Mammon

Audio Recording by George Hahn

I just paused my Hulu subscription — pretty sure that means I’m blackmailing Bob Iger. The real tragedy of Andrew Ross Sorkin’s interview with a co-founder of OpenAI is that ketamine addicts deserve a better spokesperson. But that’s another post.

The collapse and rebirth of the Valley’s preeminent private company was the most bewildering business story of 2023 and an object lesson in a truth that’s hiding in plain sight: When capital and ideals clash, capital smothers ideals in their sleep. The end of the charade that OpenAI was a nonprofit signals the beginning of the end of ESG.

We are always ready, and want, to believe that this time it’s different, we will do good while making billions. The last big corporate jazz hands was the ESG movement, purporting to prioritize environmental, social, and governance concerns over shareholder returns. Succumbing to this siren call, we abdicated our responsibility to discipline corporations and curb the externalities wrought by the pursuit of profit, believing instead that one profit-seeking entity could cajole another profit-seeking entity to seek something else.

Mission Aborted

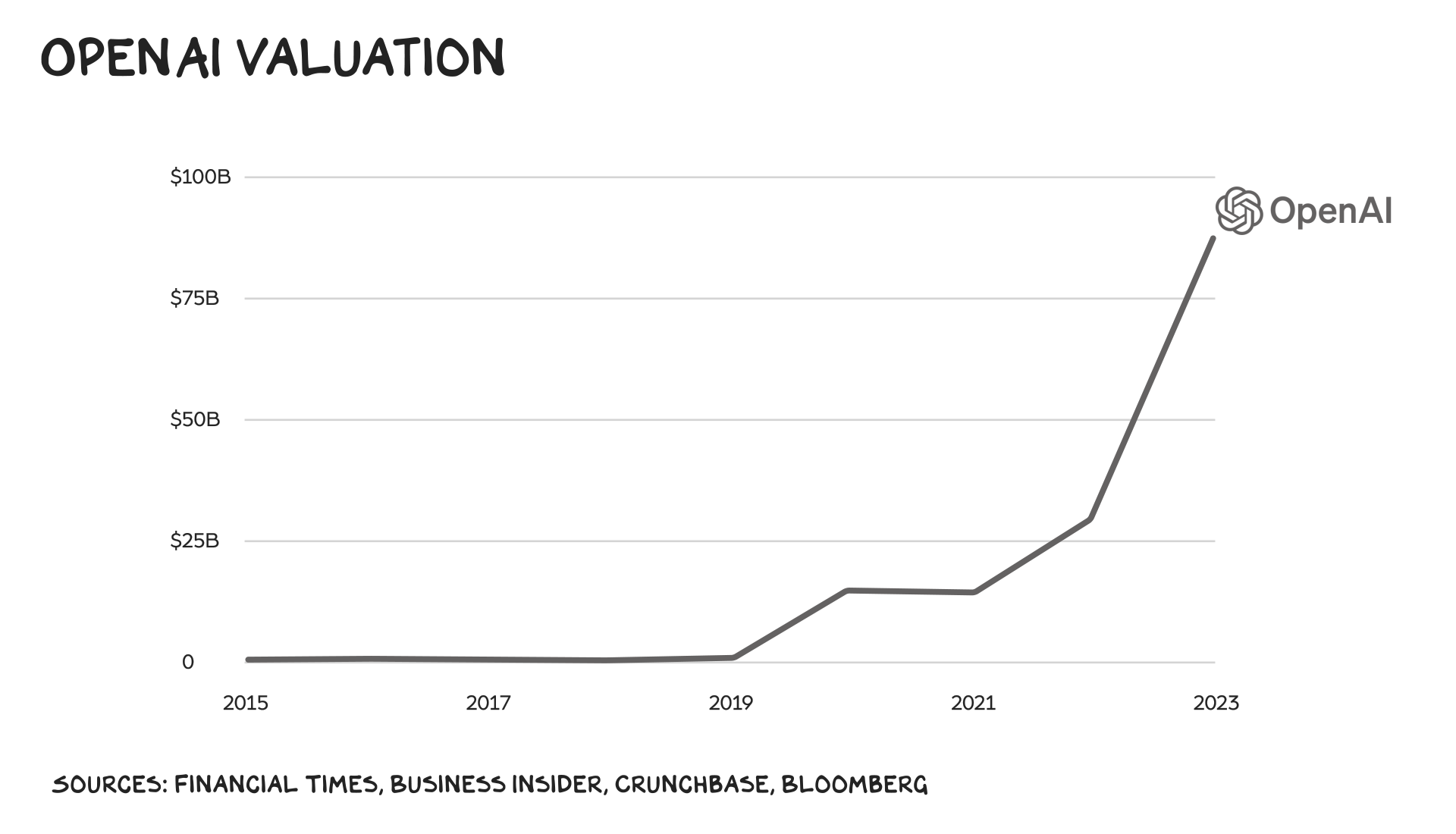

Elon Musk and Sam Altman founded OpenAI eight years ago with a specific, altruistic mission: to invent the most transformative technology ever known and then … give it away for free. They had amassed vast wealth from private enterprise and didn’t believe a for-profit company could be a responsible steward of the AI tech they planned to build. Fast forward: One box was checked with a pen the size of the Hercules–Corona Borealis Great Wall. OpenAI is likely the most important private company in the world, and it’s already one of the most valuable. But the tsunami of private capital washed over its founding ideals. Once the water receded, one house of worship, the pursuit of shareholder value, stood unblemished. Note: In this instance, “shareholder” should not be confused with “stakeholder.”

Drawn & Quartered

OpenAI’s founding mission was drawn and quartered the moment the company took its first billion-dollar investment from Microsoft, in 2019. Four years in, the company determined it would need billions to build the team and computing infrastructure that advanced AI would require. It’s possible they always knew this, and expected Elon to foot the bill. But he severed ties in 2018, either because of conflicts or because he lost a power struggle. Regardless, the company needed capital. It raised a billion dollars from Microsoft and restructured itself as a for-profit “controlled” by the original nonprofit. When a “nonprofit” takes a billion dollar investment from a for-profit, it has been bitten by the dead and is now also a profit-seeking White Walker.

