserve currency is the last to go.

Great post. I do not share your AI optimism, but I do appreciate that things in the U.S. are good. We do need to work on inequality, of course, among other things. But having problems doesn’t mean disaster is imminent. My life is great. I am very fortunate, and where I was born is a big piece of that.

Thanks, your back to the basics realism is appreciated.

Keep battling the masters of disasters and the opiates of optimism.

This is a great read. Thank you for taking the glass half full view of our country.

Perhaps the sky is not falling. Would you argue that it is not hanging lower and grayer? You can stop the list at #1 plus the cultural concerns, without reference to other countries’ behavior.

The federal government continues to borrow and to do so at unprecedented peacetime levels relative to GDP. The Republicans abandoned any semblance of fiscal responsibility in favor of the lure of tax cuts four decades ago. Tired of losing elections to them, Democrats eventually followed with big money fiscal giveaways. There is no caucus anymore for fiscal responsibility of any kind.

And yet, even if interest rates don’t rise and other countries’ don’t become squeamish about our debt levels, debt has to be serviced with annual interest costs. Demands to borrow are only going to increase over time as, within a decade, the annual deficits in Social Security and Medicare will need to be financed. By that time, all of the Boomers and plenty of Gen X will be in or near retirement.

What do you think will happen then? Retirees accept broad cuts in their entitlements? Good luck with that. Workers in the Millennial and Gen Z generations accept higher taxes? Good luck with that — those generations are already struggling in and out of the labor market.

This brightened my day, my week, my month, my year. Thank you so very much.

Wow, member of top 0.000001% thinks US is doing just fine and we should just STFU and let him keep raping us economically. I think Scott has a god complexion. We should start calling him Kanye.

Hey There Prof Galloway: You do the best job of puncturing “Catastrophic Fantasies” with Data. Thank You. Now, how do we get those whose academic experience ended somewhere between 3rd & 5th grade to “read, absorb & begin to ‘get it?” And if your response isnsomething along the lines of “they would have to be willing to ‘get it’…. I know that and agree. And/but … is there any ‘sneaky’ way that we could feed them teaspoons of data that would begin to crack their minds open to where things really stand?

Prof G.,

Nice post! Really! I’m a US citzen by design, not birth, and proud of it. Currently living in Australia and debating almost daily on USA vs Oz/China/The rest. A few of your points really resonate with me in this environment of tyre kickers and risk aversionists:

1. Start-up funding by country. Oz does not register on your graph. No surprise. We are long on talk and have short arms for our relatively deep pockets.

2. Do the right thing. We do. Mostly. but see above comment re talk.

3. Dedollarising. Our general position is we love to criticize, but hate to “put up (or shut up)”. ’nuff said.

4. Please can you do something about gun based violence and death. This keeps trumping me, and I hate it.

Cheers,

Chris

As an Australian who grew up in the US and often visits, this post gave me a wry chuckle. Australians live longer, far more comfortable lives than Americans. We have better access to great healthcare for all, safer neighbourhoods, better pay and conditions for the working class, higher rates educational results, and a retirement system which is one of the best in the world, of not the best. What we don’t do is spend 50% of the discretionary part of our budget on “defense”, more than the next ten nations combined.

Kinda like your big brother who gets in fights so you don’t have to. Remember when Japan decided you were a threat to their expansion? You think China and Russia aren’t eyeballing Oz?

A lot of good arguments. However, if we use Clay’s disruptive innovation theory, faster, cheaper and better are the finishing line of disruption for all industries. Japan didn’t make it to all industries due to its smaller population where China might be able to do it thanks to its way bigger population than USA. Short term speaking, US will definitely lead the world but long term speaking, China has a probability. The current technology war has forced the most innovative company Huawei from China to disrupt chip value chain for its premium phones in just three years, which is very interesting to observe. Always love your passion!

Good post but I’d like to point out that perhaps Singapore and Japan are not good comparisons to make vs the USA when it comes to Debt to GDP. Singapore has ample reserves to cover its debt obligations. If Singapore wanted to pay off all its debt, it could do it today.

Japan too has enormous global investments that it has made over the decades with its trade surpluses. If Japan wanted to, it could repatriate all these reserves and settle its debt.

Both countries have debt not out of need, but for liquidity.

The USA is not in this situation. It has no reserves by which it can settle its debt obligations. The USA borrows because not because it chooses to, but because it needs to.

Walk a mile in another’s shoes who makes $34k in an urban US area like SF or NYC for a year. Then write v2 of this letter. Please compare apples to apples. Or take a readers survey on just this statement. Ps even when I disagree I’ll read Galloway.

One of the best letters you’ve ever written !

History shows that narrative is power. Truth usually has nothing to do with narrative, so I really appreciate Scott’s read on the actual situation. Also, I wish humans had one another’s (and all life on Earth) best interests at heart…instead of their singular own.

