Disinflation

Audio Recording by George Hahn

I’ll do approximately 25 speaking gigs in 2023, down from 47 in 2022. The primary reason for the decline is that I live in London now. Jumping on a plane to Austin to speak at SXSW used to sound fun … now it sounds like jet lag and time away from my boys, who refuse to stop growing when I’m out of town. But that’s not what this post is about. The best part of a speaking gig is the Q&A. The questions are remarkably similar across regions and events. For most of last year the most common questions were about our research on failing young men. Then they changed abruptly, to: “When will inflation come down?”

I have a degree in economics, taught micro- and macroeconomics in grad school, and worked in fixed income at Morgan Stanley. Despite that formal training, it wasn’t until I was in my forties that I appreciated that the economy is more a function of psychology and markets vs. … economics. Also, if you want to opine about the economy, you must acknowledge that nobody has a crystal ball — economists have predicted eight of the last two recessions — and be willing to get it wrong.

Anyway, in the third quarter of 2022 we predicted on the Prof G Markets Pod that inflation would come down as fast as it had accelerated. (I just read the last sentence and one thought runs through my head: When did I get so boring?) Wrong again. It’s going down faster.

Our thinking: Inflation is a supply/demand imbalance — too many dollars chasing too few goods — filtered through our expectations of the future. And as we said six months ago, when inflation was a front-page bonfire, these factors would swiftly realign. And they subsequently have. Inflation is in fact receding, for the same basket of reasons it went up — not math, but markets. Specifically, the market of money (interest rates), the market of goods (supply chains), and the market of labor (employment). Plus, an unexpected chaser: the disruptive potential of AI.