Don’t Be Evil

OpenAI was not the first company whose founders thought they could breathe and swallow at the same time. Tech in particular is a museum of grandiose mission statements, eventually cast aside in the pursuit of profit. Google, from which Sam and Elon poached some of the first OpenAI hires, famously espoused the mantra “Don’t be evil,” putting the motto in its 2004 IPO prospectus. Steven Levy used the phrase as a thematic touchstone in his history of the company, In the Plex. The book highlights the crisis the company faced balancing principles against profit. Over and over, it asked itself, “Is this evil?” … and chose evil: building its own browser (page 210), tracking users to sell ads (338), building AI for weapons (405), and, most famously, agreeing to censor search results on behalf of the Chinese government (284). (Not to mention radicalizing young men and undermining the business of journalism.) In 2018 the company passively acknowledged what it had become, relegating “don’t be evil” to an HR scold at the end of its Code of Conduct.

Gravity

Sports analysts refer to the impact of a great player as their “gravity” — they pull defensive players toward them, leaving other players open. Messi, Steph Curry, everyone in Man City’s attack has gravity. Capital bests them all (see Ronaldo’s Al Nassr contract). Everything you want to do at a company, including hiring employees, buying raw materials, and renting space, requires capital. Your shareholders demand a return on theirs, i.e. profits. A manager’s task is difficult, but simple: Allocate finite capital to generate a greater return than their peer group gets. And when the ROI-maximizing decision isn’t one that “benefits humanity,” capital wins. Sam may have his hands on the wheel, but he’s sitting on Satya’s lap as he drives. Capital is in charge.

Beginning of the End of ESG

The saga at OpenAI is playing out at macro scale in the markets, with the decline of the ESG movement. ESG stands for “Environment, Social, Governance,” and it’s what fashionable multinationals are wearing this season. It comes in a few styles — a management strategy, an investment thesis, a product offering — but they’re all the same masquerade: that for-profit corporations and the markets can police themselves. The question of whether they can is bested by the evidence. They don’t.