Let me think about this for a moment. Would I rather be a young college grad in the early 1970’s or part of the current generation?

We have screwed our young people totally. Let’s see how that plays out.

Food for thought.

“Things Marginally Better Today” does not get clicks.

This says it all in our world today.

Great article.

Sure, Xi Jinping may make Biden look like a web browser with 19 tabs open, not knowing where the music is coming from

That’s funny.

I have a deep appreciation for your posts, few posts out there have this level of depth behind the opinions they convey, however, I stopped tracking when I hit the last paragraph.

“If you are healthy, have someone who loves you, and enjoy a household income greater than $34,000, then you are in the top 1% globally”. Think about this …

And I really thought about it, in many parts of metropolitan America, you are temporarily healthy, with a poor diet, you are tired, overworked, and poor. Half of that income can go way longer in other areas of the world.

What is meant by being in the top 1%? Is truly GNI per capita the best metric to push for American sensationalism? How about we index to the cost of living perhaps? I am confident we will come to a different conclusion.

That being said, I don’t doubt the great US of A will stay dominant during my lifetime, and for that, I have been very thankful for the welcoming opportunities the USA offered me.

Seriously? The link to prove that poverty is going down is about the impact of The Child Tax Credit? That credit ended in 2021 and childhood poverty shot right back up 41%.

Compelling post, Professor.

My question is why is there such a constant disconnect in the macro realities of the US economic landscape vs. how the US general population feels about the economy?

I understand that the post CV-19 roller coaster after a 1 in 100 year episode has impacted the cost and recovery of goods, energy and such, but is it just the “funky post-pandemic vibe” that has filtered into many streams of narrative that you mention?

After a 30 year malaise, the US has FINALLY doubled down on investments in infrastructure and domestic manufacturing and such, but it’s like no one is actually aware of this, as recent polling shows.

Are we that checked out, misinformed and so subject to an instant gratification lifestyle?

I think the point of the macroeconomic argument is that the US can afford to do big things. That the Republicans crying poverty, decade after decade, is nonsense. That the full faith and credit of the United States of America is capable of underwriting the changes that justice, health and the environment demand. We lack the political structures to tax ourselves correctly; but the infrastructure and green new deal spending, financed with money wholly invented by the Fed and authorized without a single Republican vote, is having significant multiplier effects in places where Democrats don’t even bother to run. Eventually even Fox won’t be able to castrophize away the money in peoples’ pockets.

Not sure about the 34K = top 1% globally; but I do note that Scot’s formula is more complicated…you also have to be healthy and have someone who loves you. Maybe that only gets you into the 1%…not really sure.

Keep on believing this.

US GDP numbers are padded by financialisation schemes that do not create anything meaningful. Where’s your high speed rail, oh that’s right never going to happen. As for reduced property? Your link to back it up is the federal tax benefit providing financial support. Not substantive and lasting lift in living standard. Yep keep believing this shit. You’re the town crier in a hollowed out imperial project.

Despite the rampant confirmation bias displayed throughout this blog, I was trying to remain open-minded about your efforts to challenge the current trend of doomsday-ing. Until the last paragraph, which revealed the suspension of reality. “If you have an income greater than $34k, you are in the top 1% globally.” That comment is straight out of dumfuckistan. Americans in that income range are living and working in servitude status. Then I remembered, this was written by a multi-millionaire who lives in London…..because he can….and has his head so far up on the clouds that he has no clue how that “lucky” S34k/yr earner is actually NOT.

The green energy strategy will eliminate hundreds of thousands of jobs in the automotive and other

The printing of $25 trillion dollars in the last fifteen years, plus the buying of treasuries by the Federal Reserve artificially kept rates low, inflated housing and commodities, resulting in unaffordable housing for the common person. In addition, many corporations were encouraged to buy residential housing as an economic opportunity to rent homes, adding to the creation of housing shortages and holding renters hostage to rent increases.

It does seem that all these programs, policies and inventions are self serving benefits enriching the wealthy while devastating the the common person.

The solution is taxing the rich and letting market interest rates prevail. But the rich contribute to politicians on both sides, so taxing the rich is out the window. The Republicans and Democrats have had majorities, but failed to act on tax increases. I wonder why?

Agree on all counts except on crypto. A crypto coin will supplant the mighty US dollar before 2050.

People go to the US to make money. That’s been true for a long time and will probably be true as long as the US exists. Unfortunately, in the US, almost everything is about money. I think the doom that people feel is more about the impossibility of being happy without money. Working hard to get rich is not really an option in most other countries so they can be happy with less. In the US, the long, stressful work hours and preoccupation with always trying to make more money are crushing souls. I think the massive drug and alcohol use, high suicide rates, and the large number of single-parent homes means that the collapse has already happened, it just isn’t economic.