2%, 4%, Let’s Call the Whole Thing Off

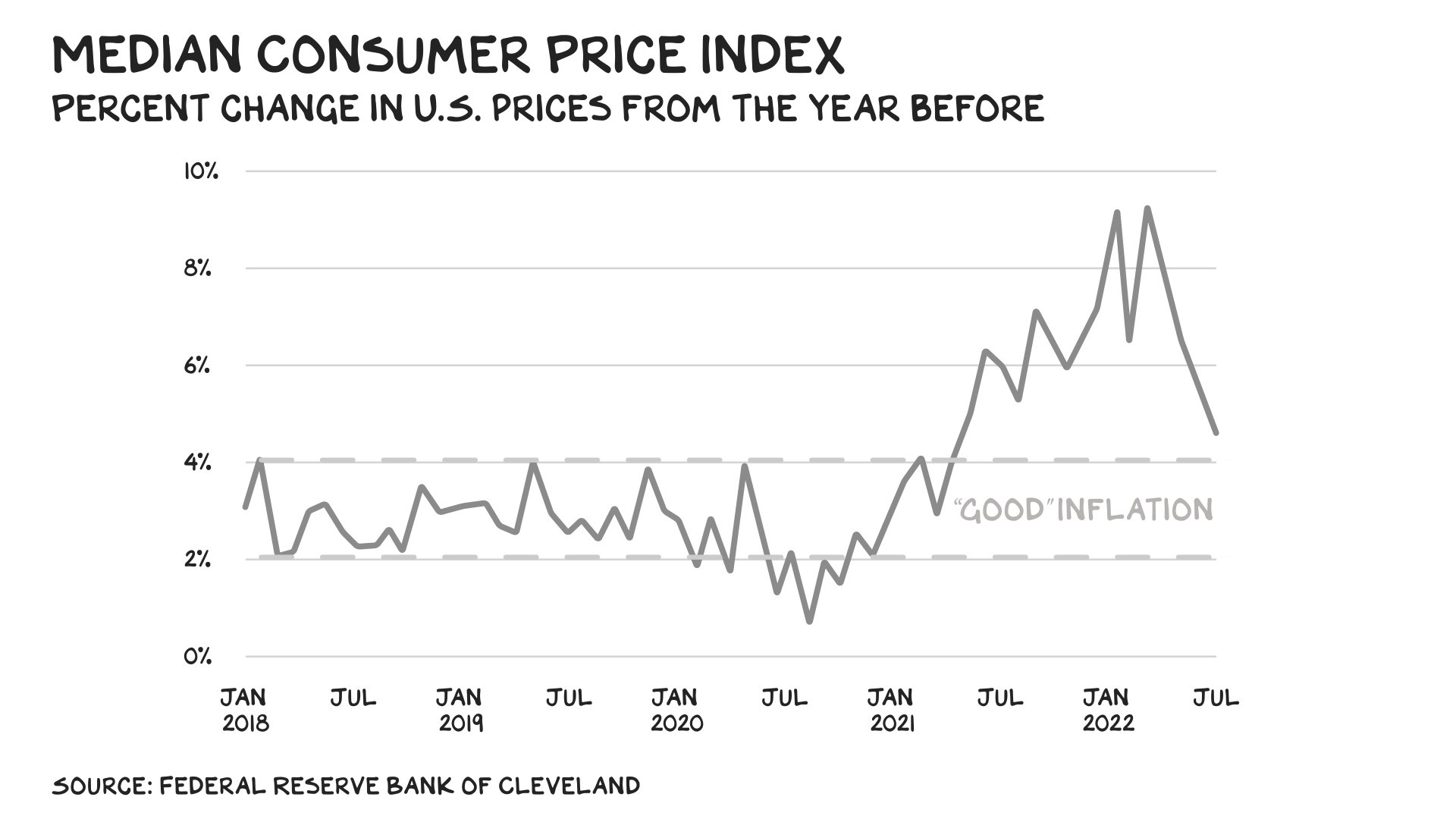

Some inflation is probably a good thing — too little and you risk tipping into “deflation,” which gives economists nightmares. The fear is that people will stop spending in anticipation of lower prices, and economies, like sharks, only survive in motion. In typical fashion, economists don’t agree on how much inflation is good. Many academics and institutions call for an inflation target of 3% to 4%. But central bankers in the U.S. and Europe (i.e. the Federal Reserve) target 2%. In actual business, a 100% disparity between metric targets would be cause for concern, but in economics it’s cause for tenure.

Consumers tend to worry about higher inflation more than economists, who recognize that inflation is at least partially self-correcting. When economist Danny Blanchflower (Dartmouth) was on my Prof G Podcast, he pointed out that inflation has never endured in a modern Western economy. But consumers also vote and spend, so their views carry weight. (This is 51% vibe and 49% science.) What everyone can see with their own eyes is that when inflation hits 8% in a country where it’s been sub-2% for decades, people get excited. So what happened, and why should we all keep calm and carry on?

Interest Rates (aka “This Invisible Hand”)

David Foster Wallace once told a joke about two young fish who run into an older fish. The older fish says, “Morning boys, how’s the water?” The two young fish swim on for a while before one turns to the other and asks, “What the hell is water?”