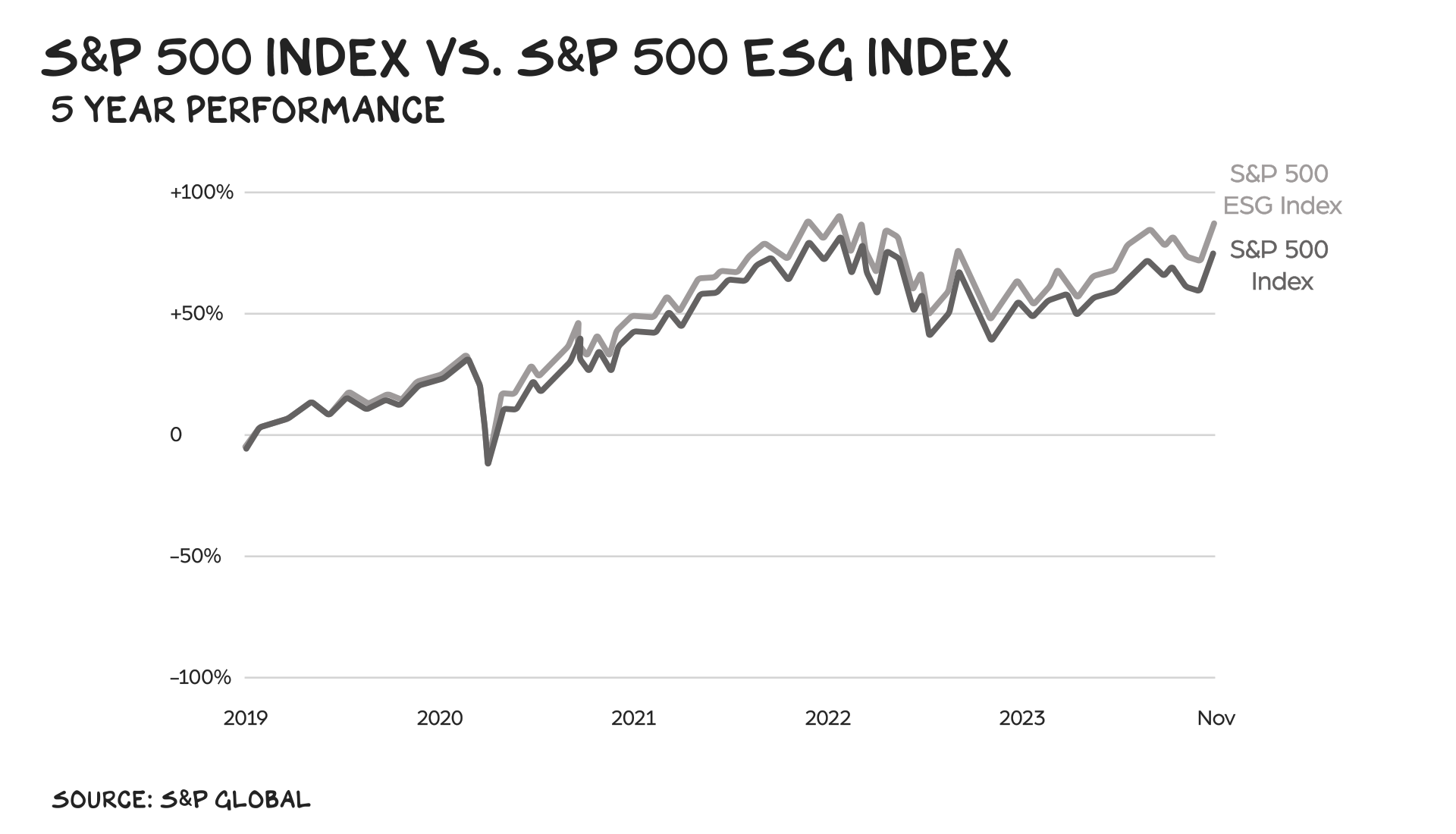

Over the past decade, a crop of funds has surfaced offering to invest your money in sustainable ways while still delivering competitive returns. The experiment has been a failure. ESG is neither an investment strategy nor altruism; it’s branding. As my colleague at NYU, Aswath Damodaran, highlights, corporate ESG scores increase every year. Is that because corporations are becoming “better”? Or is it because the bar is getting lower? When a company like American Airlines, which emits 49 million metric tons of CO2 per year, makes the Dow Jones Sustainability Index, it’s the latter.

The hollowness of ESG investing is reflected in its returns, which are neither good nor bad — but average. So average that the S&P 500 and the S&P 500 ESG indexes’ returns are nearly identical every year. And that’s by design: The top five weighted companies in the S&P 500 ESG Index are Microsoft, Apple, Amazon, Nvidia, and Google. It’s no coincidence these are also the five most valuable companies in the U.S. Meanwhile, investors pay a greater expense ratio on the ESG ETF (0.10%). And by ESG standards, even that’s low. The iShares ESG Aware ETF charges 0.15%, and the FlexShares ESG ETF almost trebles that to 0.42%. It’s the definition of branding: Create intangible associations that evoke emotion vs. product benefit, resulting in pricing power. Or, more simply, slap a green label on your fund, marginally adjust your weightings, and charge more.