Good job. I agree with you.

Doom and gloom about the US is the only way the Repubs and Trump supporters gain any traction.

Trump and his Repub acolytes are traitors.

Another idea to ‘save’ America. Maybe MBA schools could stop teaching wealthier students how to manipulate poor and undereducated into buying crap they do not need. Stop destroying young men and women with false prophets of ‘being cool’ and ‘being tough’ with the shoes, booze, and salty/sweet snack ads. How about using creativity to convince men to be dads, women to not be obese, and teens to be law abiding. I know, tough for short, not attractive types with small — to do the right thing rather than just get another Porsche or Celeb party invite. But, if they support BLM and the Latest Thing, that is enough, right?

Great article as always!

I laughed so hard at the question: “Would you rather hold Japanese yen or Botswanan pula?”. I am Romanian, and in the Romanian language “pula” means “dick”. Also, in Romanian, a common way of saying that you got nothing after a certain investment or payment of any sort is by saying that you “got a dick” (pula).

Thank you so much for what you are doing!

Well done, Scott!

Human beings, given the right “platform,” are resilient and ingenious and will generally succeed in their growth-seeking activities. If we weren’t evolved to overweight negative information, it would be easier to see.

A decade ago, I responded to David Stockman’s prediction that America had reached “an end state metastasis” and continue to feel that unfolding reality supports a “glass half full” assessment of America (“The Great Disinformation: Why David Stockman is Wrong” https://yebu.com/economy-investing/the-great-disinformation-why-david-stockman-is-wrong)

Scott, this is a really neat & compelling summary of quantitative data. How does America fare on qualitative scales? Do your next newsletter on income inequality, racism, healthcare, and other key social issues. There is far more to life than money!

Brilliant, fact-filled post. Thank you. The Republicans try to weaponize fact-free pessimism in the hope of gaining support (read votes) for their astonishingly corrupt alternate “reality.”

I’m glad to be in The U.S. Nothing is perfect, but this is the way. I like your take on things and I appreciate the solid info. Thanks.

Bravo!

People lose context. It’s human nature to have recency bias. Also to remember the good from the past while forgetting the bad.

When comparing the present to the past through the long lens of history- these are the best of times- relatively. Yes, even with all the political conflicts- which have always existed while waxing and waning (civil war/ race riots/ civil rights, etc.).

With progress everything doesn’t improve- that wouldn’t be progress- that would be a miracle.

Count your blessings- the quickest path to happiness.

I really like him and all of his content, except this american patriotism and leaning towards exceptionalism.

I‘m European and when looking at your inequality, infrastructure, educational system and level (for the average, not the elites), health spending per capita, life expectancy, crime rate, drug abuse, suicidal rates, people on food stamps, homeless people and on and on and on .. c‘mon, the US is a shithole country in decline

Trying to spread american cleptocapitalism around the world, Leaving being a clepto capitalist society, A military using the dollars we need to help. The Homeless

And rebuild the country’s infrastructure. These are certainly issues that we must address. But I have to object. This is far from being a shithole country.

Mainstream media outlets like Fox News and CNN have damaged America’s reputation by prioritizing partisan division over substance. Across the political spectrum, provocative rhetoric and wedge issues get airtime, while moderates and pragmatic solutions are ignored. This divides citizens and distorts policy debates.

Both Republicans and Democrats are to blame for accentuating our differences instead of focusing on shared goals. The media eagerly amplifies extreme voices who spew inflammatory language but offer little in terms of real policy. This fractures our civic discourse and erodes trust in institutions.

America’s strength stems from our diversity and immigrant roots. We cannot let media provocateurs convince us our fellow citizens are enemies. We must reject identity politics and special interests in favor of policies that provide opportunity based on merit and achievement.

The media must return to informative, issues-based coverage instead of chasing controversy. Citizens should demand our elected officials spend less time bickering and more crafting solutions. Only by working together and remembering our shared ideals can we ensure America’s promise endures for future generations.

Well put! In fact, I believe Scott had mentioned sometime back that we need to reintroduce civics as required curriculum so young adults can separate the BS from reality. I teach business for a small University and also served 23 years as a U.S. Marine, including combat tours, humanitarian tours, etc. There is nothing wrong with loving your country, in fact, it provides you with the motivation to want to improve the quality of life’s for all Americans. If we can change the culture of depending on social media and FOX & CNN for your view of the world, we have a chance to make an impact for the good. Well done Scott, America is not declining, its still evolving as we move away from the GWOT, COVID Pandemic and social unrest.

This is a wonderful article. Everything I read is negative so you can’t help feeling the country is collapsing. Nice to have an article that doesn’t focus on what is wrong with America. Huge fan of Mr Galloway.