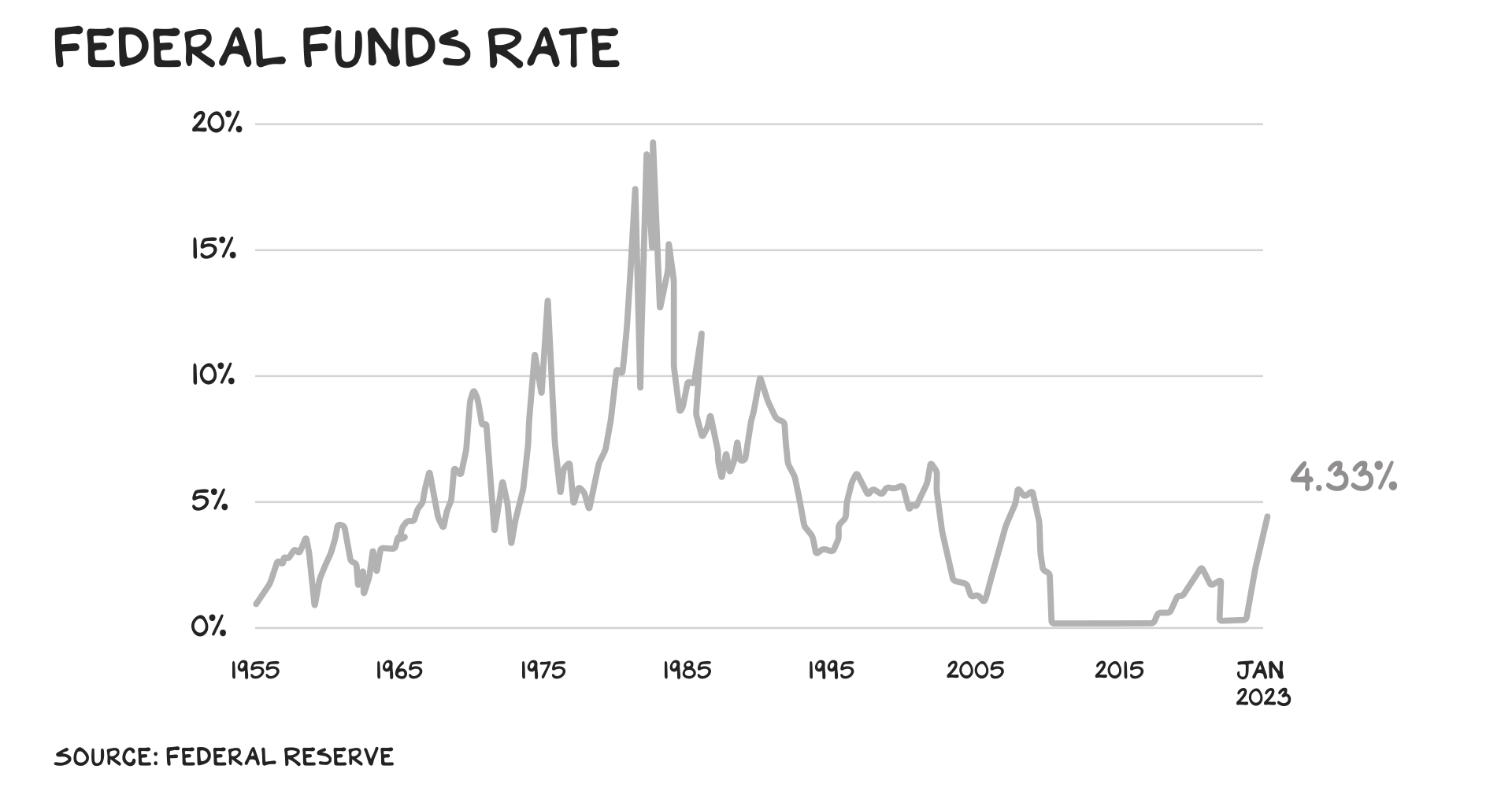

For several decades, our water has been declining interest rates. Think of interest rates as the throttle on economic risk taking. Low interest rates mean money is cheap and easy to borrow, so people take more risk. The Fed sets the floor on interest rates (the “federal funds rate”), which it took to rock bottom, Crazy Eddie “I’ve gotta move these cars today” levels to get us out of the Great Recession. Soon after the Fed finally began moving them up again, Covid knocked them back down. With the money taps gushing, the stock market ripped, as the cost to finance growth and the value of future cash flows decreased and increased, respectively. We were gamblers at a craps table crediting our resilience and daring, while the casino was pumping pure oxygen through the A/C vents.

Many strange new market phenomena emerged as a result of this new normal: Crypto, SPACs, billionaires flying to “space,” tech workers filming TikToks at their company’s kombucha bar, pet bereavement leave, car companies IPOing on zero revenue, CNBC platforming carnival barkers, VCs doing zero diligence before investing hundreds of millions of dollars in Adam Neumann (again), unprofitable tech stocks quintupling, 50-person Diversity, Equity & Inclusion departments, 30% headcount increases, Cathie Wood.

We became DFW’s fish, unaware that cheap money was even a thing. But it was. Because if inflation is too many dollars chasing too few goods (it is) then the free money party would eventually juice prices. There’s only so many crypto scams and boutique grocery delivery businesses we can create each day to soak up all that capital. And when prices did start to rise, the obvious response from the Fed and other central banks was to raise rates. Higher rates, less money flowing into the economy, less demand, slowing inflation. It should be that simple.