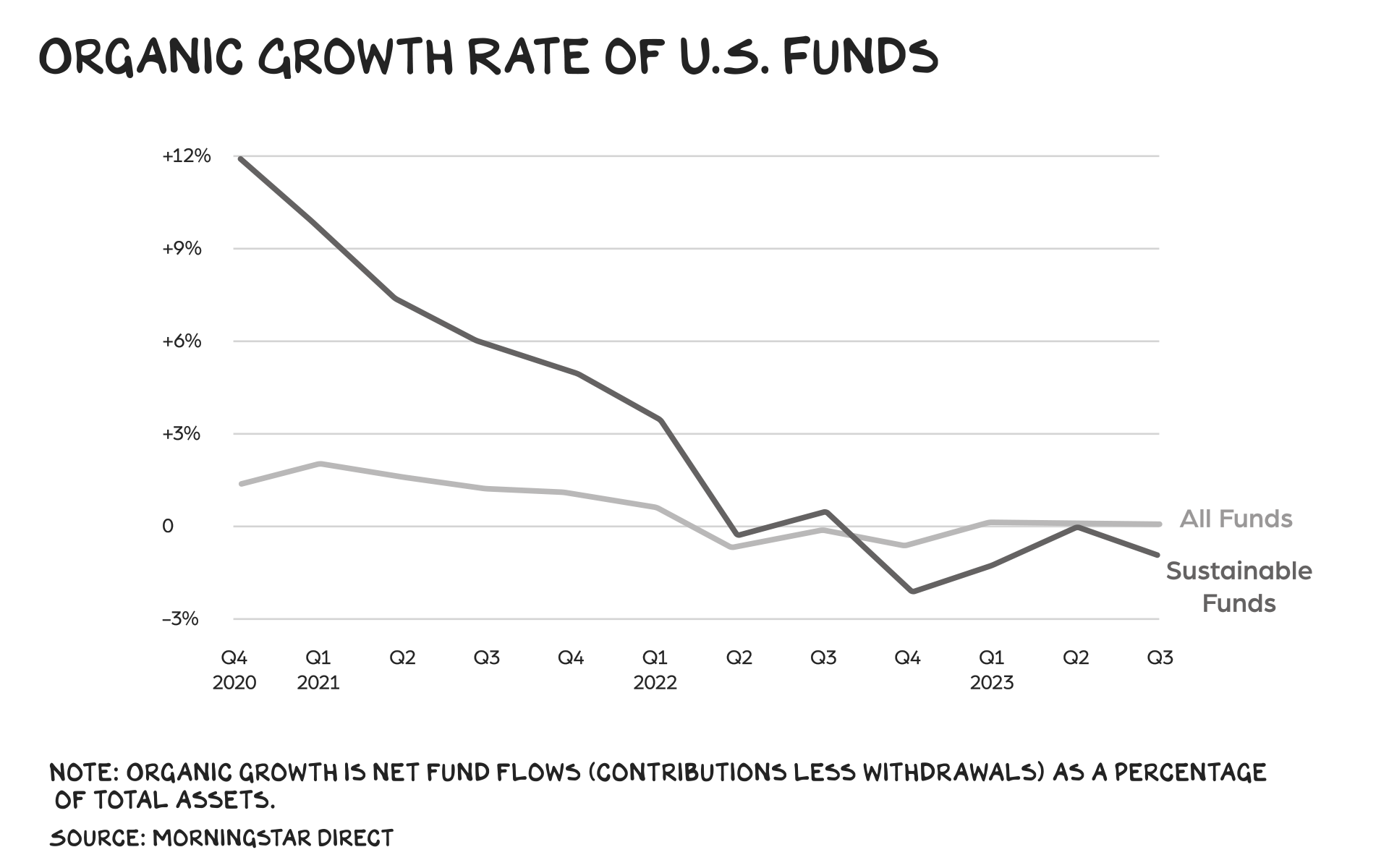

The ESG movement is waning. Investors withdrew $14 billion from sustainable funds this year. The shift is partly structural — traditional funds have also seen net withdrawals (aka negative organic growth) — but ESG funds are facing steeper declines, likely because people are catching on to their sleight of hand.

Weaponization

We wrote about a greenwasher extraordinaire two years ago, Aspiration, which promised to save the planet with a debit card. The planet is still under threat, and the company fired its founder-CEO, laid off hundreds of staff, and pivoted toward selling carbon credits to corporations. Aspiration is a case study in the deeper cost of buying into the mythology of do-gooder capitalism: Capitalists weaponize it for profit.