Prof G,

have you read “The End of the World is Just The Beginning?” by Peter Ziehan. he argues (as you do in this post)…. enough of this CNN-driven clickbait bullshit pessimism. We’re still the country everyone aspires to be! Zeihan is an all data & facts & history & pure logic kind of guy. I think you’ll enjoy reading his book. Gerry Lopez 816-379-1605

I want to trust your logic,but aren’t you ignoring the effect of our societal polarization?

Well done. America is truly the least bad and those of us that have the opportunity to take part in this smorgasbord of a country are truly fortunate. Thanks again for another insightful read.

Very compelling argument. The data comparison is quite an eye opener. Thank you!

Quite right. We’re blessed and prosperous.

But if you’re still a democrat despite the record of the last two years, your judgement is suspect.

Republican shortcomings are nothing in light of progressives’ damage, to the economy, the rule of law, and foreign policy.

Details if you care to go there.

Many great books involving “cycles” in the past 18-months. Peter Zeihan’s The End of the World is Just the Beginning; Ray Dalio’s The Changing World Order, and Neil Howe’s The Fourth Turning is Here. Your perspective is similar to Zeihan’s . . . positive. Dalio’s is dark for the U.S. and Howe’s is somewhat up in the air. As Yogi Berra said; “It’s tough to make predictions, especially about the future.”

Another timely and insightful post Scott. Fantastic stuff!

Let’s see, America is still doing great, but everything can change in an instant. Just look at a few months ago when a medium-sized bank run by tech people almost caused a systemic crisis.

Unfortunately the fundamentals are so strong that the powers that be in DC can continue stealing wealth from the proletariat via their various ingenious schemes that mostly benefit banks, government contractors, and a few others in the donor class.

The threats to Americans’ well-being are largely internal. The social, political, and economic stability Amercans are used to are all in play, with one political Party actively embarked on a project to undermine all three.

We learned a few short years ago that the “guardrails” we thought were in place were ephemeral, and that we are no different from any other human societies – vulnerable as any to authoritarianism, know-nothing-ism, and irrationality.

Most of the success / wealth of American society can be attributed to the historical good fortune of inheriting / taking over a bountiful, largely empty continent. We were born on third base and think we hit a triple.

You focus on measurable financial indicators, but the threats – such as the incessant stand-offs regarding the debt, non-stop election denialism and voter suppression, tampering with election results, the affection of half the country for authoritarian solutions – mean that our norms cannot be taken for granted.

I enjoy your columns, but think your glass half-full perspective ignores historically aberrant trends that threaten to topple the undergirding of social and political stabiltity – and with it all the graphs, bar-charts, and rosy prognostications.

Agree. What’s new is disinformation, either from internal sources (the right-wing propaganda machine) and external (Russia, China). Masses of people in the US programmed to trade away Democracy for an authoritarian, so much so that they’ve effectively taken over the Republican party. This isn’t necesssarily the end of the world for the US, but it’s a serious threat, and a hugely annoying distraction from our real problems.

Bad take. progressives have had their way for far too long and the damage they’ve wrought is undeniable.

Site desperately needs a down-vote button.

Wrongo. It’s the conservatives whose policies have dominated since Reagan. You know, the anti-science, more greed for me policies, that Prof Galloway rails against. Try again.

Kirk, authoritarianism from the Right? Seriously?

Who forced an untested vaccine on the military and tried to implement vaccine passports on the general population? Who wants higher taxes for “many” while the “most” have zero skin in the game? Which media denies Biden’s vivid dimentia or the problems associated with open borders?

Galloway, people would pay good money to witness a debate between you and the great Thomas Sowell. Hope you would consider such an event.

Yes seriously. The points you cite are trivial (and largely bogus) compared to the effort by Trump and the Republicans to overthrow the government on Jan 6. This what authoritarians do.

I came here to make essentially this comment, but you already made it perfectly — thank you

Best. Post. So. Far!

I’m surprised you didn’t quote Warren Buffett, who has always said “never bet against America!”

> history has proven that “Things Marginally Better Today” does not get clicks. But it’s the truth.

I think while directionally correct, it’s very incomplete.

“Some things are better for some, some things are worse for others”

Even on your podcasts and previous posts you talk a ton about the problems facing young people face, and when all the gains in the economy go to a handful of people* that is a major issue.

A growing economy or a healthy-ish GDP debt ratio relative to our peers means absolutely nothing to the 30 year old seeing rent skyrocketing wondering how they can ever afford to own a home. If anything being as comparative as we are by nature, amplified magnitudedly with what we have now, seeing the rich get richer is going to make a stagnant person feel much worse about their lives.

*exaggeration, I believe 2/3s of the trillions gained in the past few years have gone to the top 1%

Easy to take what we have for granted and focus on the negative which gets all the press, but yeah, half full it is, and still getting better despite all the nonsense.