The Great Ungunking

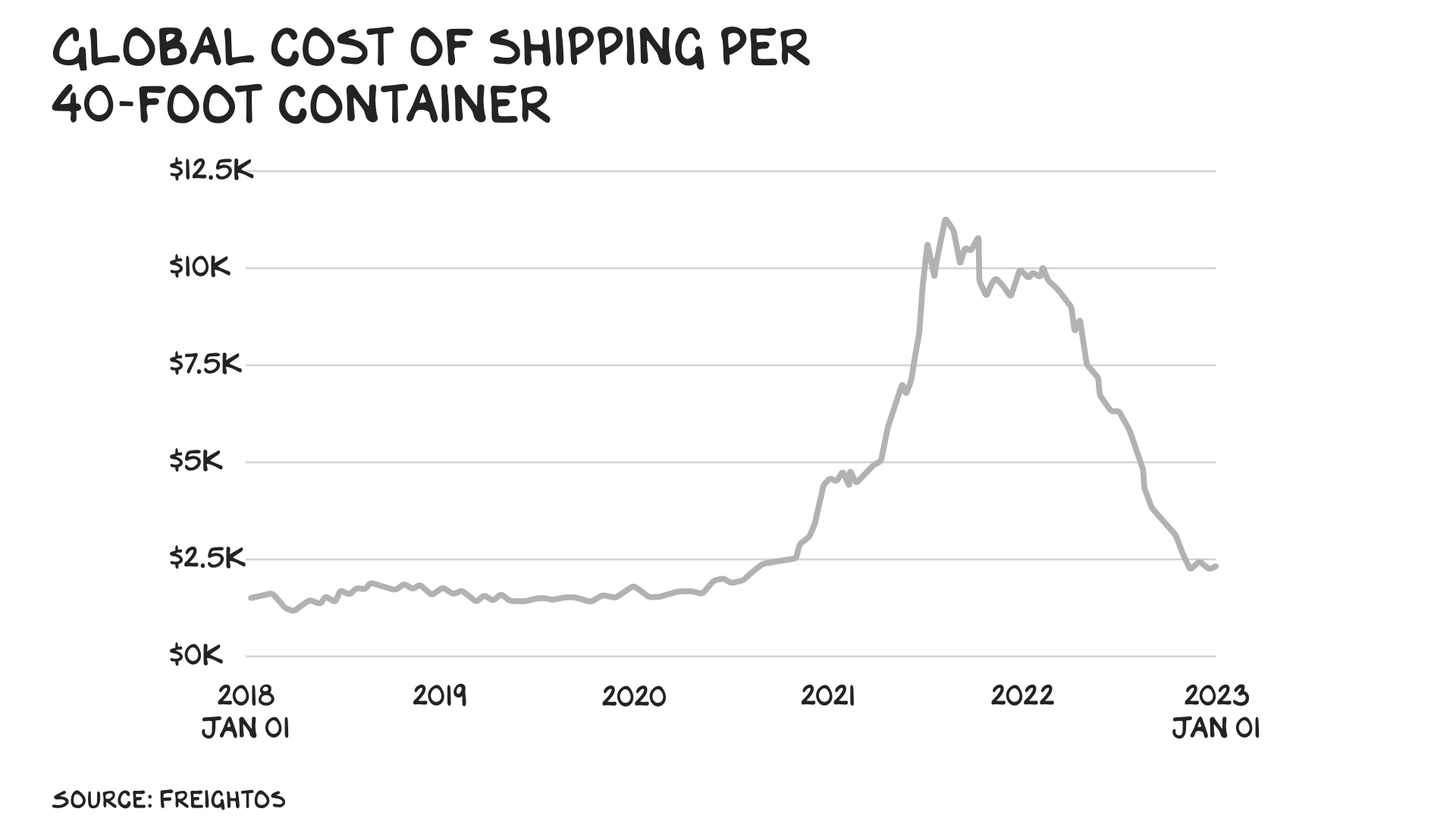

For nearly half a century, global companies had been squeezing out more and more profit by simultaneously thinning and complicating their supply chains. The Japanese pioneered “just-in-time” manufacturing, where parts and raw materials were ordered to arrive only as they were needed, rather than piling up in warehouses. Then companies from Apple to Walmart supercharged this concept globally, designing intricate webs of parts suppliers and assemblers with minimal excess capacity or inventory across the chain. It worked, but it depended on constant movement throughout the system. Which was awesome until we turned off the volcano — China and nearly every other low-cost manufacturer — in the spring of 2020. The global supply chain had become so optimized that there was no slack or ability to respond to shock. Things ground to a halt.

For a while, it felt as if half the world’s stuff had disappeared. Which it had. Covid kneecapped manufacturing’s ability to make semiconductor chips, which kneecapped tech’s ability to make … tech, and thus, anyone else’s ability to make anything else. Fewer chips meant fewer cars, printers, routers, iPads, and dog-washing machines. It wasn’t just tech. Shopping for home appliances became a SpecOps mission. Remember the baby formula shortage? Me neither. Also: lumber, toilet paper, tampons, and sofas.

By the fall of 2020, 94% of the Fortune 1000 reported supply chain disruptions, and it wasn’t just demand building. Ships were in the wrong place, some warehouses were bursting, sources of supply were coming back online at different cadences, and managers had no idea how to forecast the rate at which demand would return. Plus, China was a mess. And if the 21st century global supply chain spiderweb has a central node, it’s China. The result: All those dollars (see above) had even fewer goods to chase, so prices went up. And this is about psychology as much as reality — nothing makes people freak out about prices like empty store shelves. Retailers were snapping up any inventory they could find, and what was available for sale was sold dear. At one point, space in shipping containers was going for $277 per square foot. The cost of a house in Dallas. Only, you get to keep the house in Dallas.

Once gunked, however, ungunking was just a matter of time, and a lot of shouting over international phone lines and in stressful Zoom meetings. The entirety of the corporate world was motivated to fix these problems, and they were fixable. What remains to be seen is if we will take lessons from this debacle, and make our supply chains less brittle by investing in suppliers closer to home and becoming willing to accommodate more slack (i.e., fat) in the circulatory system. But that’s a different post.

Supply chains are almost back to normal. This is reflected in the data — the global supply chain pressure index has come down more than 75% in the past year, trade through America’s West Coast ports has risen 25% from pre-pandemic levels, and semiconductor chips are “no longer in a shortage zone.” Also, more baby formula.

Take This Job and … on Second Thought

The largest market is the market for time. The labor market is the market that underpins everything else; it’s where we get the money to create the demand and how we make the goods to supply it.

Once we pulled back from the drop in employment during the depths of the pandemic, there was a hot minute where labor had the upper hand over capital. That’s not the normal state of affairs — it’s called “capitalism” after all, not “laborism.” (Note: Any claim that market dynamics will sustain a middle class without massive investments is trickle down/on bullshit.) Anyway, imagine trying to explain to someone before March 2020 that large portions of the workforce would suddenly refuse to come to the office, and that they’d still … keep their jobs.