Two months ago, Deutsche Bank agreed to pay a $19 million settlement for claiming it made investment decisions based on ESG but not actually doing that. Which is fraud, but also dumb, as being labeled “ESG” is not a big lift. (See above: American Airlines.) Before that, oil giant Shell was accused of misleading investors on its green credentials. In the past year, corporate greenwashing incidents have risen 70%.

Misdirect

The danger bigger than usurious fees is that we don’t invest in the democratic institutions focused on preventing a tragedy of the commons, because we believe “market solutions” can handle carbon emissions and forced labor. It’s not the fault of the businesses but the citizenry, which continues to engage in a consensual hallucination that tech innovators can cosplay world leaders and solve our most pressing problems, all while making us/them rich. I don’t know if/how climate change is remedied, but I’m certain the solutions will cost money before they make any.

Corporations are so good at making money, they shouldn’t be trusted to do anything else. Treating your employees well, investing in the community, and generally supporting the commonwealth all offer short- and long-term benefits to stakeholders, and so stakeholders — us — should ensure it all happens. This is not an abdication of corporate responsibility or reheated Milton Friedman, but a call for more robust government oversight and regulation, including antitrust actions and a rebalancing of power from the top 1% and corporations.

(Do)n’t Be Evil

Larry and Sergey weren’t being disingenuous when they founded Google as a “different kind of company” or adopted “don’t be evil” as their guiding principle. In their original paper introducing the Google search engine, they included an appendix about the evils of advertising: “Advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers.” I’m sure they believed that — because it’s true. Their original sin was naiveté, not deceit. They thought they could defy gravity.

Likewise, I don’t believe that John D. Rockefeller founded Standard Oil intending to heat the planet to an unlivable temperature, or that the thousands of good people who work at Chevron or Exxon or Shell are rooting for the mass migrations and economic collapse their continued carbon production will cause. All the worst people in the world didn’t decide to go work for tobacco companies in the 20th century, nor have Meta’s recruiters developed a skills-based assessment to find evil geniuses. There are bad people in business, and immoral conduct (recruiting underage children to a product that gnaws at their mental health, promoting antisemitism) remains immoral. We should call bad acts out where we see them, and withhold our business or capital from bad actors when we can. But don’t expect it to change anything. As the late Charlie Munger put it, “Show me the incentive and I will show you the outcome.”

Door 1 or 2

If you could keep the executives and change the incentives vs. change the executives and keep the incentives, I’d argue Door 1 is the better way to go. And the upside incentives are, most definitely, in place. There is no country on Earth minting as many millionaires and billionaires as the U.S. Regardless of the odds, and the harsh reality that success is more about when and where you are born than your talent, most Americans believe they have a shot at extraordinary prosperity. And that’s a good thing.

We can’t — and shouldn’t — weaken the pull of capital. The profit motive is capitalism’s driving force, and it’s driven a greater increase in prosperity than any other human creation. The problem is our better angels are outmatched; we need counterweights to the incremental rationalizations made in conference rooms named “Only Good News.”

It’s the lack of regulation and the disincentives that have let externalities run amok. Government prosecutors sending SBF and (likely) Zhao to prison will do more to clean up crypto than any ESG fund overcharging investors. If we want to stop Meta from sending images of nooses to bullied young girls, we need to make that behavior a crime. Or, at least, let those girls’ parents sue (i.e. reform Section 230, as I advocated for here).

ESG and (in-)Effective Altruism are heat shields against real limits on action. They allow corporations to retain their power (and their capital) while expectorating exhaust into a headwind. Every time I write about the abuses of tech companies, I get the response, “Well, if you don’t like the companies, don’t use their products.” This is the cry of the defeated, those so broken on the wheel of corporate exploitation they’ve unilaterally disarmed, abandoning the one power we the people possess that’s equal to capital: democracy. It’s not up to each of us to protect the commonwealth, it’s up to all of us. Put another way, the most effective ESG is not a fund charging higher fees to invest in American Airlines. It’s a perp walk.

Life is so rich,

P.S. No Mercy / No Malice is offering exclusive sponsorships. Details here.

P.P.S. You can now take my Section brand strategy class in a two-hour, TikTok-style course on Pair. Usually $179 — free for subscribers. Enroll here.

Test comment

The lens of corporations getting a sustainability score has often struck me as rating a dancer for their skills in mechanical engineering. Though companies should be held accountable, I agree that it should be enforced through the government and our democracy. Im glad people are opening their eyes. Let capitalists be capitalist but under the justice of our government.

