Dead Canary

Dead Canary

In 1999, I and a gaggle of other SF internet founders and CEOs went to an airfield where we browsed private jets. It made sense that, at 34, I should have a one-bedroom apartment to transport me across the surface of the atmosphere at Mach .8, because I was a fucking genius that could afford, on paper, to spend the equivalent of a thousand years of my mother’s salary on aGulfstream.

A bunch of thirty-something dicks looking at planes, and it feeling normal, is a decent signal the canary is dying, and these budding masters of the universe are about to get bitch-slapped — which we were. I never got the jet, but have achieved Mosaic status on JetBlue.

What are the canaries — things that indicate markets or a company are about to find themselves on the wrong side of cyclicality / karma?

— The metrics around valuations, P/E ratios, and easy credit-inflating bubbles are logical indicators of canaries. The most successful hedge fund manager nobody’s heard of,Seth Klarman,warned this week the sugar high of stimulus combined with high-cholesterol protectionism doesn’t end well.

— Nations / firms erecting big buildings is a canary. The Pan Am Building, Sears Towers, and any number of giant penises in emerging markets plunging into Mother Earth are little more than multibillion-dollar dick pics and may seem like a good idea at the time, but are just tacky.

— There are canaries in companies. The most obvious are typically manifestations of the CEO’s ego. The layups (sell signals) are when the CEO goes Hollywood, or believes the world shouldn’t suffer their absence from fashion covers and ads.David Karp inJCrew ads andDennis Crowley inGap ads should have told us their companies would soon be a shadow of their former selves and valuations.Marissa Mayer’s 3,000-word profile in the September issue of Vogue around the time she spent $3M of shareholder money on sponsoringVogue‘s Met Ball is an indicator of poor judgment. This way of thinking leads you to spend another billion dollars of shareholder money to purchase the blog platform (Tumblr) of the guy who’s in the JCrew ads, only to find you spent$1.1B on a porn site that has little revenue.

A CEO’s fashion can be telling. When he or she starts showing up on stage wearing ablack turtleneck (“I’m the next Steve Jobs”), it likely means not that Jobs has reincarnated, but thatthe stock is about to crash, and theFDA is going to ban you from your own labs (Jack Dorsey & Elizabeth Holmes).

But where is the nest, ground zero for the next crash, the mother of all canaries, or the spark that torches the economy? Chaos theory and randomness would make anybody a fool to predict this. Ok, color me a fool.I believe Snap, Inc. is ground zero. Stay with me.

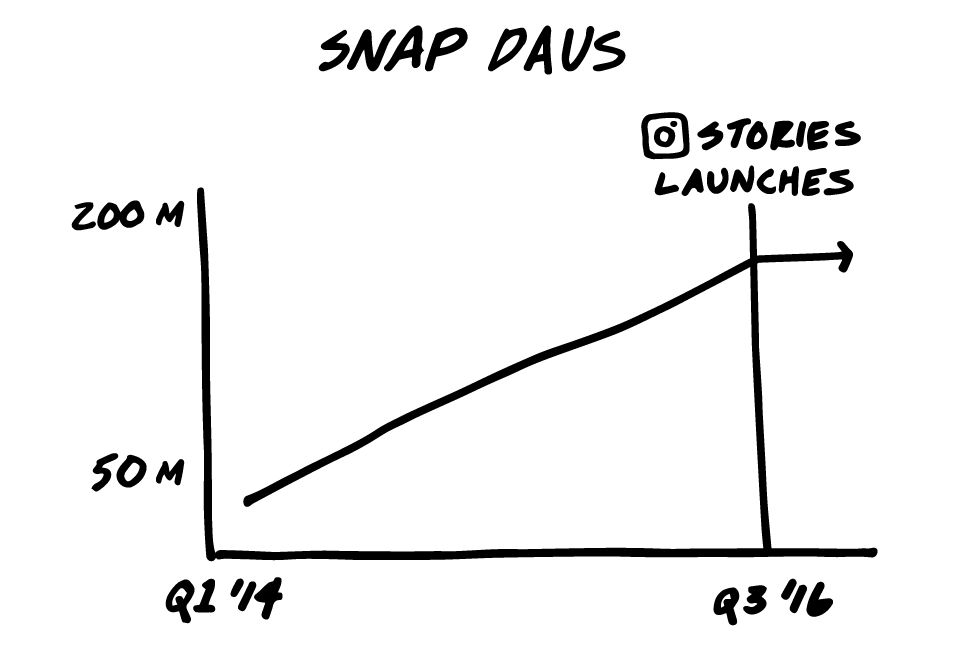

Snapchat is a great product, and the firm has shown a better feel for the consumer than most tech firms. Therevenue growth in 2016 is uber impressive, and CMOs are using Snapchat buys like Botox, believing it makes them look younger in the eyes of their CEO (“I’m so down with this whole millennial thing”). However, I see a bird and dead people — but that’s another post. CEO Evan Spiegel isshowing up in Italian Vogue and has a security detail. Thefirm’s loss last year was greater than its revenues. However, the blast zone, and my favorite piece of data of 2017 so far, is thatSnapchat’s growth has fallen off a cliff since Instagram launched Stories.

I believe Snap will go public and register a huge pop fueled by retail investors who haven’t had a chance to invest in unicorns, as unicorns are staying private longer. The firm could, feasibly, on day one of trading, be worth more than Time Warner Cable and NewsCorp combined. The intoxication with the “Facebook for millennials / video” will turn into a vicious hangover as the markets realize Instagram is the Facebook of video and is eating Snapchat’s lunch. Investors will then sour on the space and turn on Twitter and Pinterest, both great products that are, in Twitter’s case, nowofficially in decline. Animal spirits will become animalistic in an amalgam of debt, rich valuations, and tweets from a manchild — and we’ll have our next pop. The bad news: it’s definitely coming. The good news: we’ll (again) get through it. Did I mention I’m Mosaic on JetBlue?

Keep It to Yourself

Kevin Plank said our president is an asset to the country, and his key spokesperson disagrees. It doesn’t matter who’s right, but that the CEO should know better than to offer unsolicited views on his political leanings. You’re going to, pretty certain about this, alienate half your audience if you have a mass-market product. Nordstrom, on the other hand, handled their run-in with aplomb. As the president is now finding time to pimp his kids’ clothing lines and attack firms that discontinue their products, Nordstrom had no choice but to respond. Their response was even handed, gracious, and unemotional — nothing personal, shit’s just not selling. When tempted, as a CEO of a consumer firm, to express your political views, it’s a good idea, as Albert Brooks counseled William Hurt in Broadcast News, to “Keep it to yourself.”

Life is so rich,

Scott