In the information economy, the balance between capital and labor likely swung too far toward labor. Wall Street bankers decided they could do Zoom meetings and proofread deal docs at Starbucks. Big Tech was particularly under the gun, offering not just larger and larger pay packages, but a raft of perks (e.g. valet parking, red-wine-braised short ribs, and free blankets), while loading up on employees — all of which created upward pressure on wage inflation.

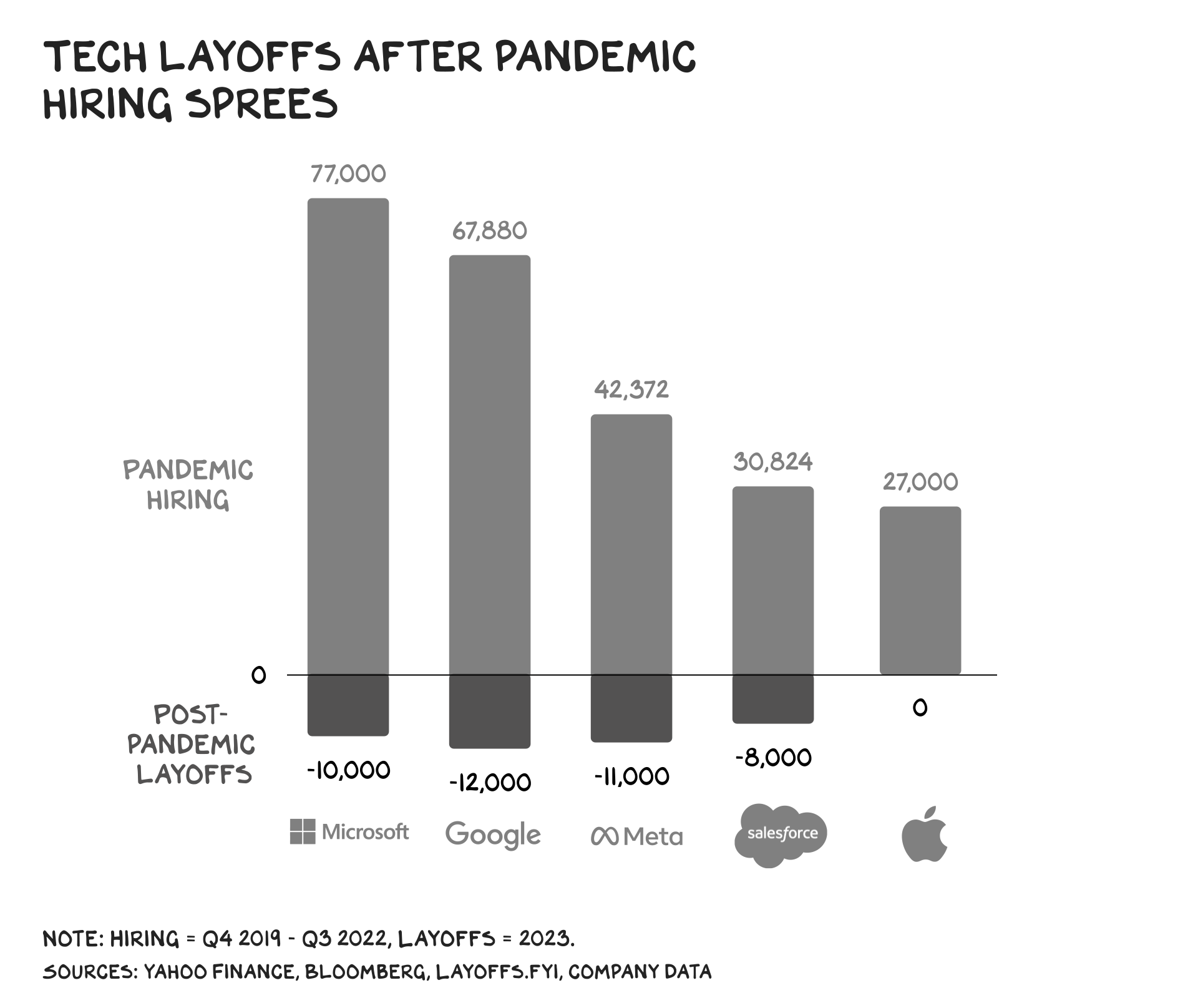

Then things changed. First, Apple added opt-in tracking to iOS, threatening the ad-supported ecosystem. Then, the impact of less free money and a return to supply chain normalcy freed up the natural business cycle, and companies (and their shareholders) realized they couldn’t keep increasing their headcount 20% each year. The balance between capital and labor in the growth economy has reverted. Tellingly, these layoffs have largely been confined to tech, a relatively small portion of the economy the media covers obsessively. Perception bests reality when headlines report a five-figure layoff every week, and nobody does the math on the broader employment picture. One of the great externalities in society is an ad-supported ecosystem that turns attention to capital, resulting in a catastrophizing of all media.