Humans are indeed the ultimate culprits in this. Too few even believe prosperity is attainable while too many think THEY themselves will be one of the next billionaires. Many other comments summarize the details much more eloquently than I could. Suffice to say your essay unfortunately captures the state of the world created by a small handful of ultra-rich narcissists – not sure where we go from here.

Two words: Atlas Shrugged

Finally figured out what was bothering me with the otherwise idealistic and morally attractive idea (let’s call it ESG) in this book. The problem is not the business or market part, it’s the human nature part, which we wish was, but we can’t count on to be, consistently good. The good news is that we have the capacity for both self-awareness and for building enduring systems. And if that fails – for trying again.

I read your essays, week after week, and come away thinking, “He almost has it.” I can’t help but wonder how you define prosperity. “The profit motive is capitalism’s driving force, and it’s driven a greater increase in prosperity than any other human creation.” And yet, only two paragraphs earlier you make reference to the cratering mental health of young adults and children caught up in the social media downward spiral. With the suicide rate at its highest since 1941, I would bet a lot of parents would define prosperity by the health of their children, and things aren’t looking so good. Being able to stream whatever I want from wherever I want from a pocket computer than could easily operate any of the Apollo missions is not prosperity, it’s distraction. Distraction from what’s being done to society day after day after day. We’re being told to trade our happiness for shallower and shallower pleasure, the kind of pleasure that makes us worse people than we were yesterday. The kind of pleasure that only has us thinking about where to get our next anti-social hit instead of how to lift up ourselves up from the sewer of a capitalist system that is intent on squeezing the life, the money, and the hope out of the bottom of the pyramid up to the tiniest fraction of its topmost point. Feeding off the corpses of the lower and middle class for the enrichment of the narcissist class does not make us prosperous. It makes us bloodsuckers.

Amen Rey,

You get it. I usually come here for a bit of light chuckles. But similar to the quote on the jesuits, “

They appear to have discovered the precise point to which intellectual culture can be carried without risk of intellectual emancipation.” Scott seems to have discovered the precise point to which critique of the predictable outcomes of capitalism can be carried, without risk of realizing capitalism is the problem.

The search for a different flavor of capitalism, or capitalism that arrests the people I don’t like is just adding an epicycle to the geocentric model.

While it is true that government should play a bigger role in curbing the excesses of corporations, you need to ask yourself why it isn’t doing that? Follow the money. Since the citizens united ruling corporations have been granted personhood, and unlimited corporate financial donations to PACS and Super PACS have been legalized. This ensures that the government now works for large corporations. BTW I agree that the ESG movement has become a frothy mess of overstatement and greenwashing. And I agree that it is a good thing to see the SEC starting to hold companies to account. But that still misses the real point — If you’re a serious business leader today you need a climate change strategy. You need a social unrest strategy. You need an ecosystem collapse strategy. You need a political polarization strategy. Not because you want to go to heaven, but because you want to continue to produce strong financial performance over the long haul. The point of sensible and authentic ESG practices isn’t to signal virtue, it is to create resilience in your enterprise and to protect the interests of your investors over the long haul. Isn’t that what corporate boards and CEO’s are supposed to be doing?

While I agree with your take on regulations and need for shaming

and even jailing corporate bad guys- I disagree with your take/blame on ESG.

ESG was to be used as a risk mitigation tool: do you have a succession plan, balanced board, policy to not pollute, supplier code of conduct, diversity in hiring, fair-pay practices, ban on child labor … instead corporations’ marketing depts have got too cute with greenwashing and politicians have used it as a wedge to attack the “woke” do- gooding liberals.

It needs fresh messaging and new scoring but if done with transparency it is the way to at least begin the conversation and push for good sustainable capitalism.

We’re not there yet, but we can’t keep on going the way we have and it might not seem it but it is slowly making companies at least attempt to be a little teensy bit better corporate citizens and that’s at least something.

I don’t believe any structural change is possible without weakening the pull of capitalism, it is the focus on money for money’s sake and the fact that people respect and aspire to that which is at the root of the issue. If there was a safety net for everyone and people were judged not simply on personal success, but how they impacted their communities positively then we’d have the foundations we need to prevent the impending crisis. The only issue is that this change requires…..Capital. Damn.

You shill an app promo for an app that barely works. I enjoy reading your stuff but your product recommendations don’t help your credibility prof g.

Not a word too much. Not a word too little. Every word and every sentence is to the point: it’s capitalism, stupid. But restricting turbo-capitalism, formerly known as Manchester capitalism, will not succeed, we should be that honest. And democracy? In the end, the Koch brothers and their ilk will simply buy it for themselves. We should make lobbying a punishable offense, that would be a start.

A lot to appreciate here. Many points stand out but the calls to action, centering of democracy, and dismissal of defeatism were the highlights. Would love for you to address ways you think citizens and investors can have direct impact in addition to working through regulatory and enforcement bodies. You admit not using harmful products may not alter producers’ behavior and yet sometimes such choices mustbe considered. What (other) individual actions, choices, or approaches would you suggest, and how much external “impact” should they have to be considered worthwhile? (Willing to leave aside, for the sake of these questions, issues of internal impact/conscience).

This was one of your best ones this year Scott! All facts. This really hit home for me as I’ve been wrestling with something beyond ESG in my little christian circle called BRI ( Biblically Responsible Investing).

Your essay was both well-written and enlightening. It is especially welcome in light of the travesty of Cop28, hosted in Dubai and run by the president of an oil company!

I am very interested in reporting on those entrepreneurs who really do have a low-carbon foot print—I know a major property developer who is working in that direction.

I would love to be on your mailing list.

This is well articulated. As a EdTech entrepreneur I observe that some of the biggest advocates do-gooder capitalism are the right wing groups like Cato, Koch, etc.

Of course they are. No need for regs if private sector will do the right thing. Except it doesn’t or we wouldn’t have current climate crisis.

The negative impacts of social media and search engines is well documented and you underline it in your always entertaining way. The solution is a license for internet access and social media accounts. Without a downside we will continue to open our Nation to China, Russia, North Korea and hackers within. We need accountability and responsibility. The internet is the wild west. Lack of a license to use it is like giving a grade school kid the keys to the car and not teaching them the motor vehicle code. Let the kid go however fast they want,. Drive on what ever side they want to that day. We have an open border in our internet access. Bad guys walk right in and do all the damage they want. If we make the internet less anonymous and require access by real people that can lose their access by abusing it we will take a step at correcting the problem. The same goes for our companies that abuse the power they have. Meta should be fined big time for putting young people at risk. Show Meta the noose.

Sadly, all the millions of good people there are in the world lack the power to change it.

I have more faith in Capital allocating resources than do gooders who ultimately are motivated by power and ego to tell me how to live.

.

You diagnose the problem and then spectacularly fail to suggest a solution that would work. Putting some Facebook executive behind bars wont change the system or the nightmare outcomes we are heading for.

Capitalism is the cause of this. The solution is to change neoliberal capitalism.

Brilliant

All this time I’ve been following you silently and often wondered when or if you would name the ‘elephant’ that’s owned the room for several decades now. Bravo Scott !

I love your voice and perspective. Thank you for taking the time to keep on it with your media company, for not giving up, being vulnerable. LOVE YOUR voice. each week — MAKES A DIFFERENCE. Please keep going!

Scott.

I don’t believe corporations should give one cent to charity!

They only exist to make profits and deliver a return to shareholders.

They should simply pay their taxes, which should be charged on revenue not profits at a flat rate creating an even playing field.

Governments should strictly enforce taxation collections via a tax collected monthly via the banking system.

Governments (us) should then transparently pay out to causes, charities etc from the taxes collected.

Scott. I always look forward to your weekly newsletter. Great insights and analysis. The truth as always. I can’t wait to hear your thoughts on “Poor Me Musk” and the stampede of advertisers for exit at X.

We know you’re a genius at dissecting the truth from fiction. But this is likely your best piece yet. Congrats and thank you.

Dude… the bait and switch! 🙂 “The real tragedy of Andrew Ross Sorkin’s interview with a co-founder of OpenAI is that ketamine addicts deserve a better spokesperson.” LOL. How I wish this was that post.

Great honest post as always. If you want to talk about a true counterweight to capital which hews to the promise of stakeholder capitalism or ESG, look at some of the vibrant cooperative sectors around the world. Here in the US, credit unions capture $2.2 trillion of financial services assets (collectively larger than Wells and BofA), Desjardins in Canada (reaches nearly 20 percent of Canucks) and Mondragón in Spain is a manufacturing/services juggernaut with billions in annual revenue. While these coop examples aren’t wholesale changing our economic system, they do offer an alternative to a capital first economic system. Perhaps if influential people like Prof G would talk about them more they’d gain a larger audience and more attention.