The chaser dropped on November 30, when every knowledge worker (reportedly) met their replacement: ChatGPT. With more than 30 million users, ChatGPT is arguably the fastest growing product in history. (The iPhone sold 6 million units its first year; granted, they cost $499 each and ChatGPT is free.) I used to say about WFH that if your job can be done from Boulder, it can be done from Bangalore. Well, in 2023, the new Bangalore may be ChatGPT.

Inflation is about supply, demand, and psychology, and the psychology of ChatGPT is that it may not be a good time to quit your job. Unless, of course, you’re joining an AI startup. History tells us the innovation in AI will likely create more jobs than it destroys.

Deflated Outlook

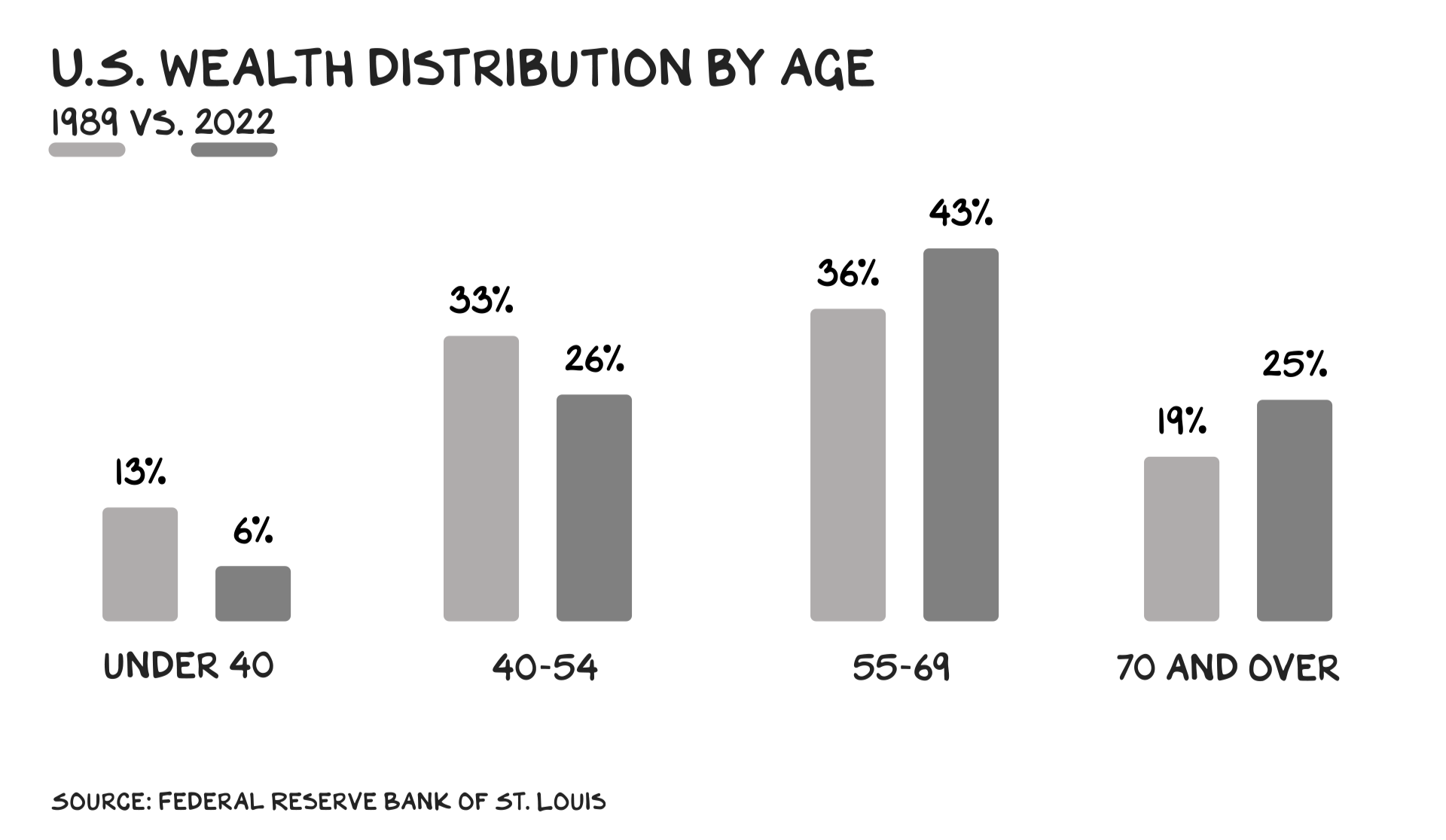

Lately, I’ve been struck by how negative young people are about the future. The aforementioned dark-colored glasses of the media, and legislative policy that has transferred wealth and opportunity from young to old, have broken the fundamental compact our society has had with its youth: At 30, you will be doing better than your parents when they were 30.