Sir,

Love your writing, but this post left me in the dust, could you write two versions, one for your silicone valley readers and one for the rest of us, I’m willing to catch up? But this one could be I. Sanskrit and would convey the same points to me, I.e., none.

Help

I think the idea that you can have integrity or honesty just because you join a club or cult is naive to say the least. We need more Charlie Mungers, gone far too soon.

As a denizen of silicon valley since 1978, I heartily concur with Scott’s thoughts about profit motive and corporate spin (do no evil, ESG, etc). My only question is … can we trust the government to wisely legislate a counterbalance to the sins of corporate greed? In our semi-democratic society, government is a reflection of citizens who for the most part, are unable to craft independent thought. Lastly, I agree with Phillip Soltan’s pronouncement that “serious pain is the only thing that changes the behavior of people”, so I suspect that things have to get much worse than they are before there’s any meaningful change. U da man, Scott.

You miss the main point of ESG-but so do most people. The point of ESG IS ‘Door #1’- to change the incentives. No serious fan of ESG wants to change the profit motive-we just want it to not work with no regard for people and planet. There is a huge range of executive behavior between good business and a perp walk. ESG is a tool for shareholders to hold executives accountable. The law comes in too late.

I agree that government should provide a counter-balance to the worst abuses of Capitalism. The problem is cognitive dissonance. People SAY they want to save the planet but their addiction to Amazon, SUVs, disposable plastic containers, and more shows what they REALLY want. We are already doomed to the bleak existence that many Sci-Fi movies predict. Serious pain is the only thing that changes the behavior of people.

The delicious irony. Rant about evil capitalism then pitch for SPONSORSHIP in your PS. You’re also sitting on Satya’s lap Big Boy 😉 Agree Musk is a twat tho.

Agree!! Agree!!!!

Scott has the worlds worst case of Elon Derangement Syndrome and Trump Derangement Syndrome, competing with his lovely female version Kara Swisher. Must be jealousy to let others live in your head rent free. When is Section4 going under?

ESG is a demoralized social credit system akin to the CCP. Anyone who is an ESG commissar is a grifting fraud. Kudos to Prof Damodaran for calling this out early and to you for amplifying the message.

Excellent! Also – the road to Hell is paved with good intentions!

Your point about greenwashing is correct but the numbers are way off.

Big airlines emit millions of tons of CO2, not billions. Your source, statista, got it wrong.

For reference the entire world emits about 34 billion tons of CO2, plus about 30 percent as other greenhouse gasses.

Fixed, thank you for the catch.

And this is the THIRD blog post in a row where Galloway takes a drive-by shot thrashing on Musk.

Musk is living rent free in Galloway’s Never-ending Grudges / Petty Vindictiveness

Bill Gates’ greatest contribution to society is not his philanthropy, it is the productivity unleashed by the PC and the Office applications.

ESG/ Effective Altruism and the like are virtue-signaling, not value added.

But regulation by government as the answer to the challenges of AI, or anything else tech? These are the same people who simultaneously shut down nuclear power plants while advocating mitigation of climate change by unscalable technologies. See “Nuclear Now” for more exposition on nuclear.

The concept that our nation’s leaders can understand AI, much less regulate it effectively, is absurd. For all their posturing about the threat known as TikTok, politicians dare not enrage those hooked on it by imposing a well-deserved ban.

That’s an astute observation. No suggestions for a better approach though? I guess we’re f*cked then…

It is too late. We are all doomed. If you can afford it, buy a ticket on Musk’s Martian express.

You offer the same defeatism cited in the article, almost as if you didn’t read it. The problem isn’t government or “leaders” in general though perhaps some specific ones currently in power. The solution, as Scott wrote, is voting for those who can comprehend the problem and have the courage to make changes, starting with the courage to dismantle our plutocracy.

I do not even believe most politicians are unable to understand AI, or social media, or technology, but, again, per Munger, have incentives to ignore it because their donors want it that way. The change won’t happen overnight, anymore than the swing from the robust progressivism of both Roosevelts to neoliberalism and Reaganomics did, but it won’t happen ever if people believe it can’t.

Love this article. But unstated here is the reason why it is defeatist: regulatory capture. If the government is corrupted by capital (as it is), we are all screwed and good. In the gilded age, we got Teddy Roosevelt. Where is he now? How do we break up the 8 largest food suppliers, 6 tech companies, 6 entertainment companies, 5 oil companies who all have monopsony and can raise our prices and reap the profits and buy our political system (and supreme court)?

The problem is not unaddressable. Other countries have done it well. Governments are not destined to be incompetent. Only some are incentivised to be.