The poor outlook on the world young people share is understandable but not accurate. Opportunity and injustice have increased and decreased dramatically, respectively. What we lack is the leadership to ensure our immense prosperity is shared with a younger generation who have registered a wealth decline in the face of historic growth in productivity. Despite this, women in Iran, Ukrainian soldiers, and an increasingly diverse cohort of young citizens see a better future that is within their grasp and worth fighting for.

Much of the pessimism in our society stems from contrasts. Specifically the contrast between our ability to achieve the remarkable and our inability to offer the obvious. We can peer into the beginning of time, re-create the sun, and manufacture vaccines against cancer, yet the U.S. can’t seem to figure out affordable child care or housing. A nation’s well-being is correlated to prosperity that translates to progress for its citizens. Since the year I was born, China’s life expectancy has increased from 47 to 77. In the U.S., we’re long on genius but short on empathy.

Life is so rich,

P.S. If you’re a team leader, consider bringing your team to sprint together at Section4. We’ll make your team more strategic and more engaged (and give you some coaching time back). Request a demo or email teams@section4.com.

Off topic Scott, but, saw you on CNN say that the FBI did not collude with Twitter censors, and that is so wrong. Please read the Twitter files that Matt Taibbi and other journalists are combing through. Don’t just follow the party line. You obviously haven’t because you are way too smart to say what you did. Lord knows how deeply embedded the FBI and CIA and NSA and DNC is at Google and Facebook, and stop with the “private business” excuse. Someday they’ll come for you and me.

I figure that the rich who own everything including the government will never allow deflation since that hits assets which is where their wealth is located (property, land, buildings, plants)

Scott. I would have to say all of my wife/my 5 children have/are doing as well as we did at age 30. The keys have been our actual “raising them” and providing them higher education. Lets face it bro, now roughly 75% of Black, half of Latino and 30% of White babies are born out of wedlock . . . and “dear old dad” is MIA. These dudes need to lose their “man cards.” Seriously though, when you have such a meaningful decline in attentively raising your offspring, of course things aren’t going to turn out well for the kids.

What has ‘wedlock’ got to do with this nowadays?

Hi Scott…there was never a Semiconductor shortage, rather a demand spike…automotive groups were put on allocation and their archaic procurement were caught with their pants down! Then the convenient “supply chain disruption” fig leaf came out…

Espouse this opinion to anybody who designs or manufactures electronics professionally, all of whom have spent two of the last three years living this ‘demand spike’, redesigning, respecifying, relearning best practice, and going months without any foreseeable way of getting new or existing goods back into production. They will confirm what I know from half a dozen manufacturing clients: you are misinformed.

35years in the Semi business…seen it all…-8% CAGR…there were disruptions in the supply chain but fabs were running at full utilization…we put the automotive guys on allocation and redirected capacity to higher margin compute products…business was good and we killed ourselves to increase capacity wherever we could…”shortage” implied disruption in output, which wasn’t the case…fig leaf…

How is a demand spike any different from a supply shortage? They’re the same thing, just described from the other side of the fence from each other. The manufacturers see a demand spike. The buyers see a supply shortage. This is just semantics and perspective.

Please read the article again…the so called shortage implied by some did not come from a disruption in output, but rather from a reallocation of product due to higher margin demand spikes…use your imagination, a demand spike is not the same as a supply chain induced shortage…

Prof G, surprised you would lump pet bereavement leave in with the rest. Thought you were a dog person and understood that for many, pets are family.

So far, almost everyone is commenting about which age group has the most wealth. The brewing tragedy you capture in your last paragraph has yet to be noticed.

Hello Scott, Can you, please, comment on (possibility? the pros- and cons-) of the US Deflating it Currency?

On the distribution of wealth by age… is the graph looking at the total wealth of each age group or the per capita wealth of each age group? Is the message that the population is older or that old people are relatively richer?

Both are probably true.

The day that the Sharehold became the companies raison d’etre, the humans making the stuff became fodder and worth less and less each year as even modest inflation eroded wages that have stagnated for decades.

I want to hear more about ‘laborism’ *Soviet national anthem starts playing*

Always thought provoking

Mr. Galloway, I understand different people think different amounts of inflation, 2% or 4%, etc., are best, but what if we had zero percent? Then no one would have to allow for it, or change the prices for it, or try to figure out if price on a product you see today, is good or bad, compared to the last time you bought it a few years ago, by calculating for inflation. If inflation was 0% we could all just ignore inflation and spend that extra time doing more productive things. What do you think (am I crazy, or would this be better)?

When does anything – not least something as complex as national / global economics – ever exist in perfect equilibrium, where no corrective measures are required to try to maintain said ‘order’?

Wonderful read, Scott. As I read the part of ‘building some slack in our overly-optimised supply chains’, was reminded of a parallel in human physiology. The body appreciates the elbow room of a relatively higher fat ratio, in the early, rapidly growing years and in the declining years. But in the good times of our prime, that same fat ratio is demonised.

Scott, Crazy Eddie sold TVs, not cars.

Very well explained……very well. If only I had you as a professor 50 years ago I could have groked so much more.

oh yay I’m a millionaire! oh I’m 79! 🙁

OH YAY!!! I’m a multimillionaire oh and I’m 79 🙁 hahahahhahaha

Scott, I always love your newsletters. I don’t always agree with your perspectives, but I always learn something new and appreciate your humor and honesty and humility. Thank you!

Ps. Speaking of people who can blend humor and honesty, I love that David Foster Wallace “joke.” When you listen to that whole speech (commencement at Kenyon College), do you also find that he is making a clear and compelling argument for the existence of God? It’s probably the best “sermon” I’ve ever heard.

Hi Scott, If “The labor market is the market that underpins everything else; it’s where we get the money to create the demand and how we make the goods to supply it”, then why are humans so undervalued in the workplace? Organisations seem to ‘other’ their employees, keep them in a box, and not let them fly. Organisations treat humans as disposable resources, but not real people. It seems like they are self-sabotaging their social and economic potential. Why do they choose to do that? Is it because they want to keep control of people and use them as ‘good soldiers’ to harness the collective energy towards achieving an economic goal? They don’t want people to play to their individual strengths as it weakens the collective effort? Poll after poll says that people leave bosses, not jobs, so I wonder how much good stuff gets ‘left on the table’ because of this self-imposed constraint? Ultimately, businesses exist to solve problems for people…not the other way around. We need to make businesses work harder for humanity and the planet so that we can leverage this social and economic resource to create a bold future where humans and the planet can thrive. Would love your thoughts at a macro level on the relationship between business and humans and how it can become more mutually beneficial. Thanks!

It’s almost seems like things would be better off if the workers controlled the means of production…. Sounds like laborism to me

Your idea of how organisations treat their employees seems to be incredibly narrow here. I would say that the overwhelming majority of real-world organisations do not treat their employees as disposable resources at all. Where have you picked up this sweeping generalisation from?

All these facts can be refuted with the history of the Argentine economy.

The US dollar is backed with Plutonium standard of it’s nuclear arsenal

didn’t work for the Russian Ruble.

The chart on wealth distribution by age is terribly misleading because it does not adjust for the fact that the percentage of the population in each of those age groups has changed dramatically the past 30 years. The bulk of the increase in wealth owned by the 70+ age group is driven by the simple fact that the 70+ age group is a large share of the population than it was before. A more compelling story is that the distribution of wealth *within* every one of those age groups – the gap between the “have’s” and the “have not’s” has expanded significantly.

My thought exactly. As the baby boomers moved through the economy over the years they created and captured a great deal of wealth. Would be interesting to see some type of population-corrected view of the Wealth Distribution chart.

Scott always delivers an interesting perspective .

Another thought is that the older generations in 1989 still had pension plans from employment. Whereas younger generations in 1989 understood that they had to save for themselves as pensions were going away or already gone. Then wealth expanded as the economy expanded, leaving this aging cohort with more and more wealth, all in addition to the baby boomers being the largest population cohort.

Regarding inflation, the phrase “too much money chasing too few goods” suggests that the cure to inflation is to reduce the money or increase the goods. But inflation is sort of like the physical acceleration that causes us to feel g-forces. When velocity stabilizes we no longer feel the excess g-force, and when prices stabilize we no longer experience it as inflation (and of course if the price remains steady for 12 months then we no longer measure it as inflation either). So another cure for inflation is simply time. The phrase omits corporate profits. Case in point: cereal manufacturers last year took extraordinary price increases that were far beyond anything justified by increases in raw materials, labor, transportation, etc. How do we know this to be true? Profit margins exploded. Now this year these same corporations signaled to Wall Street during their investor conferences that future price increases be very modest. One might argue that these investor conferences provide opportunities for implicit price collusion among manufactures, but even setting that aside it’s clear that inflation in the cereal market had nothing to do with “too much money chasing too few goods” and more with the fact that it takes time for consumers to change their habits and behaviors such as shifting from national brands to store brand cereals, shifting to larger sizes with a better price per ounce, etc. Again, time cures.

Scott, I’m glad you are spending more time with your sons. What you are discussing is the (hegemonic) neo-liberal paradigm of global destruction and human suffering. Any chance you could write about Quality of Life (QOL) indicators as valuable metrics?

Hey Scott, I usually don’t comment on anything online. I have been listening to you for a few years (Pivot) and now reading your thoughtful essays weekly. I have to say, these are some of the best texts I get to read weekly. It’s deep and data driven but not to the point that it makes it too dense (that’s a hard balance to achieve) and it’s intertwined with all your experience, knowledge, humor.. What a delight. I absolutely love this one. Thanks and congrats.